Stablecoin market hits record $169B: A launchpad for Bitcoin’s rise?

08/27/2024 15:30

Stablecoin market cap hits $169.553B after 11 months of growth, boosting Bitcoin potential while European regulations slow trading volumes.

- Stablecoin market reaches a historic $169 billion in market cap, setting the stage for a potential Bitcoin price boost.

- Regulatory challenges in Europe contribute to a decline in stablecoin trading volumes despite market growth.

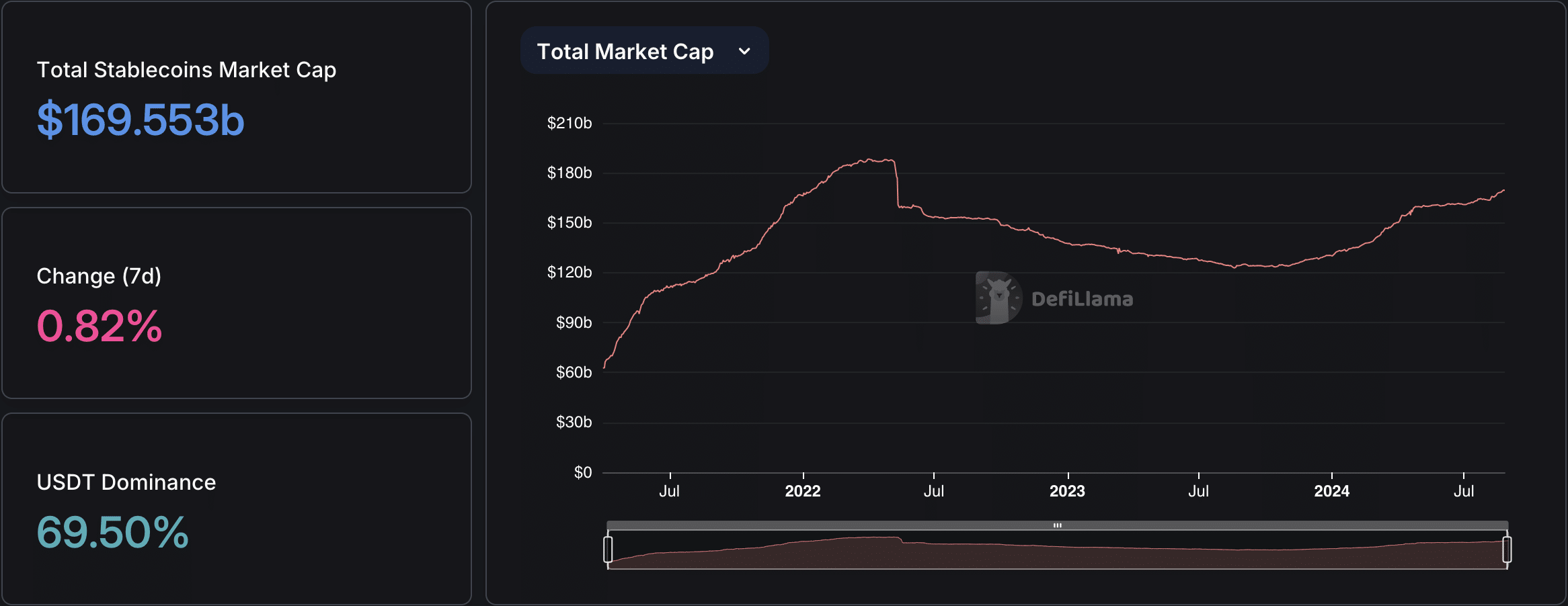

The stablecoin market has reached an unprecedented milestone, with its market capitalization soaring to $169.553 billion. This figure represents the highest point in history, marking 11 consecutive months of growth.

According to data from DefiLlama, this new peak surpasses the previous record of $167 billion, which was set in March 2022 before a significant downturn later that year.

The current market cap excludes algorithmic stablecoins, which rely on algorithms rather than external assets for their value.

Source: DefiLlama

Stablecoin surge boosts Bitcoin potential

Tether [USDT] has been a key driver in the stablecoin market’s recent growth. Starting 2024 with a market cap of $91.69 billion, USDT has seen consistent monthly increases, culminating in a market cap exceeding $117.844 billion in August.

Circle’s USD Coin (USDC) has also experienced growth, reaching a market cap of over $34.338 billion. While this is the highest point for USDC in 2024, it remains below its all-time high of $55.8 billion recorded in June 2022.

The surge in stablecoin issuance has brought renewed attention to its potential effects on Bitcoin’s [BTC] price. The increase in liquidity from dollar-pegged tokens has been viewed as a potential opportunity for Bitcoin to rise.

As of press time, Bitcoin was trading at $63,645, down slightly from the previous day’s high of $64,879. The increased liquidity may take time to reflect in Bitcoin’s price action, as market dynamics adjust to the influx of new stablecoin capital.

Europe’s crypto rules slow trading

Despite the growing market cap, stablecoin trading volumes have seen a decline. According to a report by CCData, trading volumes fell by 8.35% to $795 billion in July, largely due to decreased activity on centralized exchanges.

The report attributes this drop to the introduction of the Markets in Crypto-Assets (MiCA) Regulation in Europe, which has raised concerns about the future of stablecoins like USDT in the region.

This downward trend in trading volume continued into August, with current figures standing just above $50 billion, as reported by CoinMarketCap.

As the stablecoin market grows, issuers like Tether and Circle have increasingly turned to US Treasury bills as their preferred back-up assets, according to a recent AMBCrypto report.

Known for their safety and liquidity, these assets have become a cornerstone in ensuring the 1:1 backing of stablecoins.

This trend has solidified Tether and Circle’s roles as key players in the market, as they work to maintain the stability and reliability of their tokens.