Here are 2 main reasons behind Bitcoin’s dropping demand

08/24/2024 12:00

Bitcoin's demand growth has slowed significantly since hitting a peak in April amid weakening ETF inflows and whale inactivity.

- Bitcoin’s demand has dropped to its lowest levels in recent weeks as prices consolidated.

- However, the reducing Bitcoin supply on exchanges made the case against significant price drops.

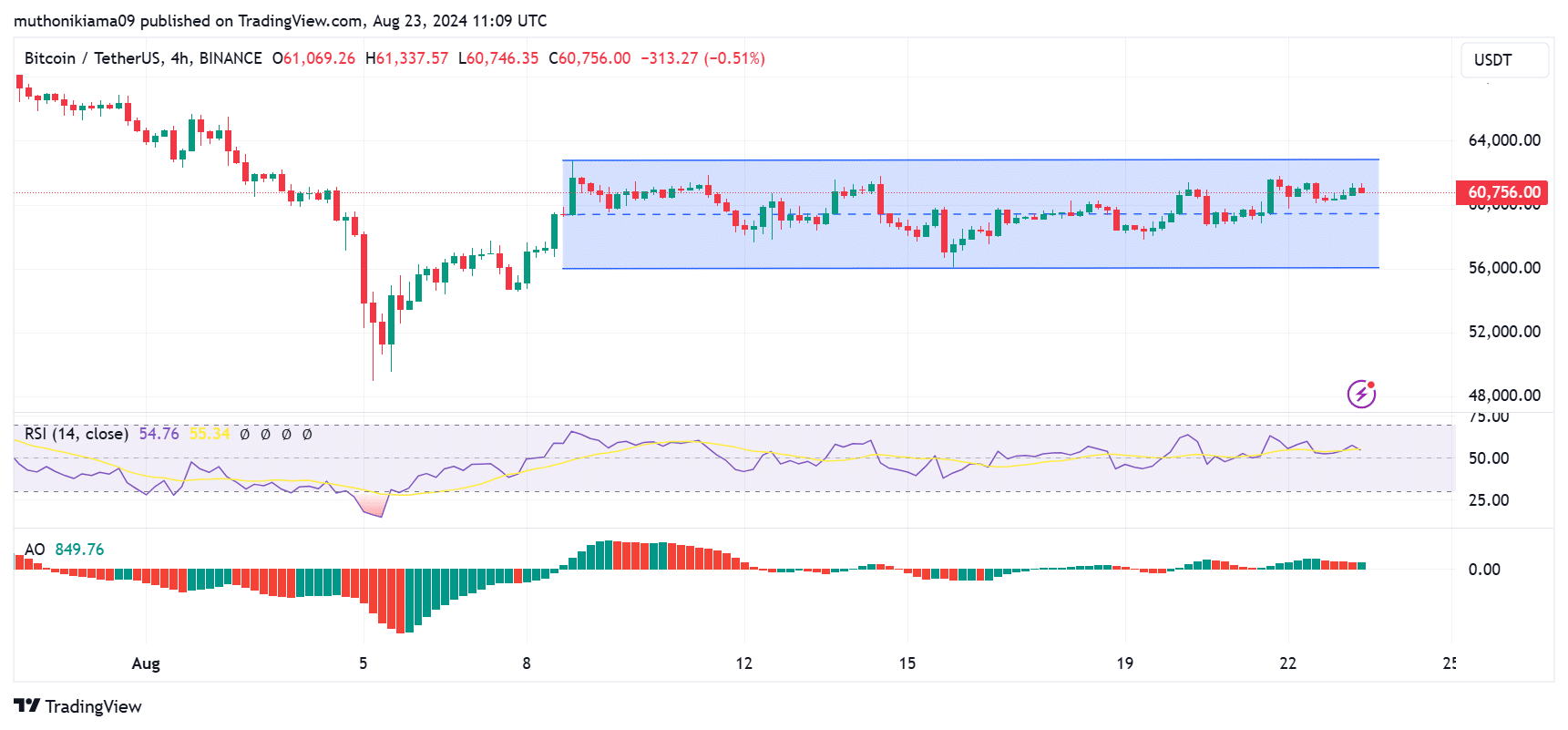

Since recovering from the drop on the 5th of August, Bitcoin [BTC] has traded rangebound between $56K-$62K.

The price has not broken below or above this range since the 8th of August, signaling possible consolidation or market uncertainty.

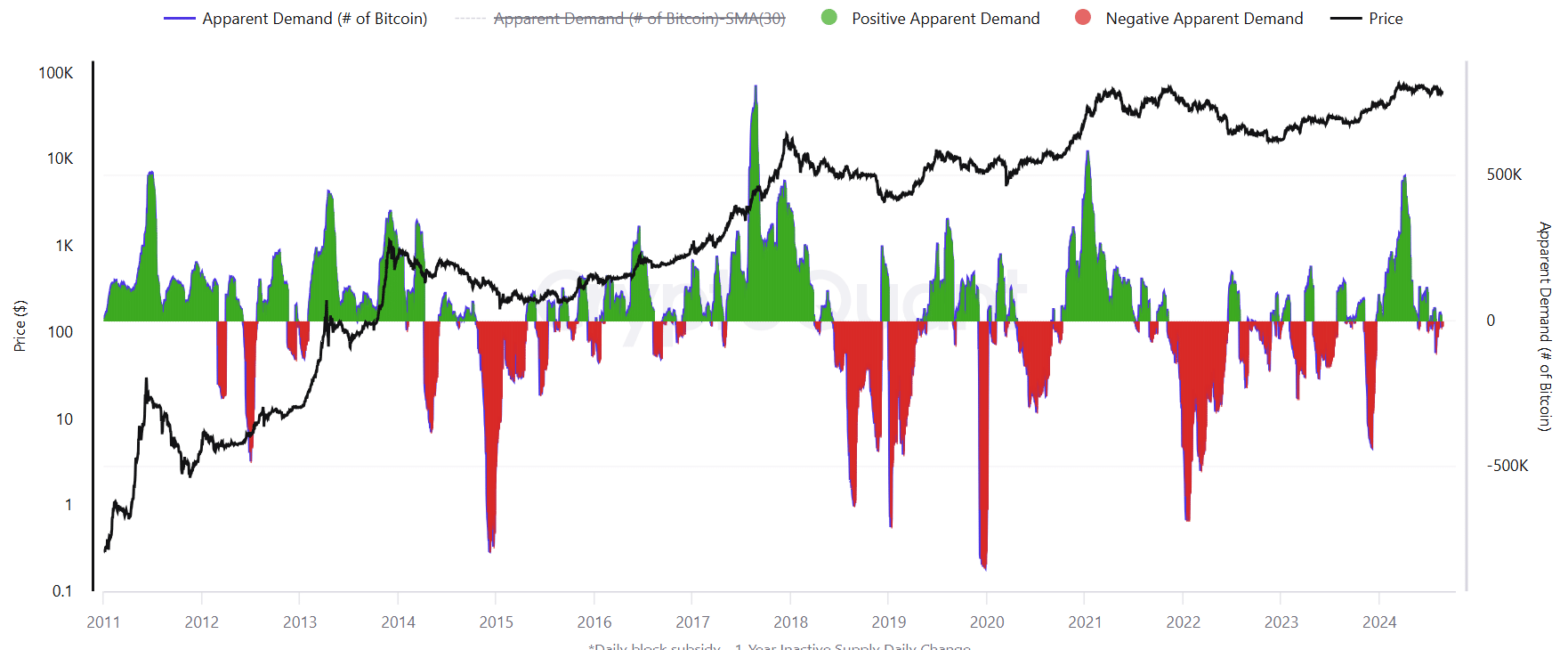

One of the factors preventing major breakouts above this zone is weak Bitcoin demand growth, which remained at low levels, per CryptoQuant. This even turned negative in recent weeks.

Bitcoin’s demand hit a three-year peak in April 2024 coinciding with the Bitcoin halving event. However, it has since dropped to the lowest level this year.

So why is Bitcoin’s demand falling?

Looking at ETF and whale activity

The analysis pointed out the drying inflows into spot Bitcoin ETFs. In March, as BTC surged to all-time highs, the average daily purchases into Bitcoin ETFs stood at 12,500 BTC.

This dropped to 1,300 BTC last week.

Total inflows into spot Bitcoin ETFs have remained below the $100M mark since the 9th of August, as seen on SoSoValue. While these products hold over $55 billion in net assets, buying activity is needed to boost the overall demand.

Whales also appear to be reducing their Bitcoin stake. The 30-day average whale holdings have dropped from 6% in February to 1%. This marks the fastest drop since February 2021 per CryptoQuant.

Whales play a crucial role in supporting Bitcoin price growth. Decreased whale holdings point to a general bearish sentiment across the market.

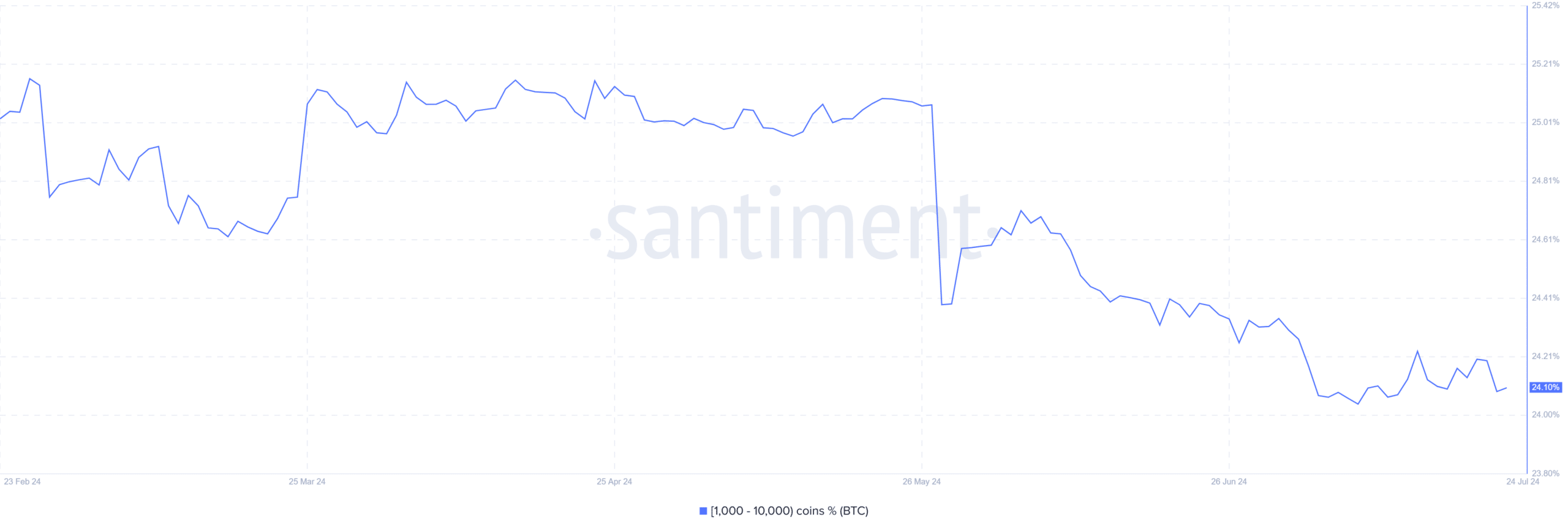

A decline in whale activity was further confirmed by data from Santiment, which showed that Bitcoin addresses holding between 1,000 and 10,000 coins have dropped significantly since March.

Despite slower whale activity, long-term Bitcoin holders have increased their positions. These holders have been increasing their BTC holdings at a rate of around 391,000 BTC per month.

Will Bitcoin breakout of its range?

As demand for Bitcoin slows, it begs the question whether it will break out of the $56K-$62K range. A deeper look into on-chain data paints a grim picture.

According to IntoTheBlock, over 3 million addresses bought Bitcoin at this price range. New investors who bought at these prices have not made significant profits.

Therefore, breaking out past $62K will be met with selling pressure as they rush to take profits.

Technical indicators also fail to make the case for a breakout. The Relative Strength Index (RSI) has also remained rangebound with no significant surges in buying momentum.

The Awesome Oscillator, which was in the positive region, showed an uptrend. However, the short histogram bars pointed towards a possibly weakening uptrend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, the possibility of a steep downtrend below the current range is unlikely in the short term, due to the declining supply of Bitcoin on exchanges.

Per CryptoQuant, the Exchange Supply Ratio has been on a steep decline over the past year. Therefore, despite demand being significantly low, exchange supply is also low, reducing the risk of steep corrections.