How did MKR react to MakerDAO preparing for ‘Endgame’ launch?

08/24/2024 16:00

MakerDAO has unveiled a new pair of tokens as part of a restructuring to position the ecosystem for long-term growth and increased...

- Introduction of new ecosystem tokens is part of initiatives to refine decentralized governance and increase participation

- Conversion of Maker (MKR) and Dai (DAI) to the yet-to-be-rolled-out tokens will be optional for holders

Ethereum decentralized finance (DeFi) protocol MakerDAO has been undergoing a major transformation in line with its pre-communicated strategic ‘endgame’ plan. This week, MakerDAO introduced two new tokens with placeholder names, NewStable (NST) and NewGovToken (NGT), representing upgraded versions of the current ecosystem tokens – DAI and MKR.

The move aims to modernize the MakerDAO ecosystem by enhancing governance and bolstering the protocol’s stability.

The future of MakerDAO

DAI, launched in 2017, is the third-largest stablecoin with a market capital of $5.365 billion, according to CoinMarketCap. The stablecoin provides a stable currency for DeFi lending and borrowing transactions. It is generated by locking collateral into smart contracts called Vaults, which keeps the value stable and independent of centralized control.

MKR, on the other hand, facilitates decentralized governance by ensuring the system remains stable and self-regulated. MKR is also the last resort resource to rebalance the system in cases of bad debt or insolvency, aligning governance participants with the system’s stability.

NewStable (NST) improves on DAI, MakerDAO’s crypto-backed stablecoin pegged to the U.S dollar, by enhancing its stability features. DAI owners will be able to transition to the new stablecoin offering on a 1:1 basis. NST will support compliance with real-world assets – A move the DAO hopes will increase its adoption among institutional users.

NewGovToken (NGT) supplements the governance token, MKR, through better incentives for governance participation. MakerDAO specified a re-denomination scheme allowing MKR holders to exchange their tokens at a 1: 24,000 NGT ratio. This strategy seeks to widen the involvement of users in MakerDAO’s governance by enabling users to hold significant amounts of NGT.

Endgame transformation

The ‘Endgame’ plan was first proposed in May 2022 and approved by a governance vote in August 2022. In March 2024, MakerDAO Founder Rune Christensen provided the first significant update pertaining to the three-phase transformation roadmap on the ecosystem governance forum.

In its latest update this week, Maker reiterated that both sets of tokens will exist in parallel “unless governance decides otherwise” in the future.

Maker’s team, in an August 22 post on X (Twitter), also said,

“The ecosystem will eventually explore ways to differentiate DAI and NewStable, with DAI focusing on crypto-native use cases and NewStable targeting mass adoption.”

MakerDAO also confirmed that the conversion between tokens will be optional, and users who decide to transition to the new pair can revert to the original tokens if they choose. Thursday’s announcement, however, did not provide the specific date for the roll-out of the new tokens.

MKR’s price action

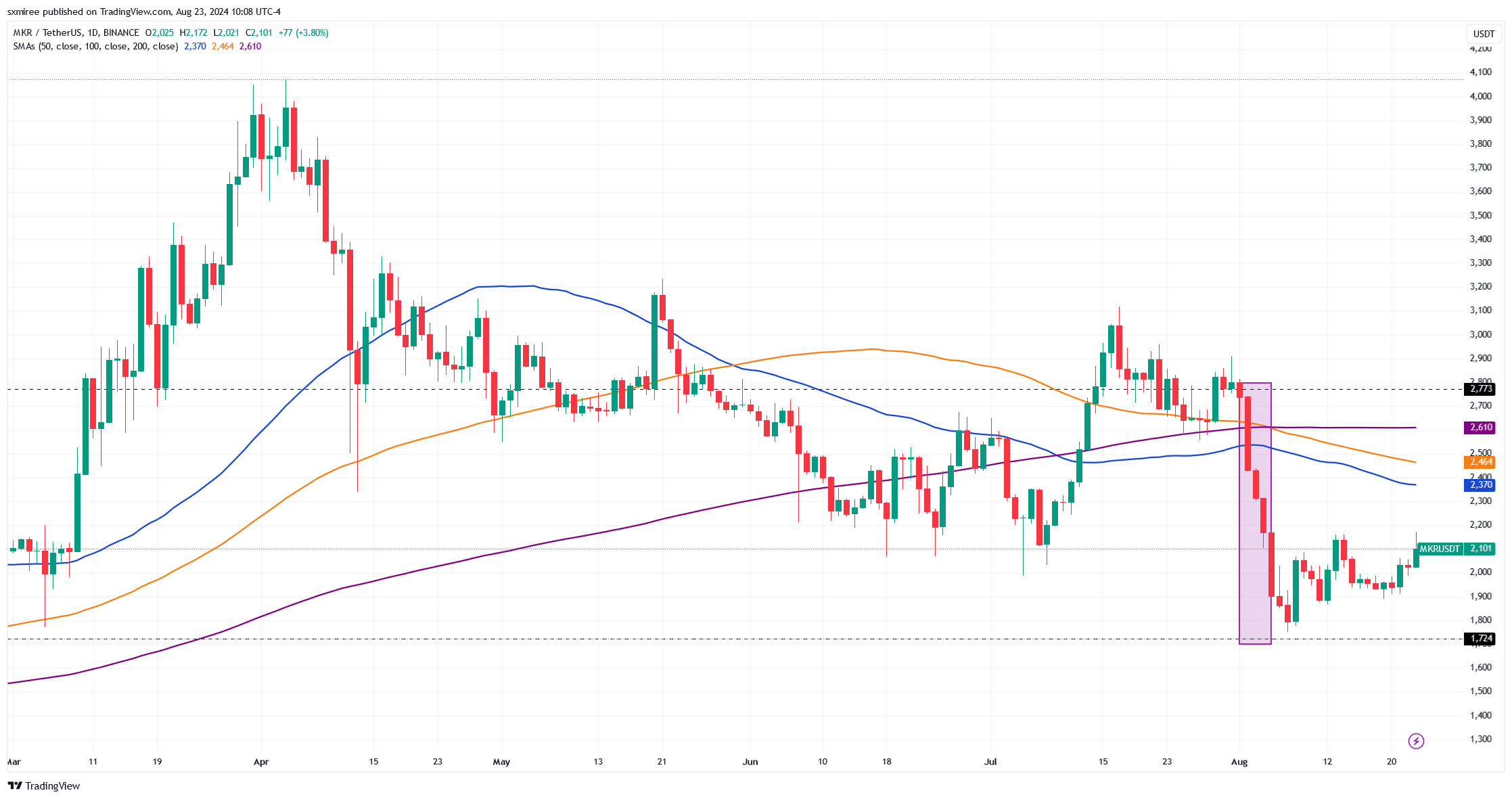

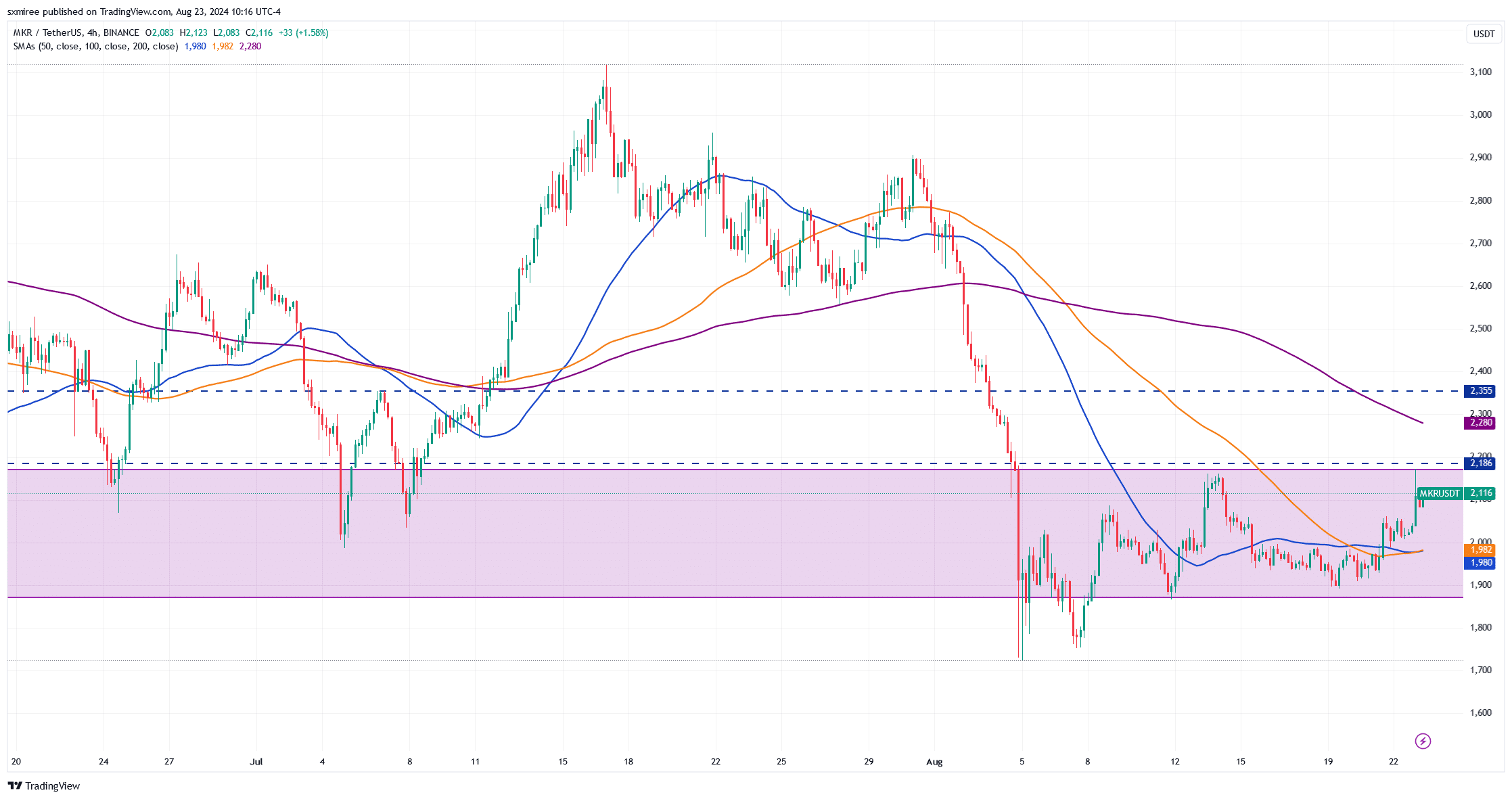

MKR was among the tokens severely affected by the global market crash between 3-5 August. In fact, MKR’s price chart on TradingView revealed the token dropping from $2,773 on 1 August to $1,724 on 5 August – Marking its highest 4-day loss since early April.

Though MKRD/USDT has since recovered to climb above $2,100, the pair remains confined between the $1,870 and $2,170 range. This is where it has traded over the last two weeks.

Market bulls could target the resistance just above its press time range at $2,185, a level where MKR was rejected on 14 August.

Triumphing over this hurdle would pave the way to attack the next target of $2,354. This level previously posed a challenge in June and July.