Avalanche: Why AVAX could be on the edge of a pullback

08/27/2024 16:00

AVAX is poised for a pullback to $25, driven by a $4M liquidation pool, whale activity, and bearish signals.

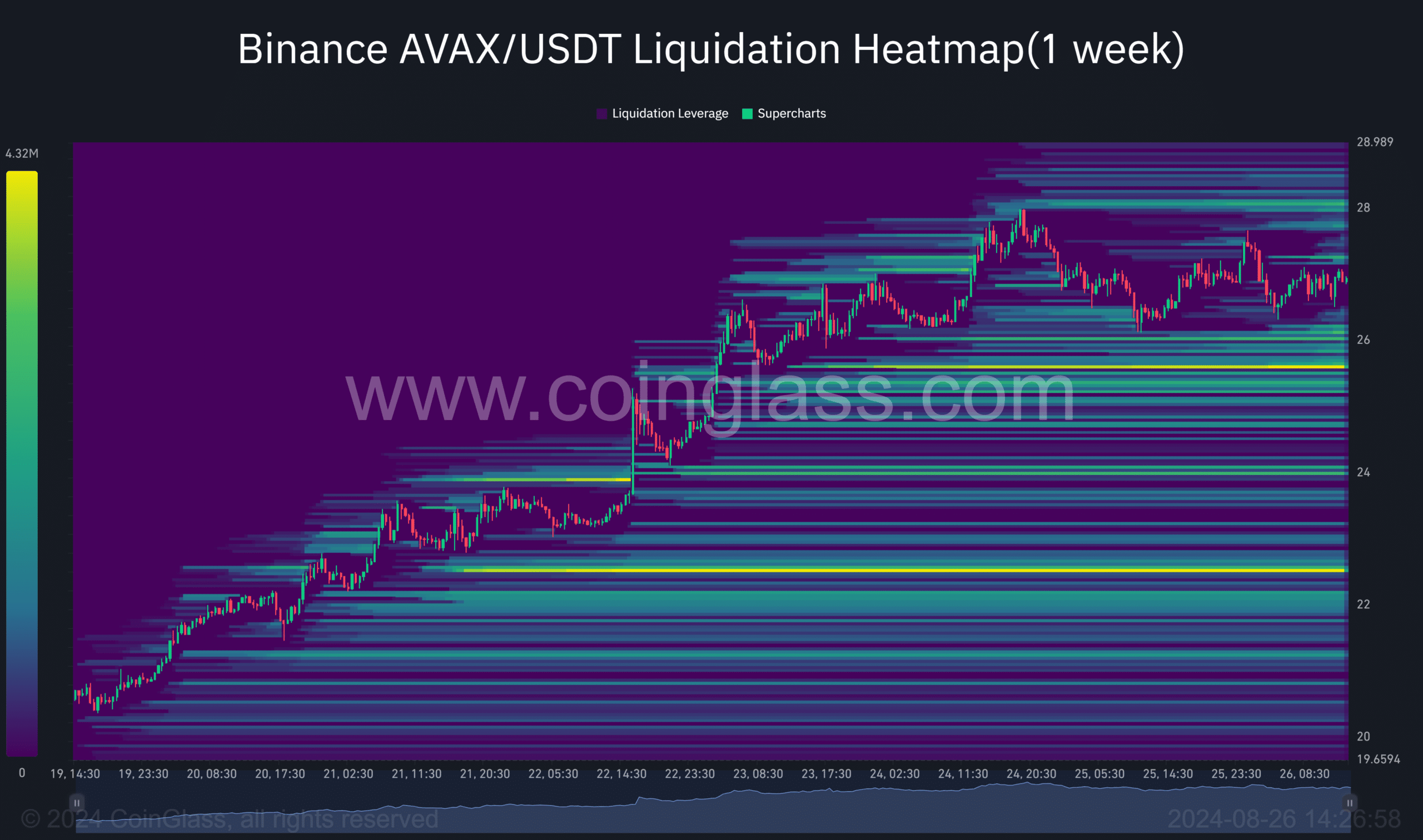

- AVAX liquidation heatmap indicates a significant pool of $4 million at the $25 level.

- Whale activity and holding distribution could boost the price movement.

Avalanche [AVAX] was on the edge of a pullback to about $25. The Coinglass liquidation heatmap data indicated a $4 million pool at $25.

This big concentration of liquidity shows that this significant price level may be what the market inclines towards and possibly triggers an extensive liquidation that could happen.

If the market behaves in line with expectations, then this movement will be confirmed within the next few days when traders focus on this level.

Source: Coinglass

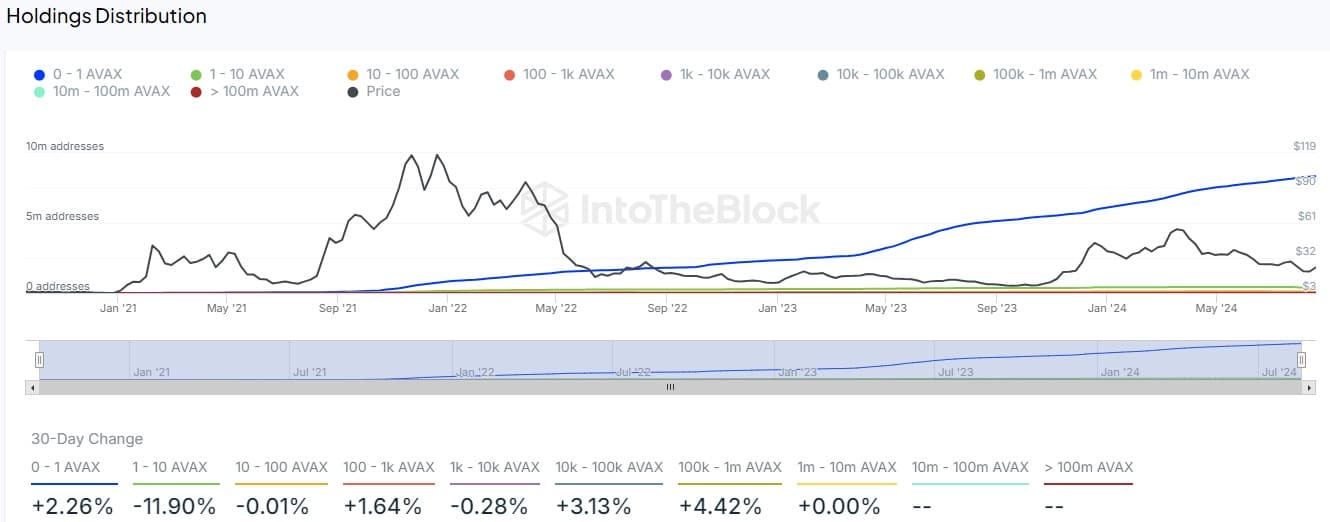

How holding distribution may speed up the drop

According to IntoTheBlock Holding distribution data, AVAX whales are further increasing their chances of downward adjustment.

These significant crypto investors have continued to buy more AVAX shares, and if they were to offload them at $25, it would probably fuel already strong bearish investor sentiment.

This concentration of major transactions at these levels implies potential instability; in this case, however, it might align perfectly with gravity from the liquidation pool.

Source: IntoTheBlock

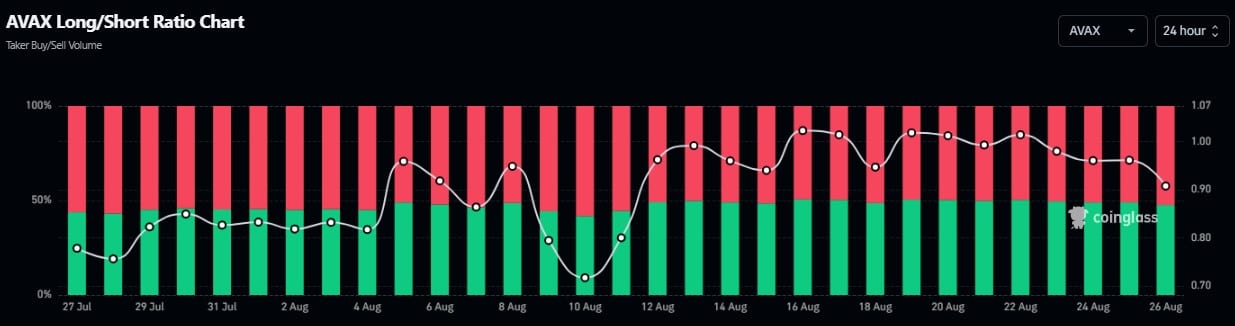

With about a 7% surge in holders with more than $100k in AVAX, their price movement will be significant in its market direction. The Coinglass 24-hour short ratio data stands at 0.90, which indicates that the market is near an equilibrium point.

However, the sluggishly declining ratio indicates accumulating bearish pressure in the short term as the price declines to take the liquidation pools.

Source: Coinglass

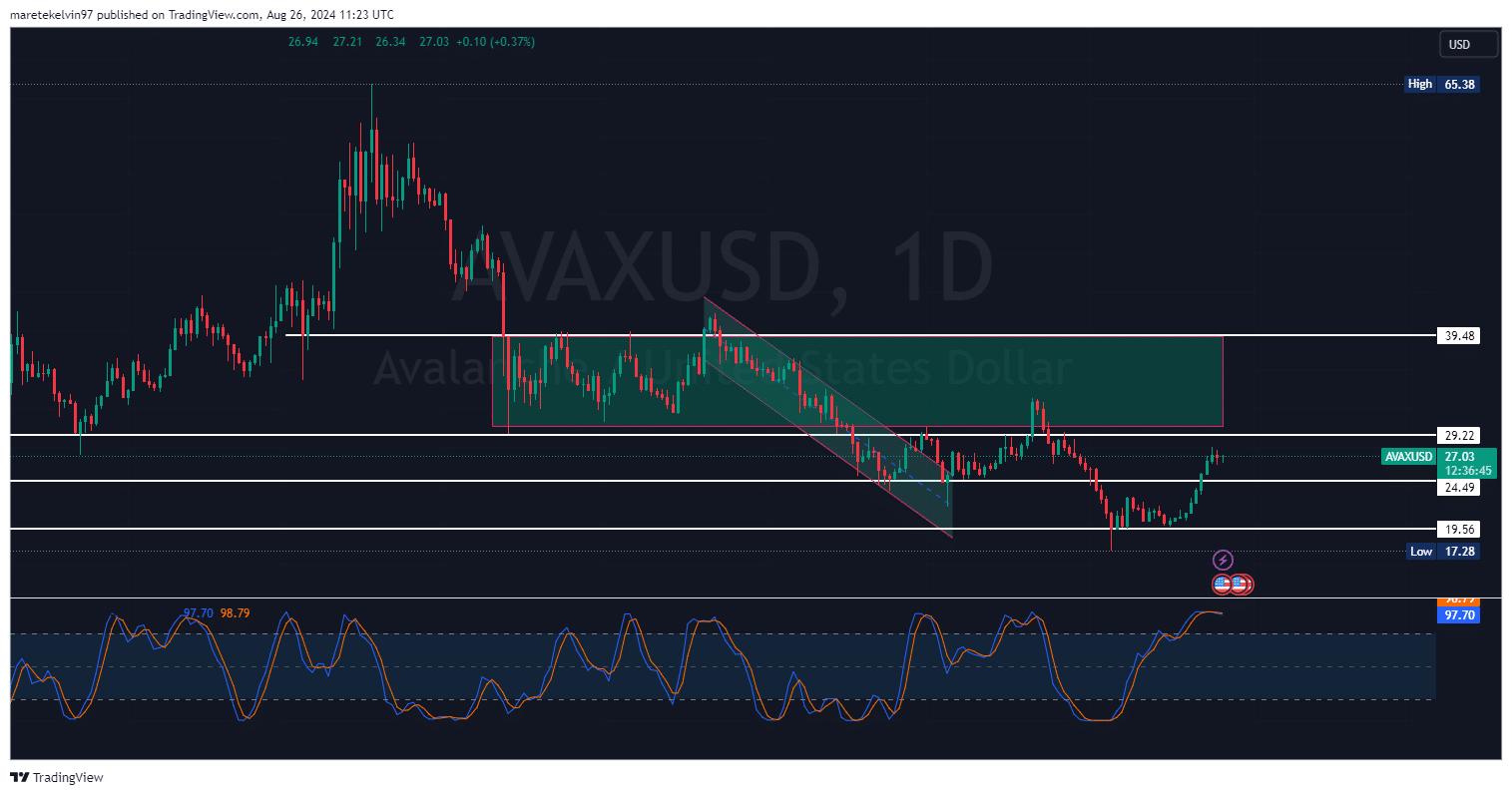

AVAX bearish signals

Adding to the pullback potential, the stochastic RSI has recently moved into bearish territory. This again adds another dimension of worry as it often precedes downtrend movements this time along with liquidation heatmap and whale activity.

Is your portfolio green? Check the Avalanche Profit Calculator

The combination of the liquidation heatmap, whale activity, and technical indicators such as stochastic RSI paints a bearish short-term outlook for AVAX.

With these bearish factors, there is an increased probability of a retracement to the $25 level before the market defines a clear direction .