FET, the native token of Artificial Superintelligence Alliance, has surged 11% as seen on Aug. 26 morning, making it the top gainer among the leading 100 cryptocurrencies.

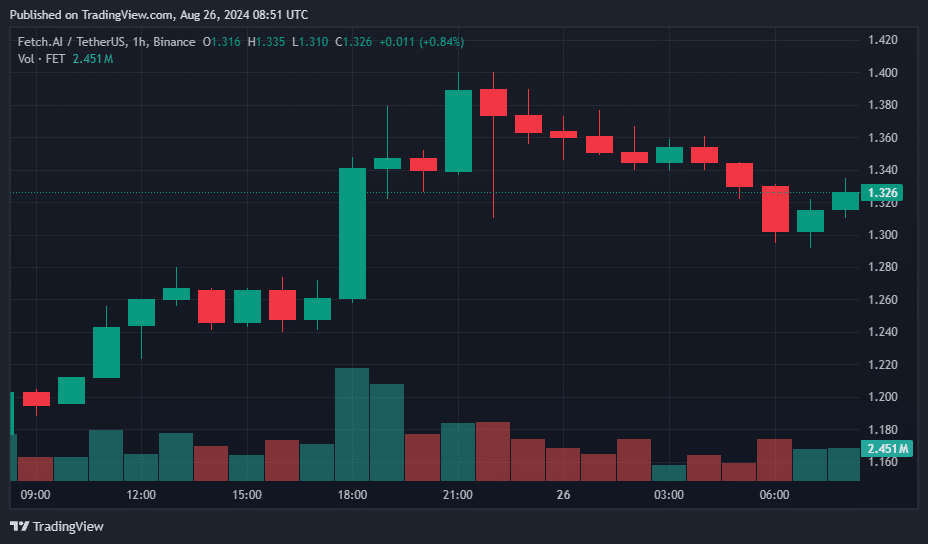

At the time of writing, FET was still up 11.7% in the last 24 hours and was trading at $1.32 — a high not seen since July 27. At its highest price on Aug. 26, it was exchanging hands at $1.39, 93% higher than its drop to $0.72 on Aug 5, when the global crypto market saw a massive crash, resulting in over $1 billion in liquidations.

Despite significantly recovering from then, the crypto asset is still trading 62% lower than its all-time high of $3.45, attained on March 28, 2024.

The latest surge in FET comes as Fetch.ai, a pioneer in autonomous digital ecosystems and a core member of the Artificial Superintelligence Alliance, recently unveiled its new Innovation Lab in San Francisco.

The company has committed $10 million each year to support startups that develop on its platform, with potential investments reaching up to $1 million for each project. Additionally, Fetch.ai is launching an internship incubator aimed at nurturing talent in decentralized technology, artificial intelligence, and machine learning.

Another key factor driving the rise in FET price is the growing anticipation for Nvidia’s release of its second-quarter results after the market close on Aug. 28

Nvidia’s stock has climbed more than 176% this year, pushing its market capitalization over $3.1 trillion and making it the world’s third-largest company by market value.

The upcoming earnings are expected to shed light on the continuing demand for AI. Nvidia saw its revenues soar by more than 240% to over $26 billion in the first quarter. Analysts are predicting that revenues will increase to $28.6 billion for the second quarter.

Strong revenue figures and positive future projections are good signs for the AI industry, likely leading to higher prices for related assets. It has also led to a general surge in AI cryptocurrencies, as reported by crypto.news earlier on June 20. However, if the results fall short of expectations, there could be a sharp market pullback.

The Artificial Superintelligence Alliance, which operates at the nexus of the blockchain and semiconductor industries, has a business model that complements Nvidia’s. The Alliance is a partnership among three AI initiatives, Fetch.ai, SingularityNET, and Ocean Protocol that aims to accelerate the creation of decentralized Artificial General Intelligence and, ultimately, Artificial Superintelligence.

As per CoinGecko, the total market cap for all AI tokens stood at $25.9 billion on Aug. 26, with trading volume reaching $1.3 billion.