Mt. Gox transfers 13K Bitcoin: Will this sell-off pull BTC down to $56K?

08/21/2024 21:30

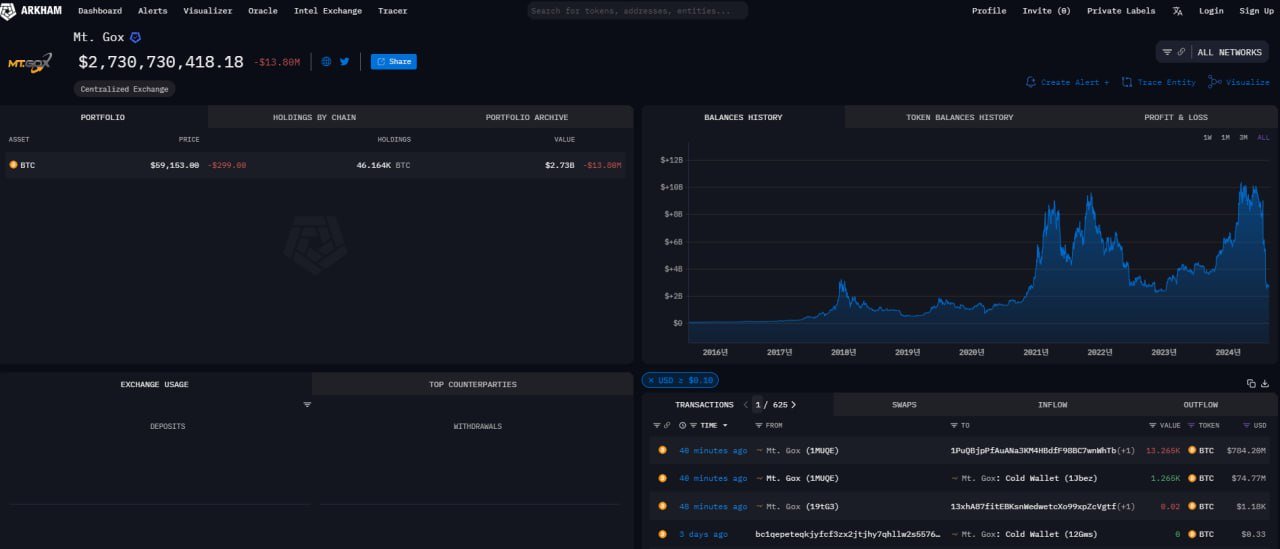

Mt. Gox moved 12,000 BTC to a new address, and 1,265 BTC were deposited into a cold wallet, leaving 46,164 BTC, valued at $2.73 billion.

- Mt. Gox transferred 13,265 BTC as Bitcoin neared its 200 EMA.

- Bitcoin’s 56% dominance led major markets since the 5th of August.

Mt. Gox, once a top cryptocurrency exchange during Bitcoin’s [BTC] early days, has continued its slew of transfers, recently moving 13,265 BTC worth $784 million.

Of this, 12,000 BTC moved to a new address, and 1,265 BTC were deposited into a cold wallet, leaving 46,164 BTC, valued at $2.73 billion, still unmoved.

This movement by Mt. Gox could significantly influence future Bitcoin prices and chart patterns, especially as BTC’s current momentum slows.

Following these developments, Bitcoin started trading near its daily 200 exponential moving average at press time — a key level at around $63,000 — which also aligns with its local highs.

The bulls need to break this level to signal a strong upward trend. If the price drops below $56,500, bears may regain control in the short term.

The overall expectation is for Bitcoin to break above the 200 EMA and maintain that position to confirm a sustained bullish trend.

After Mt. Gox transferred 13,000 BTC to exchanges, Bitcoin began a small rally, but the king coin must close above the 200-day and 20-day EMAs or maintain a price over $60,000 to confirm strength.

The daily time frame RSI has already confirmed a possible breakout retest, and the eight-hour model shows price rallying.

Altcoins also held firm during yesterday’s sell-off, indicating that Bitcoin and the broader crypto market are likely to rally in the coming months.

Bitcoin dominance and markets correlation

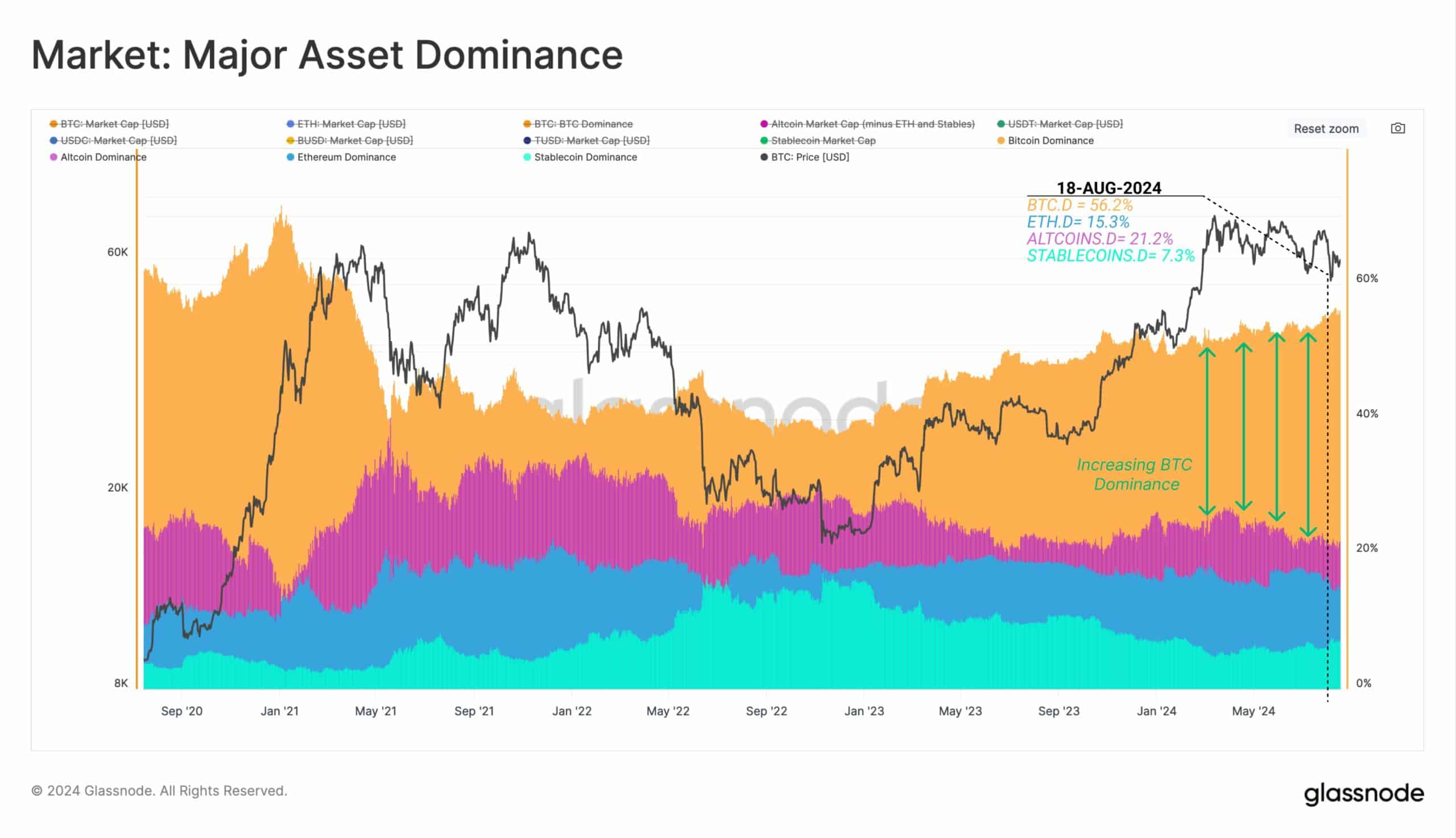

Bitcoin’s dominance in the market was growing, making up 56% of the total cryptocurrency market capitalization at press time.

This increasing dominance was supported by long-term holders who continued to accumulate Bitcoin, showing strong confidence in the asset’s future.

Despite market fluctuations, these holders remained committed, suggesting underlying accumulation pressure that could drive Bitcoin’s value higher.

As Bitcoin maintains its leading position, its influence over the entire cryptocurrency market continues to strengthen.

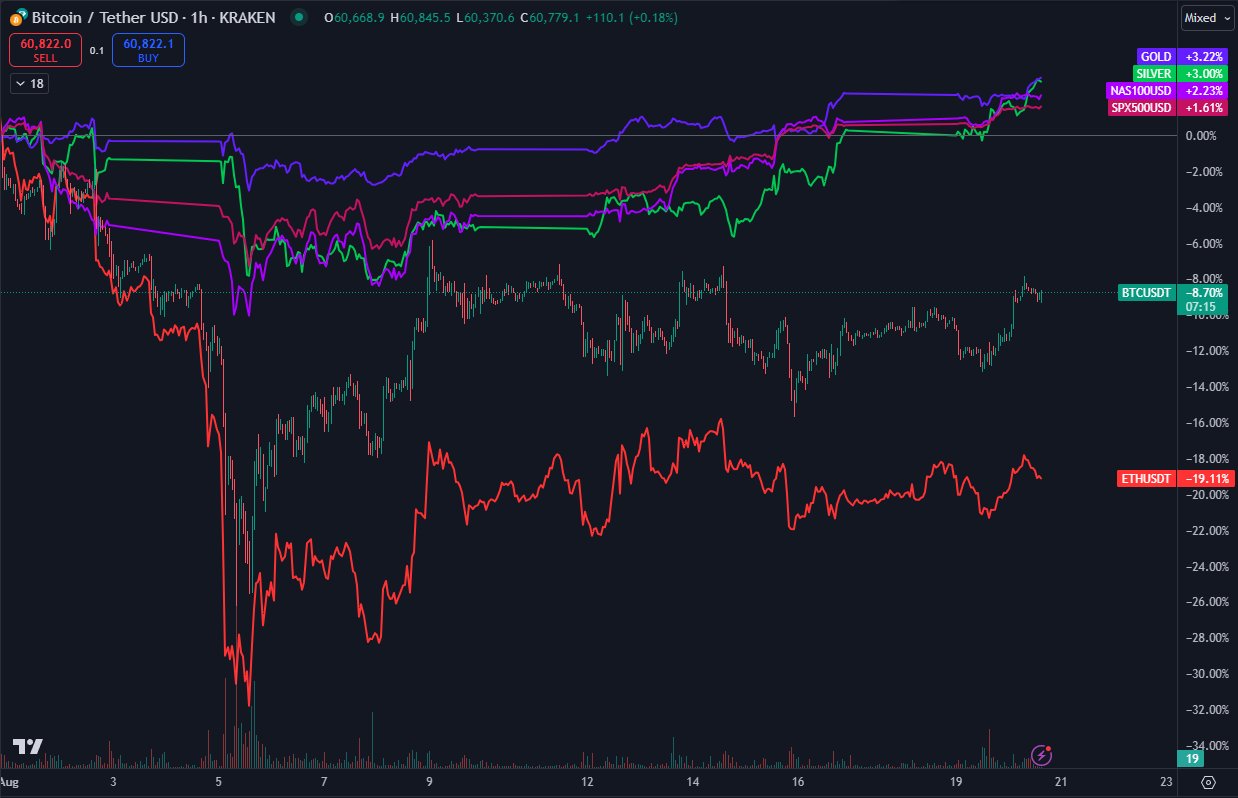

Bitcoin, along with markets like Gold, Silver, Nasdaq, S&P 500, and Ethereum [ETH], has been moving in sync since the early August downturn.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin has outperformed them all, recovering strongly from its lows despite a significant drop. While stocks are now up for the month, cryptocurrencies, including Bitcoin, still have room to catch up.

The recovery in the crypto market has just begun, and it appears to have strong momentum, suggesting continued growth in the near future.