Powell’s ‘Time has come’ speech – Good news for Bitcoin, altcoin investors?

08/24/2024 19:00

Jerome Powell's recent statement has set the stage for significant shifts in the Bitcoin market. This means that the Federal reserve will...

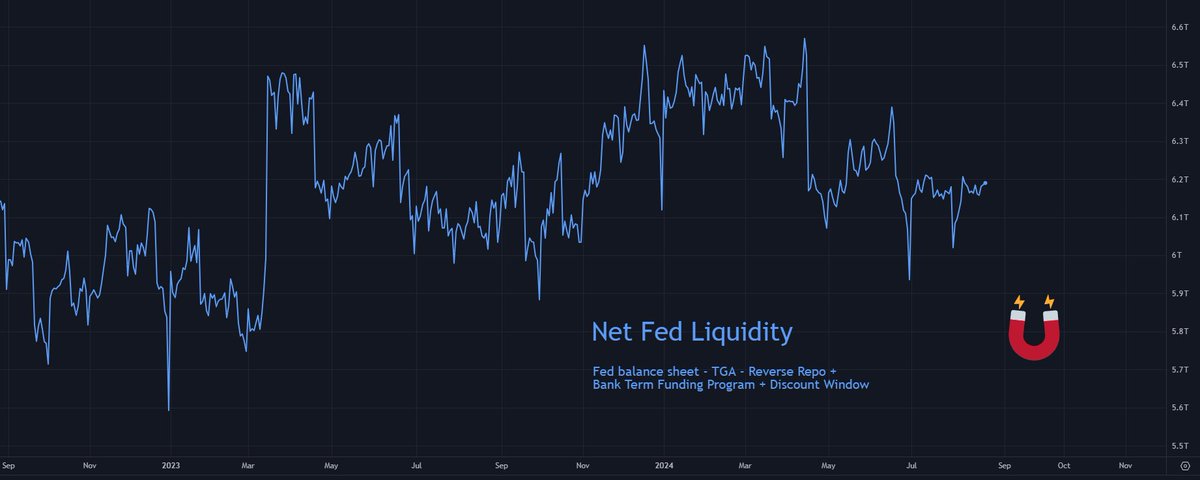

- Jerome Powell spoke about rate cuts as short-term Fed liquidity weakened

- Bitcoin and the broader crypto market have been showing signs of bullish sentiment

Jerome Powell’s recent statement has set the stage for significant shifts in the cryptocurrency market. Powell’s indication that “The time has come for policy to adjust” suggests that U.S rate cuts are on the horizon.

This move, combined with strong global liquidity, is expected to weaken the U.S Dollar (USD) significantly. As the USD weakens, Bitcoin (BTC) and other cryptocurrencies may be poised for significant gains.

In the short term, the Federal Reserve’s liquidity outlook remains weak though, a continuation of the medium-term downtrend that began back in April.

This trend suggests that Fed liquidity could hit a new “lower low” by the end of September, potentially reaching its lowest level since March 2023.

As liquidity fades and rate cuts loom, Bitcoin’s pairing with USD becomes increasingly advantageous. Particularly as Bitcoin prepares to close its seventh consecutive monthly candle above its 2021 all-time high.

The longer Bitcoin’s price consolidates above this level, the stronger the support, setting the stage for a potential breakout in September when the Fed begins its rate cuts.

Bitcoin’s profitable days

Bitcoin has historically been a strong performer, with over 96% of its history showing profitability for holders.

This historical trend, coupled with the imminent weakening of the USD, makes a compelling case for a hike in Bitcoin’s price.

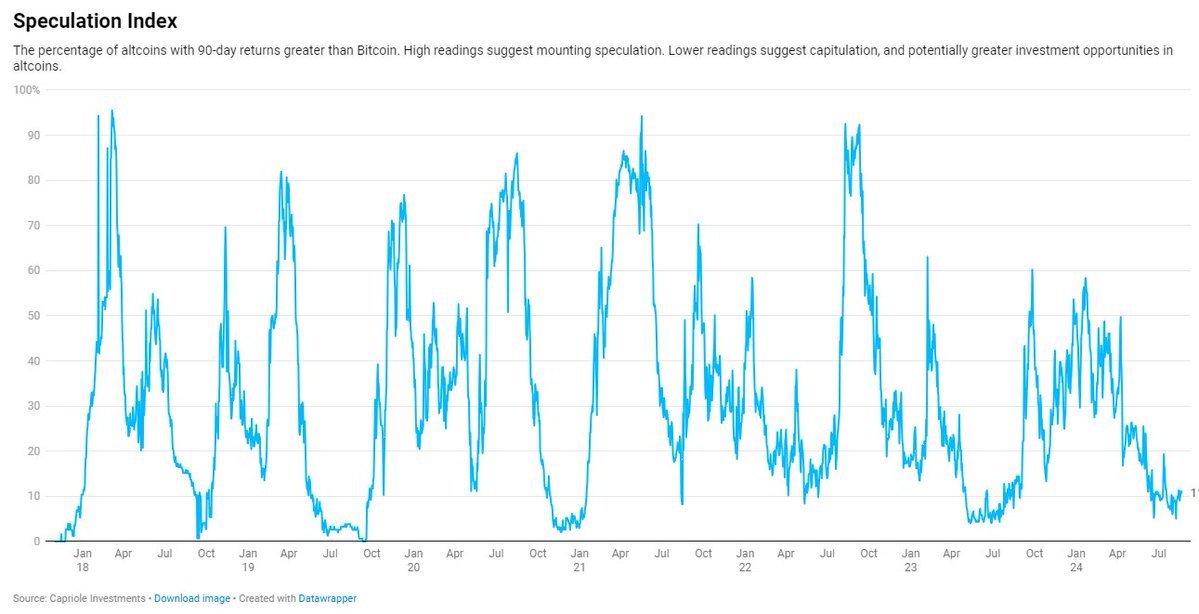

The Altcoin Speculation Index

However, Bitcoin won’t be the only beneficiary of the Fed’s actions. The entire crypto market, including major altcoins like Ethereum, BNB, Solana and XRP, is likely to see a boost.

At press time, the Altcoin Speculation Index, which is at its lowest point since July 2023, indicated that altcoin prices may have bottomed out. Simply put, this index may be signalling an opportunity for growth as USD weakens.

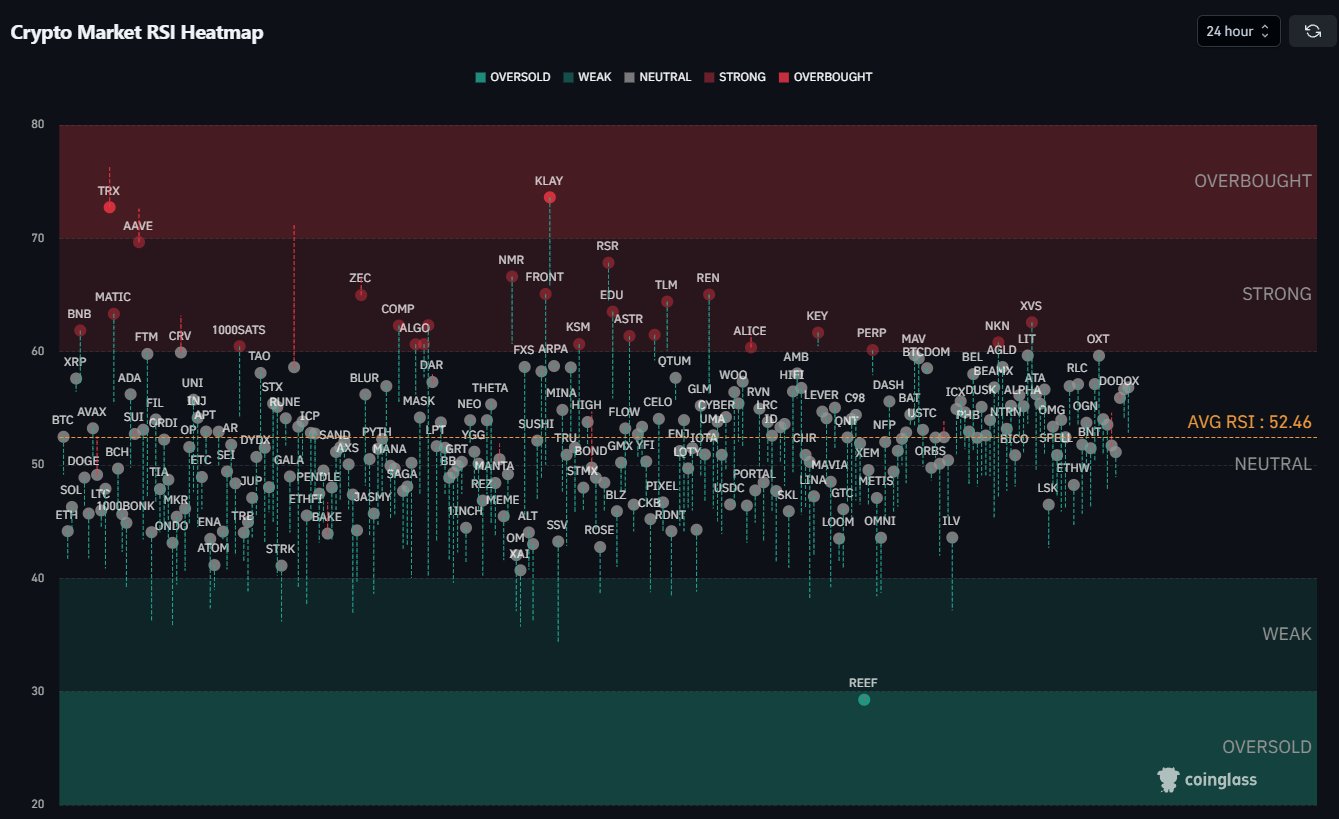

Crypto market RSI heatmap

Here, it’s worth mentioning that the broader crypto market is also showing signs of recovery. The Crypto Market RSI Heatmap recently flipped from oversold to neutral, suggesting that the market may be poised for a rebound.

Daily RSI levels have crossed the 50-level too, indicating healthy momentum with room for further gains before reaching overbought territory.

As the Fed moves towards rate cuts and global liquidity strengthens, the stage is set for Bitcoin and the broader crypto market to rise. This will offer potential gains for investors across the board.