Crypto investment products saw largest inflows in five weeks, CoinShares says

08/26/2024 17:34

Driven by positive market sentiment, crypto investment products saw their largest inflows in weeks, data from CoinShares shows

Driven by positive market sentiment, crypto investment products saw their largest inflows in weeks, data from CoinShares shows.

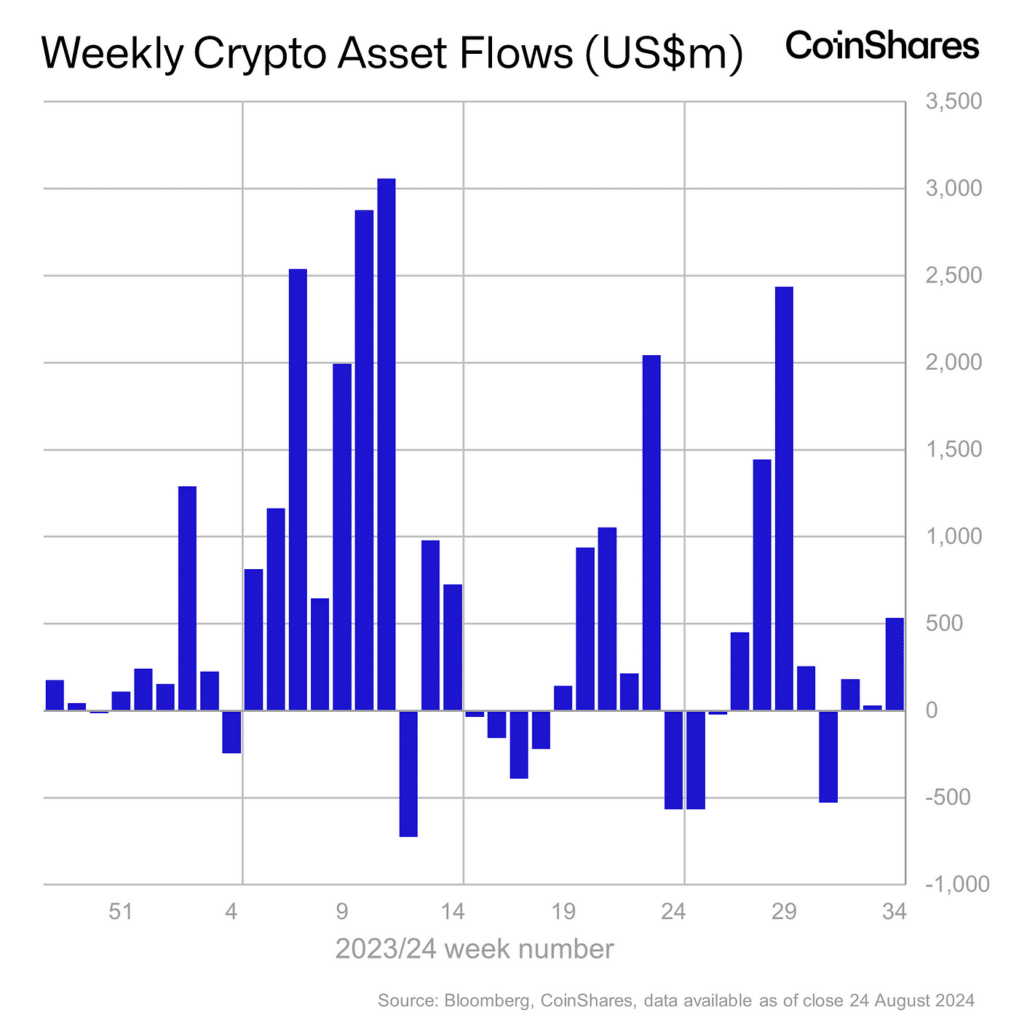

Crypto investment products attracted over $530 million in inflows last week, the highest in five weeks, as investors reacted to dovish signals from Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium, according to a report by CoinShares head of research James Butterfill.

He noted that even though trading volumes were lower than in recent weeks, they “remained high, reaching $9 billion for the week” as Powell’s remarks, hinting at a potential interest rate cut as early as September, spurred significant market activity.

While the U.S. led the inflows with $498 million, Hong Kong and Switzerland also saw gains of $16 million and $14 million, respectively. Butterfill added that Germany bucked the trend with outflows totaling $9 million, leaving it as “one of the only countries with net outflows year-to-date.”

Bitcoin (BTC) was the primary beneficiary, with inflows of $543 million, underscoring its sensitivity to shifts in interest rate expectations, with the bulk of BTC inflows occurring on Friday, Aug. 23, immediately following Powell’s comments, Butterfill added.

Although Ethereum (ETH) saw contrasting movements with outflows of $36 million last week, new Ethereum ETFs have gained traction, attracting $3.1 billion in inflows over the past month, the CoinShares head of research says, noting that those inflows were “partially offset by outflows from the Grayscale Trust of $2.5 billion.”