SYS crypto soars 200%: Can it maintain the momentum?

08/21/2024 03:30

We explore Syscoin (SYS) after its latest bullish outburst and assess its performance to establish if the bulls can sustain the momentum.

- SYS joins the list of top gainers after a sharp breakout from its falling wedge pattern.

- Can SYS sustain this new-found momentum?

Syscoin (SYS) is making headlines courtesy of its latest explosive rally this week which has thrust it into the limelight. It has emerged as one of the top gainers this week but can it sustain this impressive run?

Bitcoin’s layer 2 ecosystem is starting to experience some excitement and Syscoin is one of the projects currently in the limelight.

Its native token SYS is one of the best earning cryptocurrencies so far this week, after achieving an impressive upside by as much as 200% in the last three days.

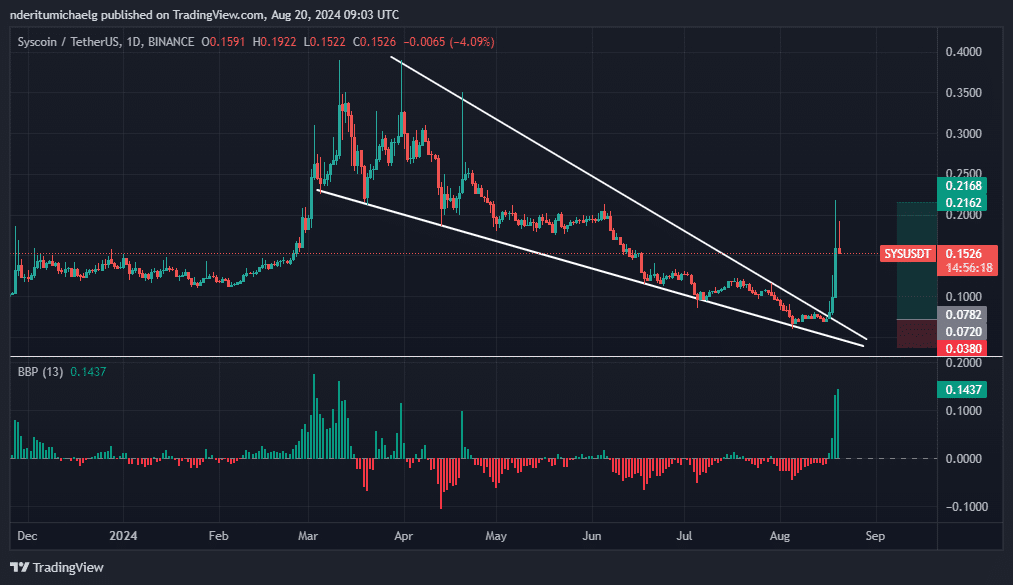

The SYS rally is the consequence of an explosive breakout. Its price action previously traded in a falling wedge from its March peak of $0.38. It entered the narrow range in the wedge pattern earlier this year, followed by a breakout during the weekend.

According to the charts, SYS crypto traded as low as $0.0691 on Friday, before breaking out of the descending resistance the next day. Its bullish momentum peaked at $0.21 on Tuesday, resulting in a 202% rally from the weekend lows.

SYS has since pulled back to a $0.154 press time level, after a slight pullback. The result of profit-taking from traders that purchased near recent lows.

A short lived rally or the start of its recovery trend?

Zooming out on the SYS chart reveals that it is a long way off from its historic ATH of $1.32. In fact, its latest bounce marks its first attempt at recovery from its historic all-time low.

Despite its latest recovery, SYS is still within its low range where it hovered from May 22 to February 2024.

SYS had initially attempted to rally from that bottom range between February and March this year. However, that rally was short-lived followed by a reversion to the downside and its eventual historic low achieved recently.

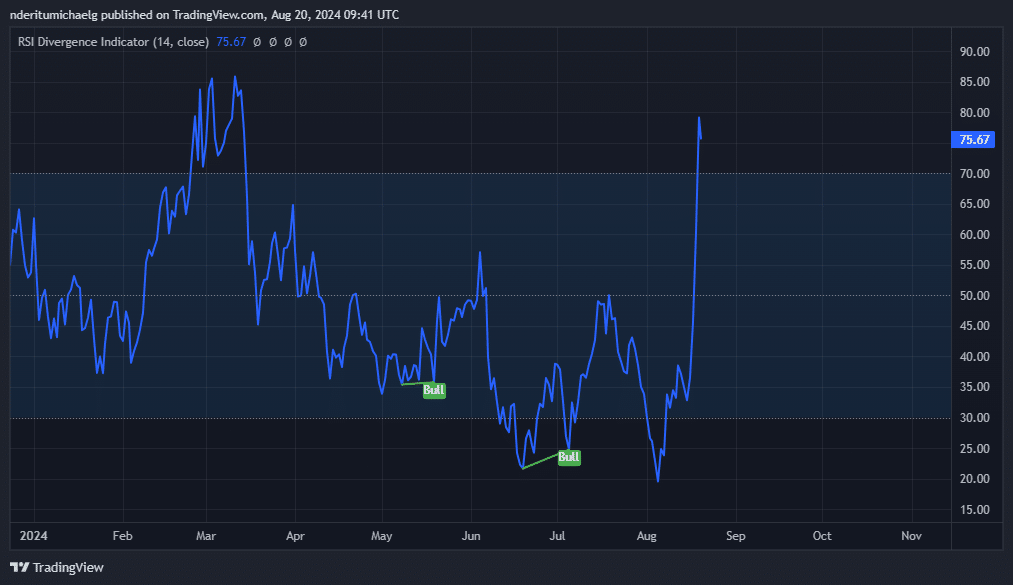

Although SYS is still trading at a relatively discounted price despite the recent upside, it is worth noting that its RSI indicates that it is overbought. This may explain the immediate profit-taking observed in the last 24 hours.

Source: TradingView

A sharp pullback signals the presence of strong sell pressure. This may hinder further recovery attempts. In addition, it may signal that the recent rally may have been the result of whales attempting to induce a rally.

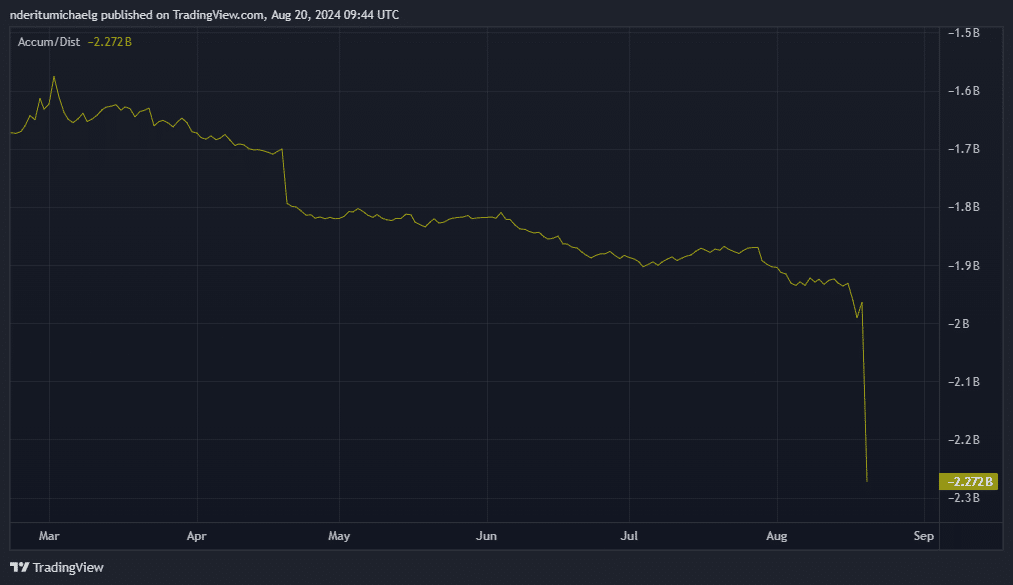

In addition, the accumulation/distribution indicator extended its decline further after a brief bullish pivot.

Source: TradingView

This observation may indicate a lack of enough liquidity to sustain more upside. SYS could still present significant opportunities ahead. However, caution is warranted since further upside is not guaranteed.