Metaplanet Follows MicroStrategy Footsteps, Buys More Bitcoin

08/20/2024 23:15

Metaplanet's stock surges 12% as it buys $3.4 million worth of Bitcoin, solidifying its place as Japan's largest corporate BTC holder.

Metaplanet’s stock surged 12% after the Japan-based investment firm expanded its Bitcoin (BTC) holdings. Following its commitment earlier this month, the company invested 500 million yen (approximately $3.4 million) into Bitcoin.

Japan continues to strengthen its position as a leader in cryptocurrency adoption. With the yen weakening and government officials issuing warnings, more investors are turning to digital assets as a hedge.

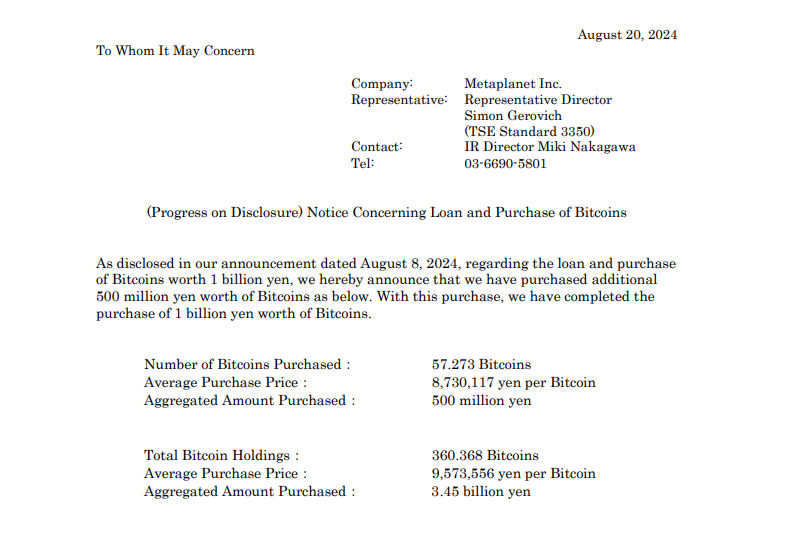

In an August 8 commitment letter, Metaplanet announced plans to purchase 1 billion yen worth of Bitcoin. The latest acquisition fulfills that promise.

The investment firm bought 57.273 BTC at an average price of 8,730,117 yen per token. With this purchase, Metaplanet’s total Bitcoin holdings have grown to 360.368 BTC, acquired at an average price of 9,573,556 yen per BTC.

As previously reported by BeInCrypto, the firm purchased 20.195 BTC valued at $1.02 million in early July, making it Japan’s largest corporate Bitcoin holder. The latest acquisition further strengthens this position, indicating rising crypto adoption in the country.

Read more: Who Owns the Most Bitcoin in 2024?

Metaplanet attributes its interest in Bitcoin to MicroStrategy, with CEO Simon Gerovich citing Michael Saylor as the driving force behind their strategy. Similar to MicroStrategy, Metaplanet has steadily expanded its Bitcoin holdings since April 2024.

“It was an honor and privilege to meet Saylor in Nashville ahead of the Bitcoin conference. Thanks for inspiring Metaplanet to adopt a Bitcoin standard,” Gerovich indicated.

The firm’s strategy includes a $1.6 million BTC purchase on June 11, followed by a June 24 commitment to acquire an additional $6 million worth of Bitcoin through bond issuance. MicroStrategy’s blueprint has inspired numerous other firms beyond Metaplanet, as businesses across different industries increasingly incorporate Bitcoin into their investment strategies.

Japanese Firms Flee to Bitcoin Amid Weakening Currency

In July, Metaplanet announced that long-term Bitcoin holding had become its primary strategy. This shift is part of a broader effort to reduce exposure to Japan’s weakening currency, the yen, while offering Japanese investors access to crypto with a favorable tax structure.

BitMex CEO Arthur Hayes recently suggested that the Federal Reserve might resort to unlimited dollar-yen swaps to stabilize the yen’s depreciation. Despite the Bank of Japan’s (BOJ) hawkish stance, the currency remains volatile.

“We support the BoJ’s view and bodes well for further rate hikes, although the central bank would remain cautious as the last rate increase had caused a sharp spike in the yen,” Kazutaka Maeda, an economist at Meiji Yasuda Research Institute, said.

Japanese Economy Minister Yoshitaka Shindo added that the yen is expected to recover gradually and that incomes should improve. Shindo also emphasized the government’s commitment to working closely with the BOJ on flexible macroeconomic policies.

With the yen facing significant challenges, investors may seek alternative assets to protect their wealth. Bitcoin, viewed by some as a store of value, is one such option. Metaplanet’s decision to adopt BTC as a reserve asset reflects its strategy to mitigate risks from Japan’s debt burden and the yen’s volatility.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.