From Michael Saylor’s tweets to Tether’s impact: Bitcoin turning bullish?

08/21/2024 17:00

Michael Saylor's tweet coincided with 60% of top US hedge funds gaining Bitcoin exposure while Tether Treasury minted 1B USDT.

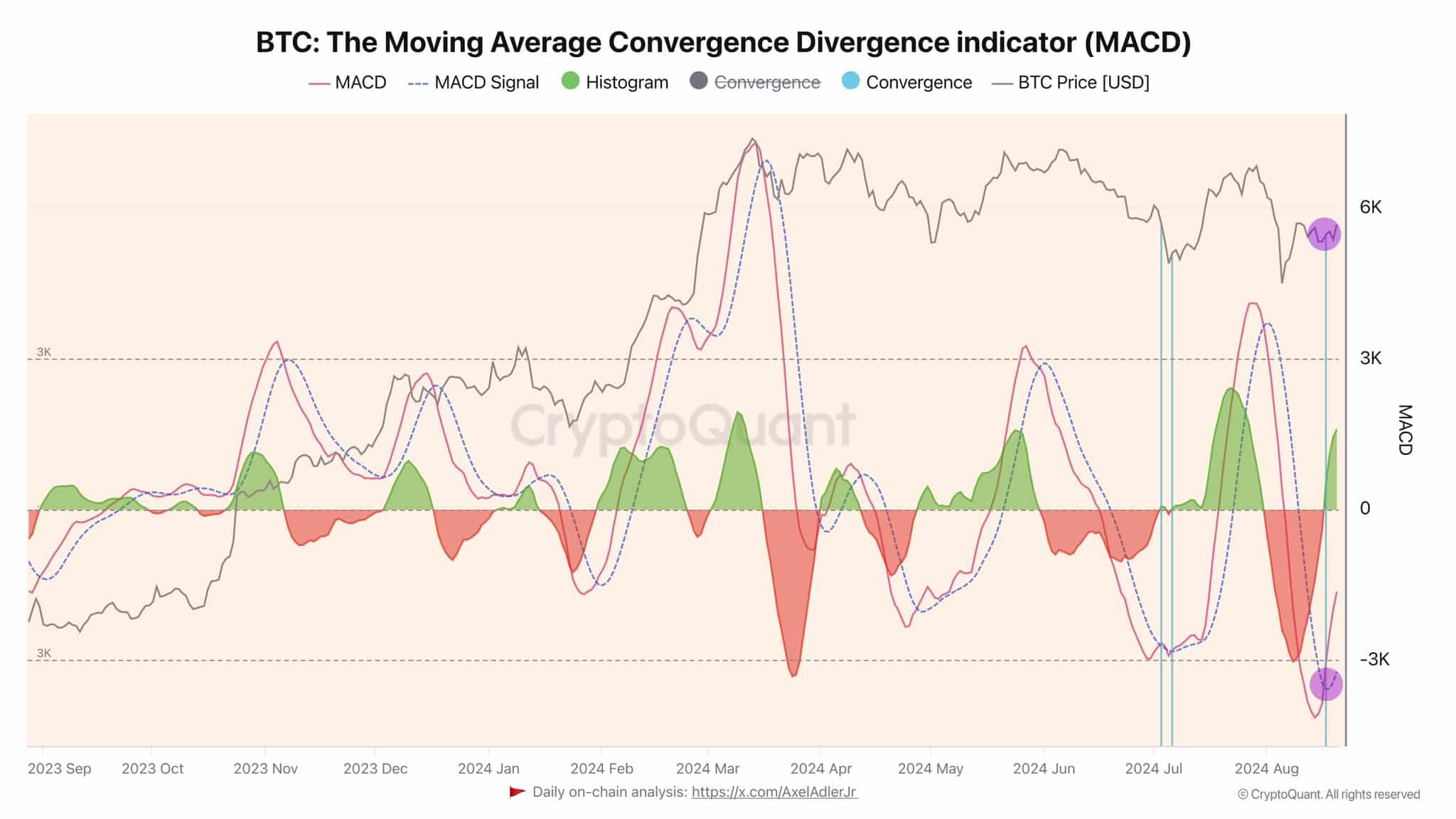

- Michael Saylor’s statement was in line with what the Bitcoin MACD indicator showed.

- Tether treasury mints $1B USDT with zero fees.

The founder and former Microstrategy CEO, Michael Saylor’s tweet, “By my calculations, Bitcoin [BTC] is going up forever,” resonated strongly with the crypto community, fueling anticipation for a 2024 bull run.

Saylor’s comments coincided with 60% of top US hedge funds gaining Bitcoin exposure in the first half of 2024. This surge in institutional interest has driven up Bitcoin ETF prices and Bitcoin itself.

On the charts, Bitcoin has shown intention to go higher after wicking above the 4-hour resistance while the 3-day chart shows a bullish double bottom with a significant engulfing candle, indicating a strong upward momentum.

Moreover, Bitcoin MACD indicator on the daily time frame began forming a bullish pattern five days ago and has now fully flipped bullish.

The market has steadily moved towards a bullish convergence on the MACD, signaling potential upward momentum.

This shift in the MACD suggests a strengthening trend that could lead to further gains, as more traders are starting to notice this bullish signal.

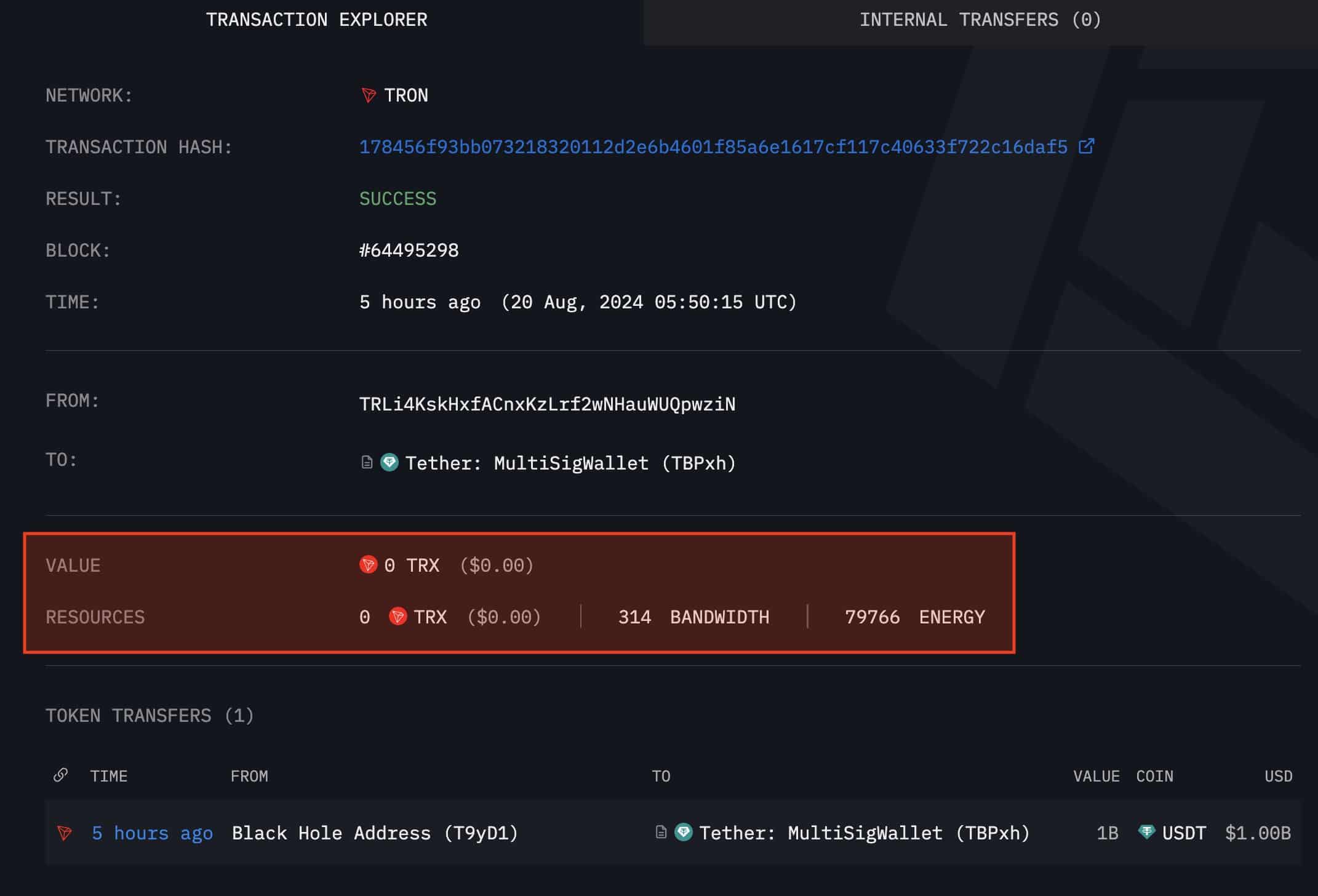

Tether treasury mints another $1B USDT

Tether, which operates like the Federal Reserve of crypto, influencing market trends whenever new USDT is minted. Tether Treasury minted $1 billion USDT on TRON with zero fees.

During the latest Bitcoin correction, Tether’s printers were highly active as Whale Alert noted on X with the total minted USDT distributed as $85 million transferred to Bitfinex and $50 million to an unknown wallet.

The continued minting of USDT is expected to drive Bitcoin prices higher in the upcoming bull market.

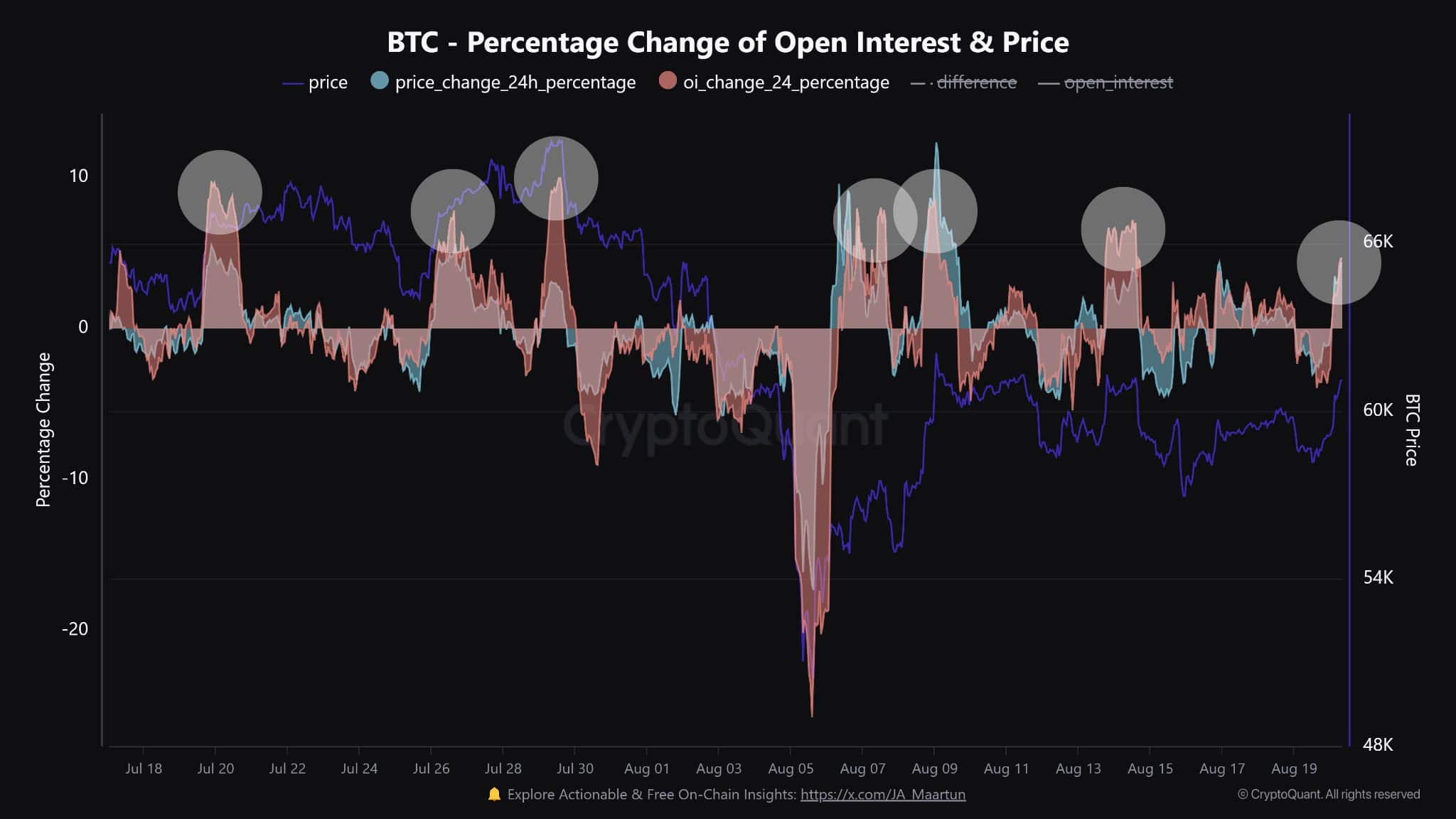

Strong accumulation as open interest rises

Bitcoin is in a strong accumulation phase, with Metaplanet purchasing 500 million Yen ($3.4 million) worth of Bitcoin, raising its holdings to 360.368 BTC as Karan Singh noted on X.

This move, alongside rising institutional confidence, has driven Metaplanet stocks up by 13%. Additionally, Glassnode reports that the Bitcoin accumulation index has peaked at 1.0, indicating a surge in buying activity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Investors are increasingly accumulating more positions following BTC’s open interest increase by 5%, driven by leverage.

Source: CryptoQuant

Historically, leverage-fueled pumps have often led to price reversals, though there’s no certainty it will happen again.