Sony Block Solutions Labs, a subsidiary of Sony Group, has unveiled plans to develop Soneium, an Ethereum Layer-2 network designed to accelerate blockchain technology adoption, according to an Aug. 23 statement.

The layer-2 network—a result of a collaboration with blockchain infrastructure provider Startale—seeks to bridge blockchain technology (Web3) with everyday internet services.

This project signals Sony’s ongoing expansion into the digital asset space. Sony Group hinted at launching a crypto exchange in July after acquiring Amber Japan’s WhaleFin exchange. The tech giant plans to rename and relaunch the exchange, although the timeline remains unclear.

Soneium

The network would be designed as a versatile, general-purpose blockchain with competitive features, blending elements from entertainment, gaming, finance, and other sectors.

Soneium would leverage the Op Stack and Superchain developed by the Optimism Foundation. A testnet will be launched in the coming weeks to provide developers with hands-on experience.

Several crypto protocols, including Chainlink and the Astar network, are already joining the project as launch partners. Astar said its zkEVM solution would transition into Soneium, and its native ASTR token will play a vital role within the planned layer-2 solution.

Jun Watanabe, Chairman of Sony Block Solutions Labs, highlighted Soneium’s opportunity to introduce blockchain technology to a global audience by leveraging Sony’s extensive reach across entertainment, finance, electronics, and gaming. He emphasized that Soneium will eventually integrate with Sony Group services to attract users unfamiliar with Web3.

Layer-2 networks

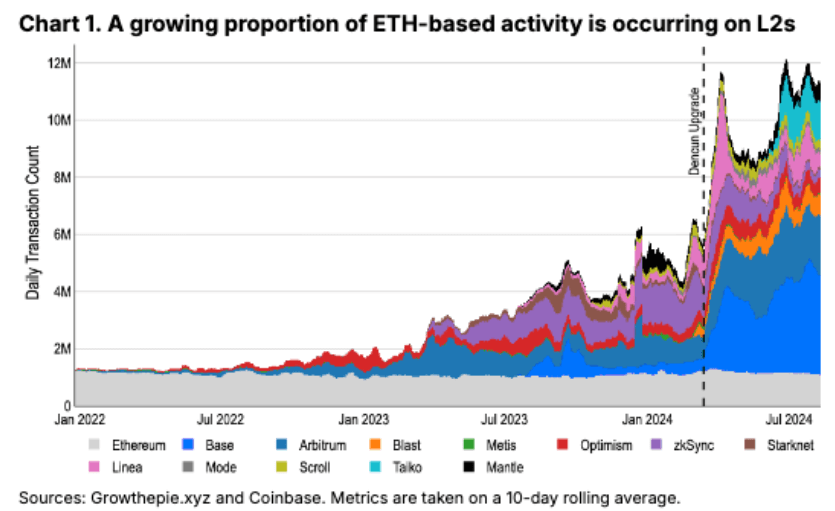

Ethereum layer-2 networks are designed to enhance mainnet scalability and speed and have seen sustained success recently.

Over the past year, the layer-2 landscape has become crowded with major crypto firms, including Coinbase, launching their networks and scoring massive community adoption.

As a result, layer-2 networks now handle most of Ethereum’s activity. According to available data, about 89% of blockchain transactions occur on these platforms.

However, some critics argue that this expansion could harm Ethereum in the long run. These networks have already pushed the blockchain network’s fees to three-year lows and could also potentially signal the end of ETH’s “ultrasound money” narrative.