Ethereum mirrors 2016 trend as price stalls: Are more ETH losses likely?

08/22/2024 18:00

Ethereum could see a little respite in September followed by possible losses in Q4 2024, according to analyst.

- ETH could see a relief rally in September.

- However, losses in Q4 could be likely for the altcoin, per analyst.

Ethereum’s [ETH] price has been consolidating above $2500 for over a week, a boring scenario for crypto traders who live off volatility.

However, according to renowned crypto analyst Benjamin Cowen, the largest altcoin could experience only a brief recovery in September before counting possible extra losses in Q4. Cowen’s projection was based on the similar ETH pattern observed in 2016.

‘#ETH / #USD monthly candles continue to track 2016 perfectly. If it continues to play out, it would suggest #ETH is green in September, and then red Oct-Dec.’

What’s next for ETH price?

However, QCP Capital cautioned that ETH could drop even lower if the Fed makes a big downward revision in September.

‘A large downward revision, or an especially dovish Powell, could potentially reverse the 2-week equity rally and push #BTC and #ETH below support levels.’

Interestingly, the above mixed ETH views have been prevalent across the crypto community for a while. ETH bear and bull camps have put forward strong arguments for price prospects, deepening its uncertainty.

However, Cowen pointed out that a strong ETH rally could be feasible in early 2025.

‘Then in 2025 #ETH turns green for a while.’

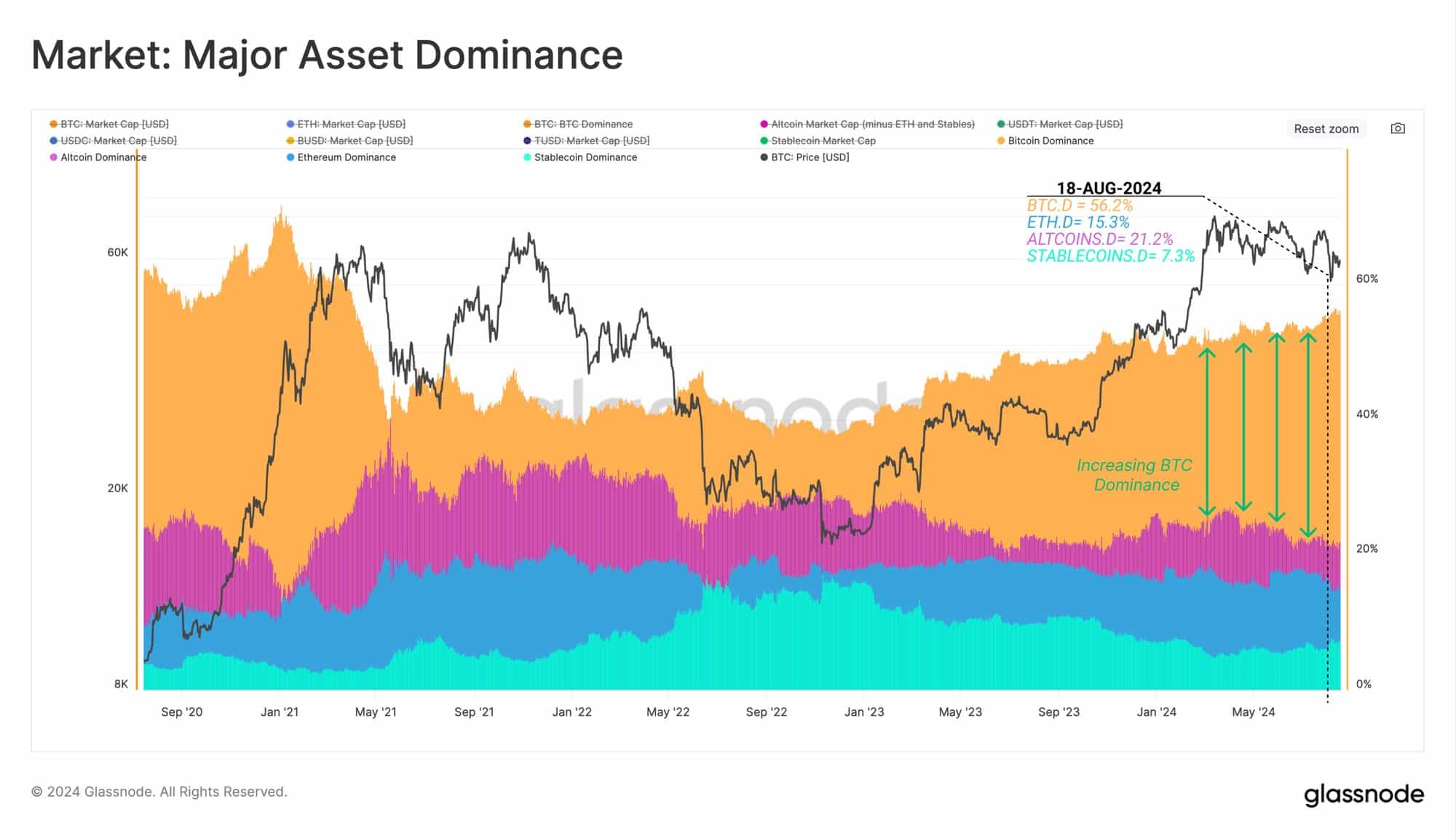

In the meantime, Glassnode highlighted that Ethereum’s market dominance has dropped from 16.8% to 15.2% since crypto bottomed in late 2022.

‘As the second largest asset in the ecosystem, Ethereum has recorded a dominance decline of 1.5%, remaining relatively flat over the past two years.’

On the contrary, Bitcoin’s [BTC] dominance has surged from 38% to over 56% over the same period, underscoring possible capital rotation to the largest digital asset.

Interestingly, even the US spot ETH ETF approvals didn’t boost ETH’s market dominance. Despite the ETFs recording net outflows since its debut due to Grayscale’s ETHE outflows, BlackRock’s ETHA had a wild run. ETHA hit $1B in net inflows in a month.

ETH price analysis

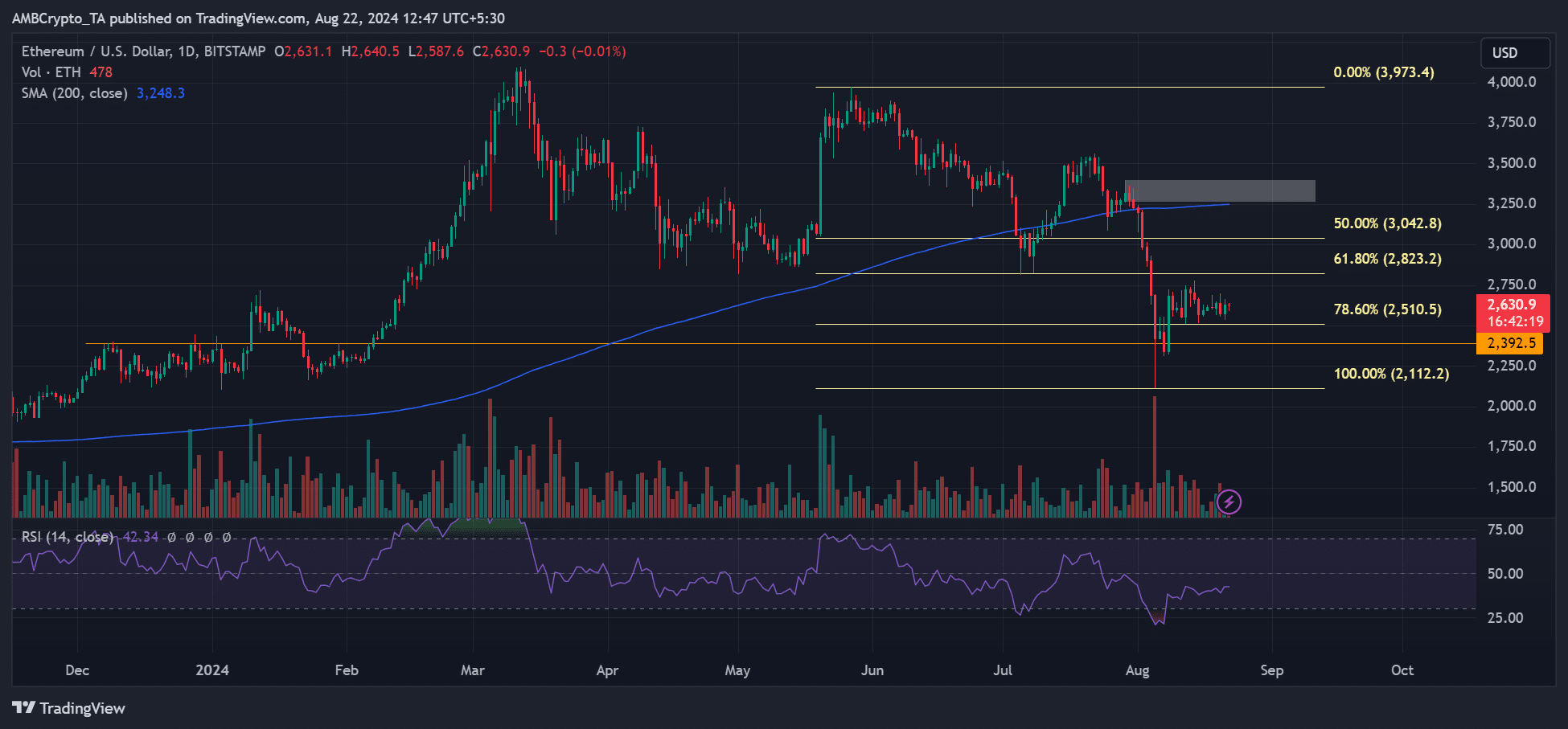

On the price charts, demand has improved since the dump on August 5th, as indicated by the RSI (Relative Strength Index), which has risen from the oversold territory. However, demand was not above average, indicating a lack of strong momentum for price.

As such, key short-term support levels to watch were $2500 and $2300 on the lower side of price action. Conversely, if sentiment improved, $2.8k and $3k were crucial short-term bullish targets.