Franklin Templeton Files for Crypto Index ETF

08/22/2024 04:10

The issuer has already debuted spot bitcoin and Ethereum funds.

Franklin Templeton is looking to expand its cryptocurrency ETF footprint with its application for the Franklin Crypto Index ETF, which will track a digital currency index.

According to the Aug. 16 filing with the Securities and Exchange Commission, the new ETF will use the ticker symbol EZPZ and track the CF Institutional Digital Asset Index–US–Settlement Price, which includes bitcoin and Ethereum.

An ETF tracking a crypto index was inevitable, said Nate Geraci, president of The ETF Store in Overland Park, Kans. “Spot bitcoin and Ethereum ETFs were simply the first steps down a long path towards index-based and actively managed crypto ETFs,” he said, pointing out that “spot bitcoin ETFs were the most successful launch in industry history.”

The filing comes as issuers try to meet soaring demand for crypto-based investments. The SEC has already approved applications this year for funds based on the spot price of bitcoin and ether, tthe oken of the Ethereum blockchain. Those two categories of ETFs have attracted billions in assets.

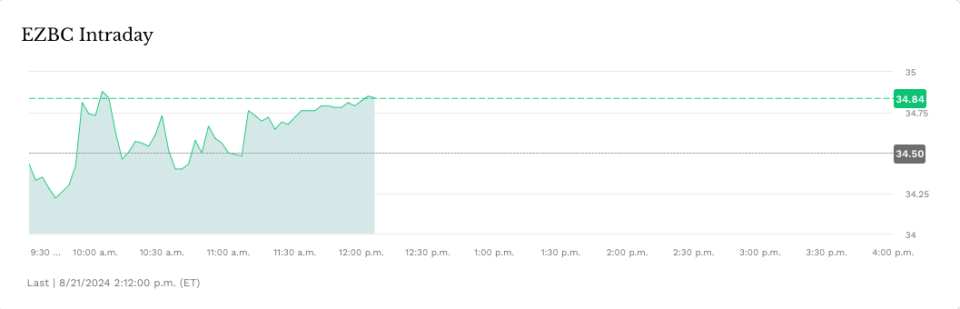

Franklin Templeton said that it was not able to comment on EZPZ during the filing period. The asset manager already offers a $390 million (in assets) Franklin Bitcoin ETF (EZBC) that debuted Jan. 11, and $31 million (AUM) Franklin Ethereum ETF (EZET), which launched July 23.

“Spot crypto ETFs have received very positive reception in the U.S. market and Franklin Templeton continues to grow its capabilities to meet investor interest in digital assets,” said David Mann, Franklin Templeton’s head of ETF Product & Capital Markets in an emailed response.

“EZBC has been one of our firm’s fastest growing ETF products and, if we’re using the market-cap ratio between bitcoin and Ethereum as a way to prognosticate investor interest in spot Ethereum ETFs, our EZET product is outperforming from a flows perspective,” he added.

Incentive to Create More Crypto-Based Funds

According to the filing, if the underlying index tracked by EZPZ adds more cryptocurrencies, an updated filing will be required, but Franklin Templeton intends to fully replicate the index as it evolves.

Geraci said the success of the separate spot bitcoin and spot Ethereum ETFs “only incentivizes issuers to get back in the lab and start cooking-up new products.”

“The natural evolution of single spot crypto ETFs is multi-asset products,” he added. “Digital assets are obviously an emerging area of the market, which could bolster the case for taking a diversified approach to the category, and financial advisors absolutely love diversification, so investing in a basket of crypto assets might be much more attractive than attempting to select which individual ones might outperform.”