Popcat experienced a substantial bullish trend last week, coinciding with an overall uplift in the cryptocurrency market.

Over the past seven days, Popcat’s (POPCAT) price has soared 95.7%, climbing from $0.393 on Aug. 19 to a peak not observed since July 30. In the last 24 hours alone, the asset has increased by 2.2%, currently trading at $0.75.

This recent surge has elevated Popcat’s market capitalization beyond $735 million, ranking it as the 102nd-largest cryptocurrency by market cap. Its daily trading volume has reached approximately $76.4 million.

A significant driver behind this price escalation was the listing of Popcat perpetual contracts on Binance Futures, which offer traders up to 75x leverage, as per the recent announcement from the exchange.

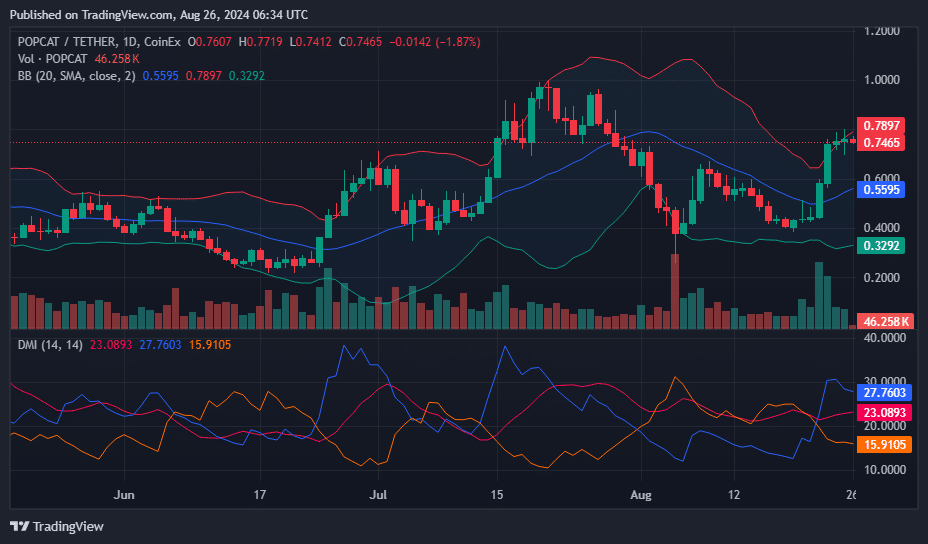

As of now, Popcat’s price positions it above the middle Bollinger Band at $0.5595, indicating a bullish movement from lower levels. However, it remains below the upper Bollinger Band set at $0.7897, suggesting that there is potential room for upward movement before encountering significant resistance.

The width between the lower Bollinger Band at $0.3292 and the upper band at $0.7897 indicates moderate market volatility. The current price nearing the upper band but not touching it may imply that while the price has recovered from lower levels, it hasn’t reached a state of overbought condition yet, allowing scope for further upward movement.

The +DI line is at 27.7603, which is higher than the -DI line at 15.9105. This shows that the buying pressure is currently stronger than the selling pressure.

The DMI setup underscores the ongoing positive sentiment as the +DI remains dominant over the -DI, aligning with the bullish signal from the Bollinger Bands. Given these indicators, traders might look for potential buy opportunities, anticipating a test of the upper Bollinger Band at $0.7897 in the near future unless new market dynamics emerge to shift the current trend.

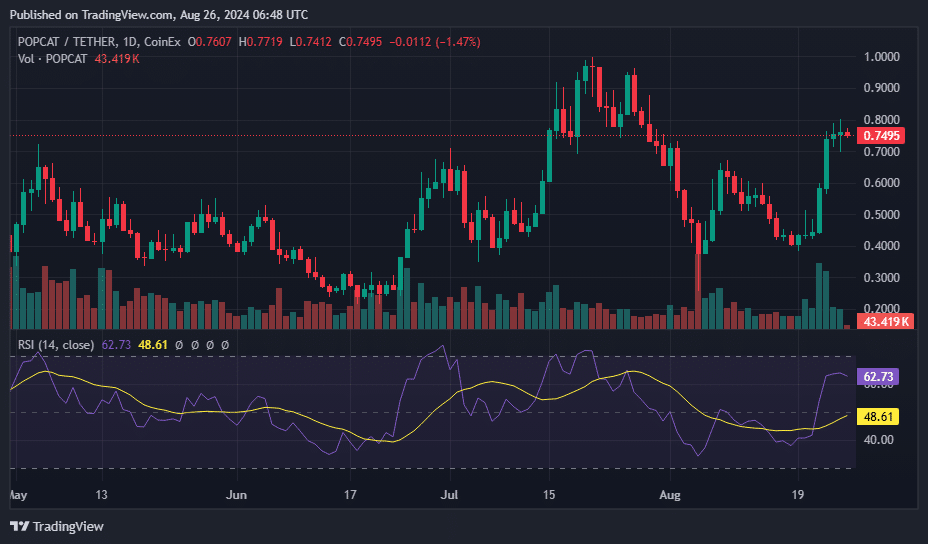

The RSI value stands at 62.73, which is significantly above the neutral threshold of 50 but still below the typical overbought marker of 70. This indicates robust upward momentum without veering into overbought territory, suggesting that while the market is strong, there is potentially more room for the price to rise before becoming overextended.