Spot Bitcoin ETFs have seen their third consecutive inflow day this week, while spot Ether ETFs saw net outflows, adding to their five-day negative flow streak.

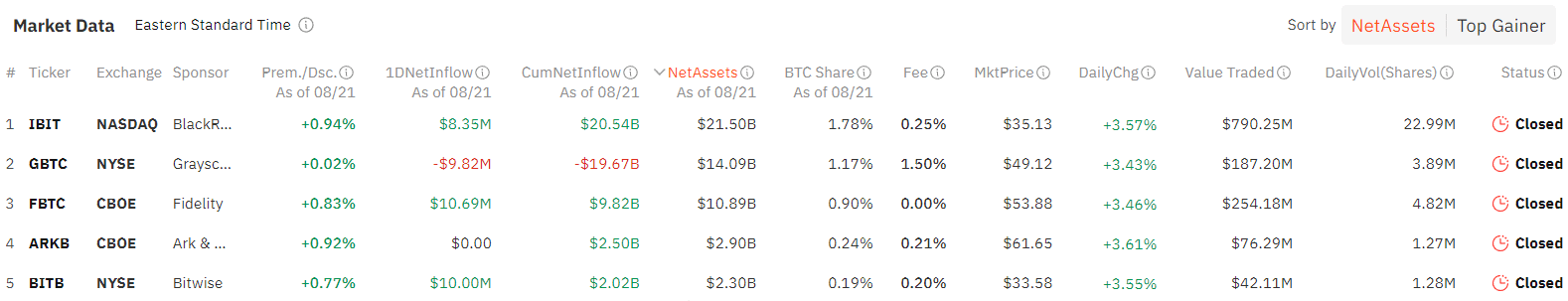

According to data from SoSoValue, the 12 spot Bitcoin exchange-traded funds recorded $39.42 million in net inflows on Aug. 21, representing a 55% decline compared to the $88.06 million net inflows seen on Aug. 20.

Grayscale’s mini Bitcoin trust led the charge with reported inflows of $14.2 million following three days of no activity. Fidelity’s FBTC and Bitwise’s BITB followed next with inflows of $10.7 million and $10 million, respectively.

BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, received $8.4 million in inflows on the day, bringing its total inflows to date to $20.5 billion. Meanwhile, Invesco Galaxy’s BTCO and Franklin Templeton’s EZBC reported more modest inflows of $2.5 million and $ 3.5 million respectively.

These inflows were offset by Grayscale’s GBTC, which logged outflows of $9.8 million, bringing its total outflows from its launch date to $19.6 billion. The remaining five BTC ETFs remained neutral.

Trading volume for BTC ETFs jumped to $1.42 billion on Aug. 21, higher than the $1.35 billion seen on Aug. 20. These funds have recorded a cumulative net inflow of $17.56 billion since inception. At the time of writing, Bitcoin (BTC) was up 1.8% over the past day, trading at $60,788, per data from crypto.news.

Bitwise CIO Matt Hougan has highlighted that contrary to the common belief that retail investors are behind the rise in Bitcoin ETF adoption, data indicates a significant contribution from institutional investors.

By the end of Q2 2024, institutional ownership of U.S. spot Bitcoin ETFs increased to 24%, even amid a difficult market and falling Bitcoin prices. Major players like Goldman Sachs and Morgan Stanley are holding $412 million and $188 million in ETF shares.

Meanwhile, the nine-spot Ethereum ETFs collectively saw increased outflows of $17.97 million on Aug. 21, marking the fifth consecutive day of outflows.

Grayscale’s ETHE led the outflows once again, with $31.1 million leaving the fund, bringing its total outflows to the $2.5 billion mark since its launch on July 23. Meanwhile, Fidelity’s FETH, Grayscale’s ETH, and Franklin Templeton’s EZET were the only offerings to record inflows of $7.9 million, $4.2 million, and $1 million, respectively. The remaining five ETH ETFs saw no flows on the day.

These investment vehicles have seen their daily trading volume rise to $201.03 million on Aug. 21, a minor jump over the previous day. The spot Ether ETFs have experienced a cumulative net outflow of $458.08 million to date. At the time of publication, Ethereum (ETH) was also up by 1.3%, exchanging hands at $2,633.