Chainlink (LINK) Price Threatened by Bearish Trend, Indicator Shows

08/20/2024 22:55

Chainlink's price is facing slow growth due to a lack of bullish sentiment in the market and an unusually high NVT ratio.

Chainlink (LINK) price might continue to suffer at the hands of the bears due to the lack of activity on the network.

Worsening the situation are the broader market cues, which, despite turning bullish, haven’t found a strong momentum yet.

Chainlink Has Been Pulled Back

Chainlink’s price might find some trouble in recovering its recent losses. This is because Chainlink’s NVT ratio has reached its highest level in four years and eight months. This is signaling potential bearish trends for the crypto asset going forward.

This elevated NVT ratio suggests that the network’s value might be overextended relative to its transaction volume. Such a condition often precedes a price correction.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

In addition to the NVT ratio, Chainlink’s Relative Strength Index (RSI) is also in the negative zone. The RSI is a key momentum indicator, and its current position suggests that LINK is experiencing bearish momentum.

While bullish momentum might be building up as the rising RSI indicates, the altcoin may struggle to find upward momentum until the neutral line is flipped into support. The lack of buying pressure reflected in the RSI could prevent any significant price recovery without additional positive catalysts.

Given these indicators, Chainlink might require stronger cues or external factors to recover from this bearish phase.

LINK Price Prediction: The Drawdown May Stick

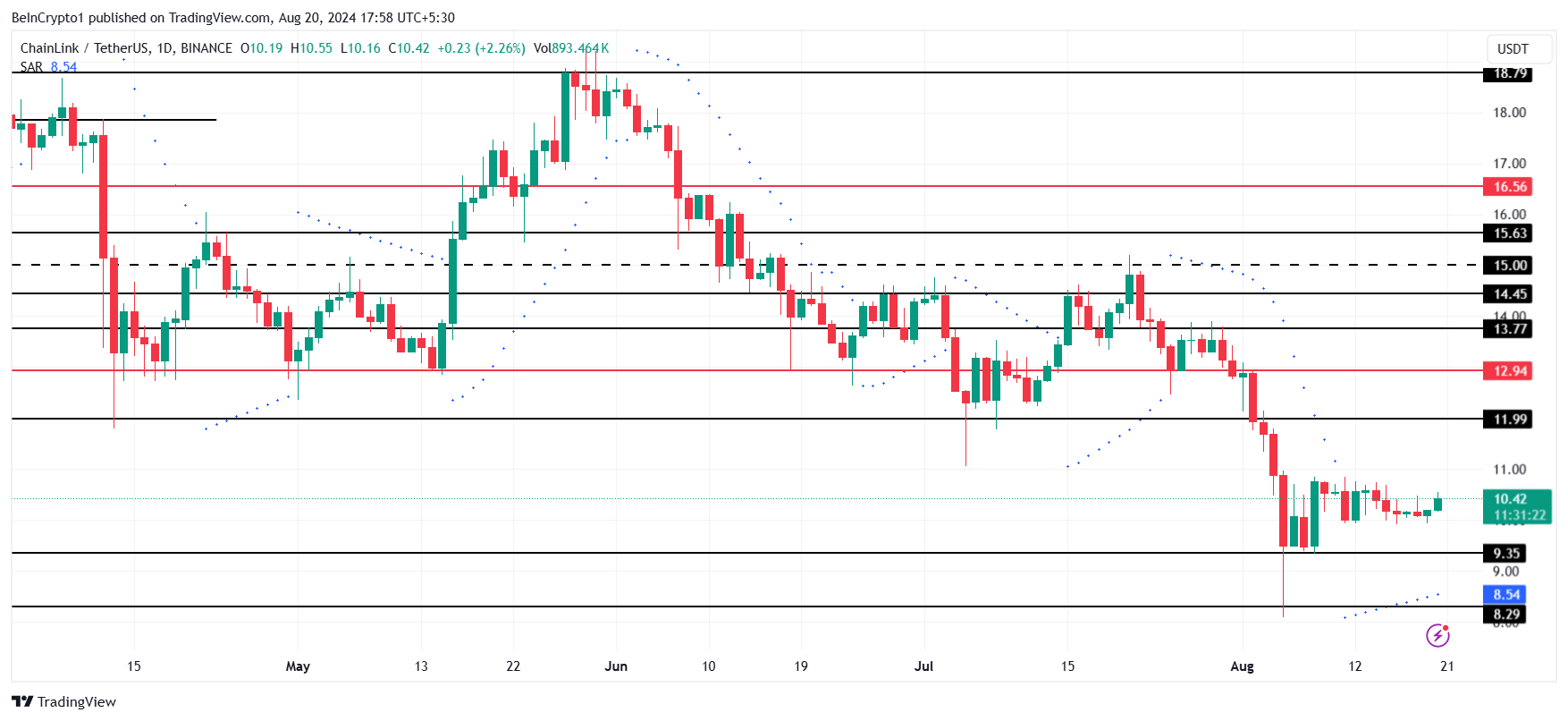

Chainlink’s price at $10.42 is far from taking back the profits it lost in the recent decline. With the altcoin’s value being at a ten-month low, LINK might need more than prayers to push it back up.

For now, the most probable outcome appears to be consolidation under $11.00. The chances of breaking out above it are slightly low and could remain rangebound above $9.35.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

However, if $11.00 is flipped into support, the altcoin could note an uptrend and potentially breach $11.99. Crossing this barrier would invalidate the bearish thesis and enable further recovery.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

READ FULL BIO