MATIC rises 27%, but here’s why long-term holders might sell soon

08/23/2024 07:00

Polygon (MATIC) surges 27%, but analysts warn of a potential correction as most long-term holders face losses.

- MATIC rallies 27%, but 90% of long-term holders are at a loss, signaling potential selling pressure soon.

- Active MATIC traders see profits while TD Sequential warns of an imminent correction that could impact short-term gains.

Polygon [MATIC] has experienced notable price growth over the past week, rising by 27.37%. MATIC traded at $0.5274 at press time, with a 24-hour trading volume of $730.3 million.

This represents an 11.70% increase in the last 24 hours. Despite this upward momentum, market analysts are urging caution.

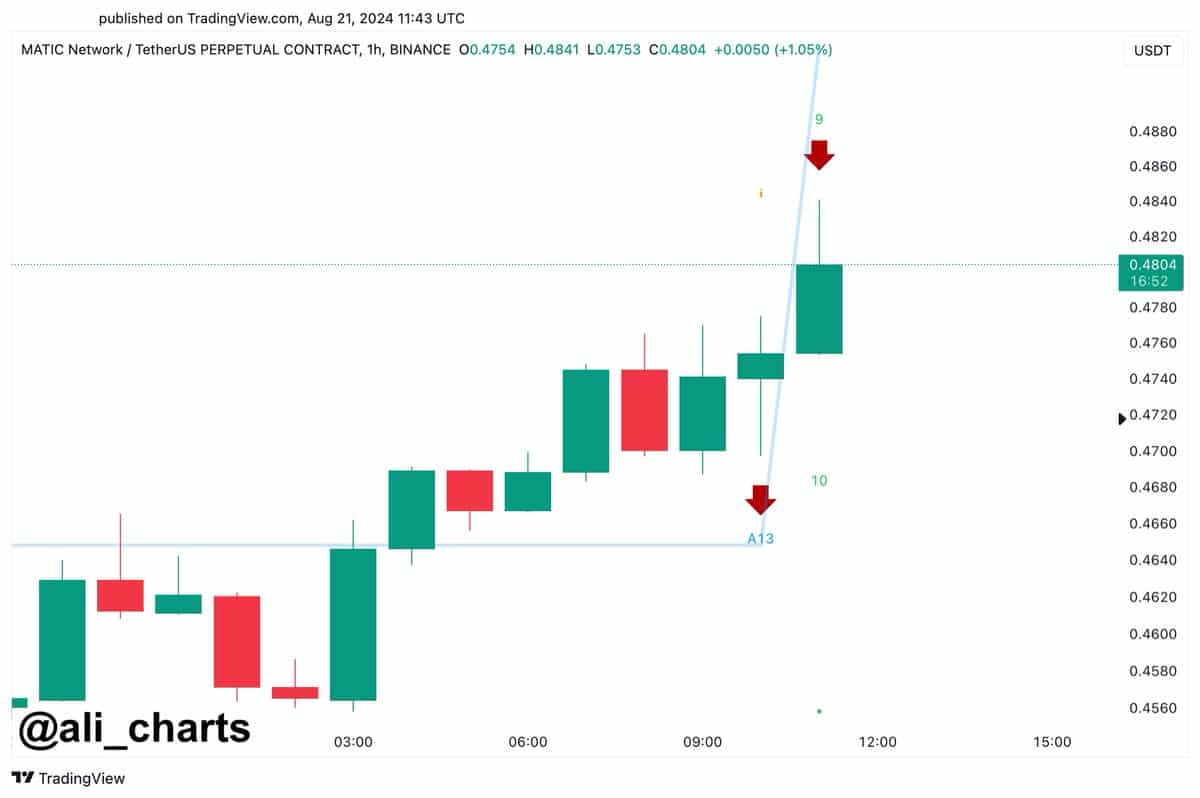

Ali, a market analyst, stated,

“Polygon has seen a significant surge in recent days, but caution is advised. The TD Sequential on the hourly chart is signaling a potential correction for $MATIC.”

Traders are closely monitoring these technical indicators as they suggest the possibility of a pullback after the recent rally.

Source: X

Long-term MATIC holders face losses

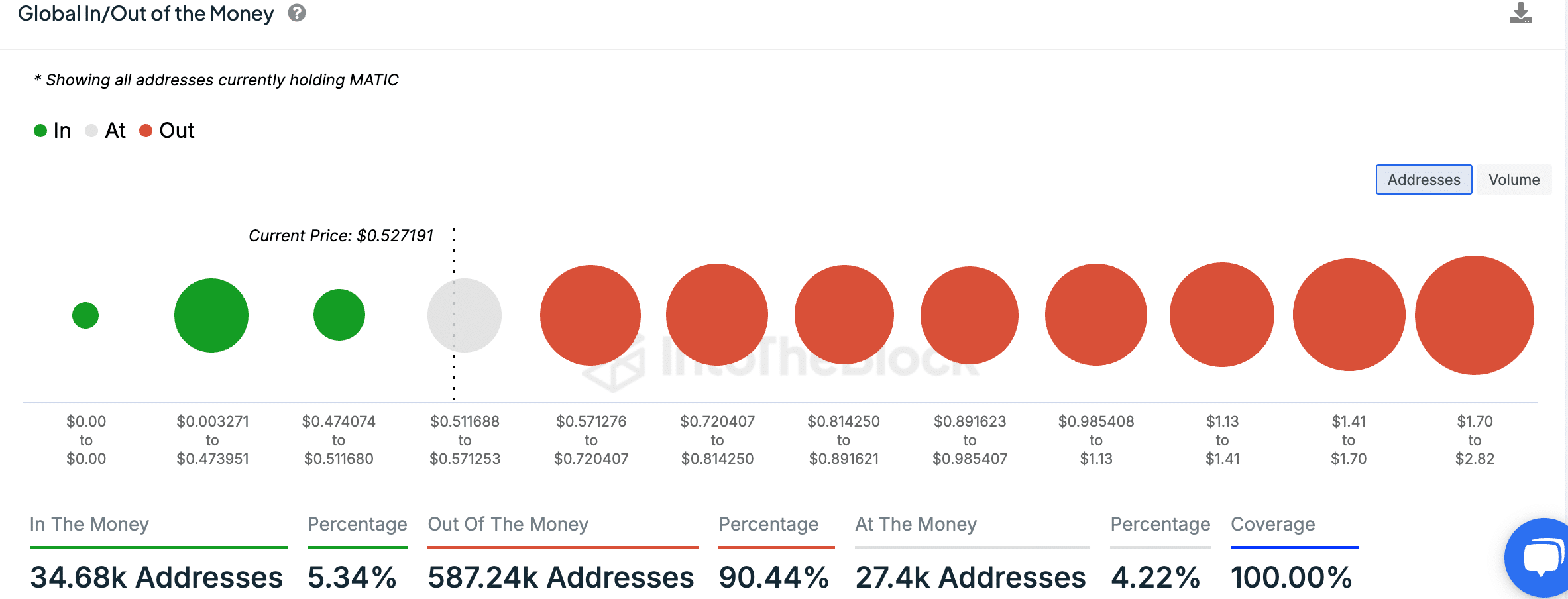

According to IntoTheBlock data, MATIC’s Global In/Out of the Money chart shows that the majority of long-term holders are currently facing losses.

As of the time of writing, 90.44% of addresses, or 587,240, are “Out of the Money,” meaning that their purchase price is higher than the current value.

Only 5.34% of addresses, accounting for 34,680 addresses, are in profit, while 4.22% of addresses are at break-even. This data suggests that most MATIC holders are experiencing losses at current levels, potentially contributing to selling pressure.

Source: IntoTheBlock

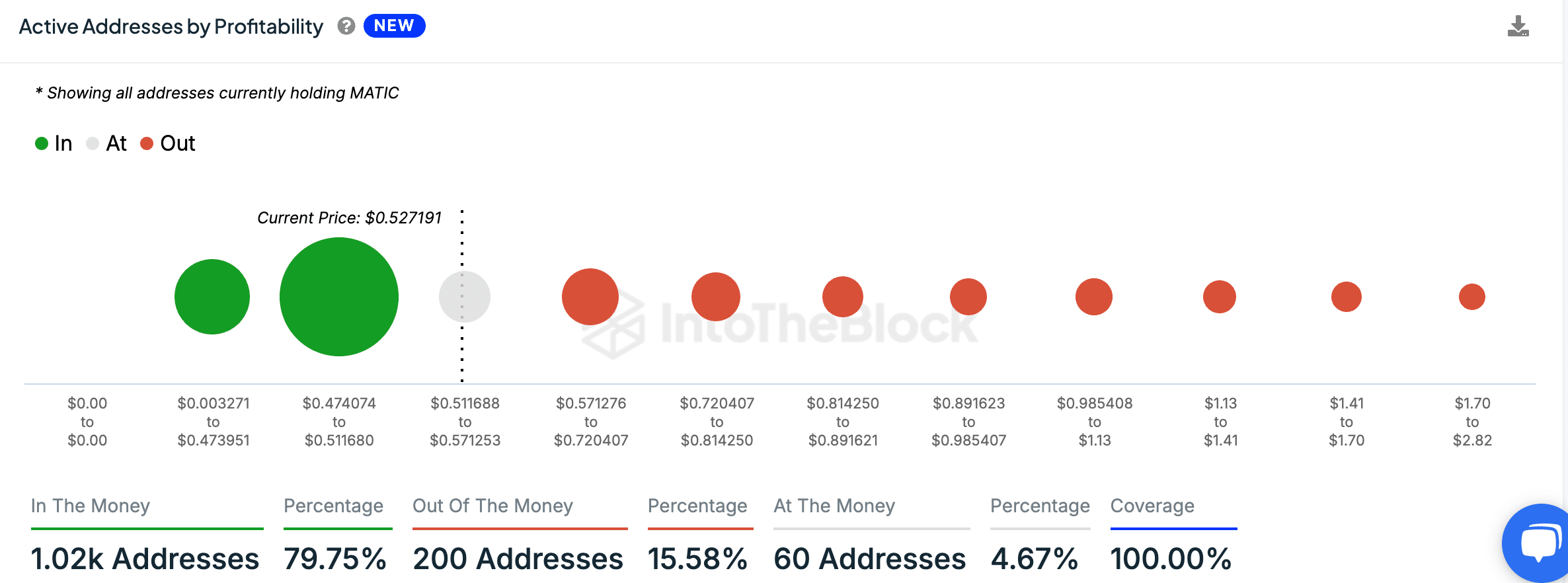

On the other hand, active addresses show a different trend. The majority of active addresses, 79.75%, or 1,020 addresses, are “In the Money” and currently holding MATIC at a profit.

This contrasts with long-term holders, as active traders have benefited from the recent price increases. However, 15.58% of active addresses are “Out of the Money,” indicating that some traders could be at risk if a correction occurs.

Source: IntoTheBlock

Upcoming migration from MATIC to POL

Meanwhile, the transition from MATIC to POL as the native gas token is set to take place on September 4, 2024. POL will replace MATIC as the gas token for Polygon PoS, which will be used for powering transactions and securing the network through validator incentives.

The migration will be automated through a smart contract, converting MATIC to POL on a 1:1 basis, allowing users to continue transacting on Polygon seamlessly.

After the upgrade, all transactions on the Polygon PoS network will automatically utilize POL. The Polygon bridge will support POL, ensuring seamless interoperability between Polygon and Ethereum.

No action is required from MATIC holders as the migration is handled through the contract.

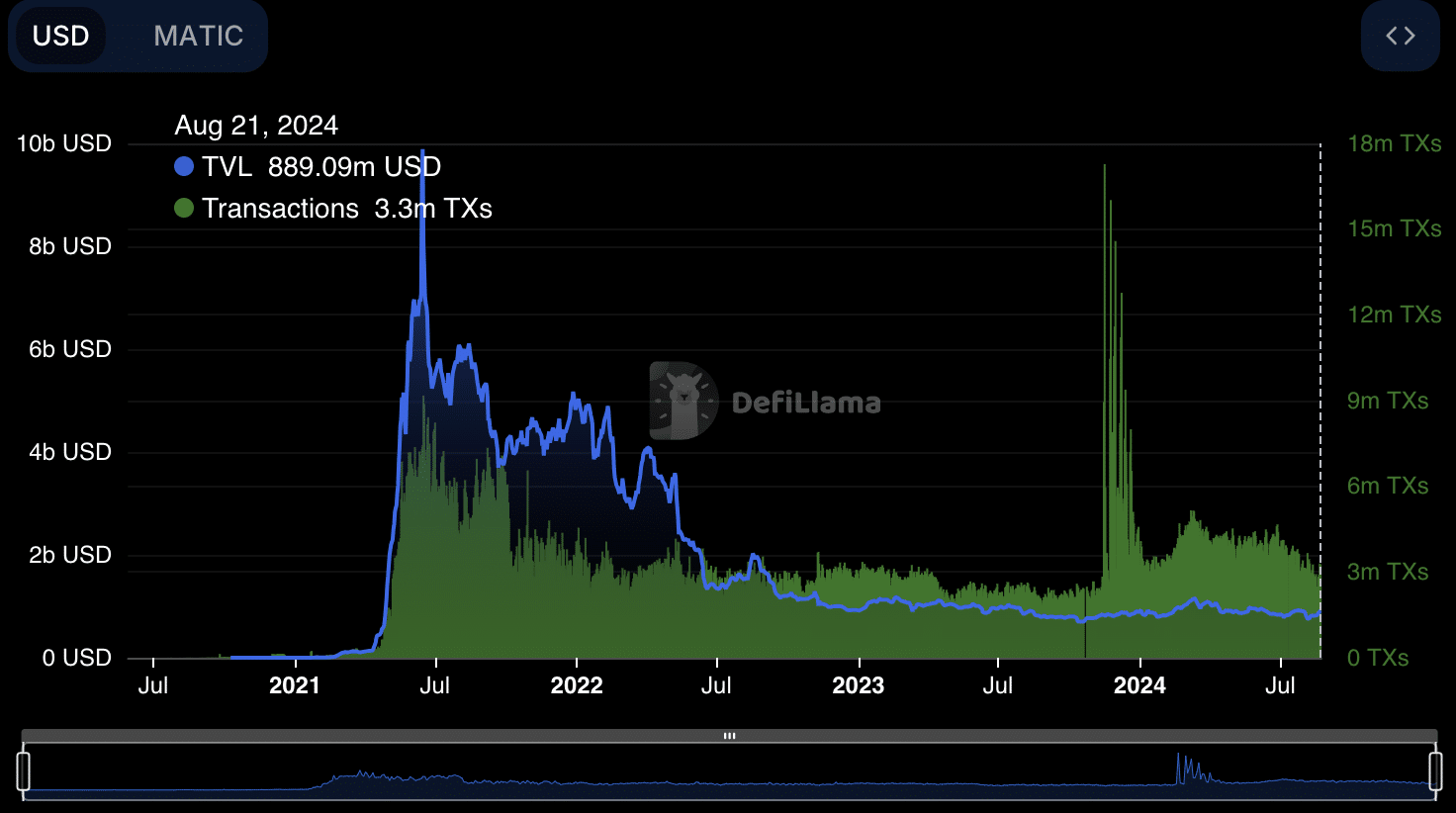

The Polygon network has maintained strong trading activity, with 3.27 million transactions completed over the last 24 hours. The network saw the addition of 55,169 new addresses during this period, reflecting increased interest in the platform.

Read Polygon’s [MATIC] Price Prediction 2024-25

Additionally, the total value locked (TVL) in the Polygon ecosystem stands at $889.09 million, with inflows of $1.67 million in the past 24 hours, according to DefiLlama.

Source: DefiLlama

Despite the positive network metrics, the potential for a price correction remains a concern for traders