Experts Predict DePIN, RWA Will Lead Crypto Adoption Wave

08/26/2024 22:30

Vitalik Buterin urges DeFi integration with decentralized tech for growth, while stablecoins, RWAs, and DePin drive crypto adoption.

Experts are questioning whether decentralized finance (DeFi) can truly drive the next wave of crypto adoption. As this debate continues, attention has shifted toward Decentralized Physical Infrastructure Networks (DePIN) and real-world assets (RWA) as potential growth drivers.

Emerging trends play an increasingly vital role in advancing the cryptocurrency industry, and their influence in shaping adoption strategies cannot be overlooked.

Ethereum and Helius Labs Executives Probe DeFi

Ethereum co-founder Vitalik Buterin believes the blockchain’s future lies in sustainably useful applications. He stresses the need to maintain core principles like permissionless access and decentralization.

The Russo-Canadian innovator advocates for integrating decentralized finance (DeFi) with other technologies to achieve this vision. Buterin acknowledges that while DeFi has its strengths, it faces fundamental limitations that cap its ability to drive a notable 10-100x surge in crypto adoption.

“The kinds of applications that I want to see are applications that are useful in a sustainable way, and don’t sacrifice on the principles. I think DEXes are great, and I use them every week. I think decentralized stablecoins are great. I think USDC is less great than RAI, but as a practical matter we simply have to respect that it’s incredibly convenient and lots of people use it,” Buterin shared.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

Helius Labs CEO Mert Mumtaz echoes this view, noting that finance is merely a downstream component of a thriving economy. Mumtaz argues that DeFi cannot exist in isolation without risking collapse, highlighting the need for a broader ecosystem to support sustainable growth.

“It doesn’t make much sense for it to exist isolated without this, otherwise it will collapse as it’s inherently circular and requires more and more input to continue functioning — which is the exact opposite of what the concept of technology means,” Mumtaz explained.

Mumtaz aligns with Buterin’s stance on stablecoins, while also naming DePIN and tokenized RWA as key drivers for the next wave of crypto adoption. However, he stresses out that sustainability is crucial in unlocking this potential.

DePin, Stablecoins, and Tokenized RWA Drive Crypto Adoption

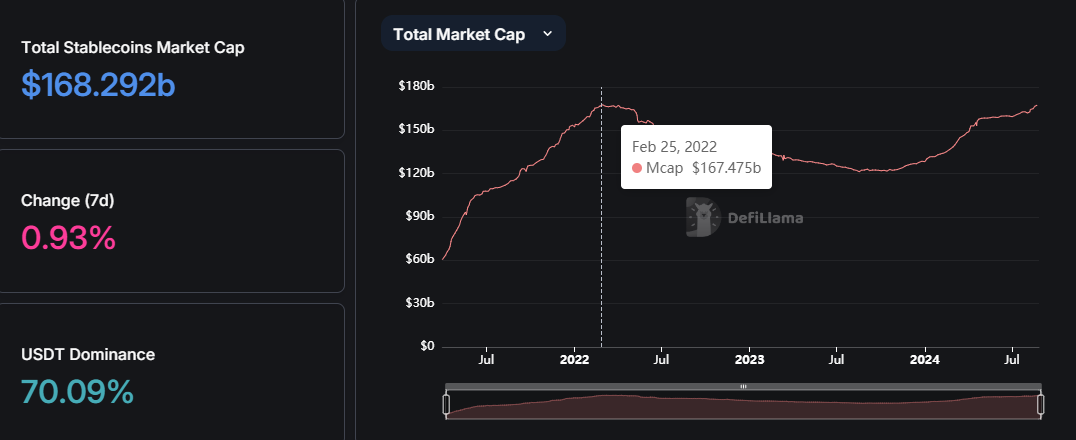

In practice, DePIN, stablecoins, and RWAs are already pushing crypto adoption forward. are already driving crypto adoption. Stablecoins, in particular, continue to see strong demand, with Tether’s USDT leading in revenue generation, followed by Circle’s USDC.

Recent data reveals that the total market capitalization of stablecoins has surged to an all-time high of $168 billion after 11 consecutive months of growth. This marks a new milestone for the sector, surpassing the previous peak of $167 billion recorded in February 2022.

The surge reflects rising capital inflows into the market, driven largely by sustained retail participation over the past eight months.

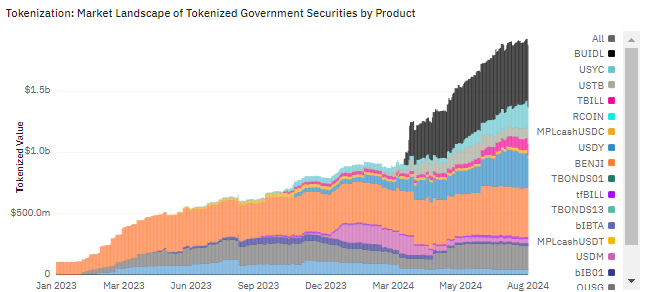

Alongside stablecoins, tokenized real-world assets are experiencing notable growth, attracting institutional interest. Major players like BlackRock, Grayscale, and Franklin Templeton are making big moves in this space. The tokenized securities market has surpassed $1.92 billion, highlighting the role of RWA in bridging the gap between TradFi and DeFi.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

The DePIN narrative is also gaining traction, with Bittensor (TAO) leading in social activity metrics. A surge in social engagement highlights growing community interest, which can drive broader adoption and momentum.

Other major players in the DePIN space include Render (RNDR), Filecoin (FIL), and Internet Computer (ICP). According to recent reports, the sector’s parabolic growth has pushed its market capitalization beyond $20 billion.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.