Stacks network speeds up with Nakamoto upgrade, unveils sBTC

08/27/2024 20:00

Stacks rolls out the Nakamoto upgrade to enhance transaction speeds and introduce sBTC, boosting network efficiency.

- The Nakamoto upgrade is underway on the Stacks network.

- The upgrade will increase transaction speed and introduce another asset class that allows broader transactions.

Stacks, one of the leading Layer 2 networks on the Bitcoin network, has announced a significant upgrade. This upgrade enhances the network’s speed, making transactions faster and more efficient.

Additionally, the upgrade will introduce a new asset class called sBTC.

According to documents from Stacks, the rollout of the Nakamoto upgrade has begun on the network. This upgrade significantly enhances the Stacks blockchain, initiated at Bitcoin block 840,360.

As of this writing, the current Bitcoin block is 858,602, indicating that the Nakamoto upgrade is well underway.

The Nakamoto upgrade aims to significantly improve transaction speeds on the network, reducing settlement times from minutes to seconds. This enhancement is expected to significantly increase the efficiency and usability of the blockchain, making it more appealing for users and developers.

In addition to these improvements, the Nakamoto upgrade will pave the way for introducing sBTC, a new asset class on the network.

The network will launch the new asset four weeks after the upgrade’s implementation. The sBTC is designed to facilitate the seamless transfer of Bitcoin (BTC) between the blockchain and Stacks. It will also be used as gas for transactions on the Stacks network.

Importantly, sBTC is a decentralized asset backed 1:1 by Bitcoin, ensuring that it retains the value and security associated with BTC while enabling greater functionality within the Stacks ecosystem.

How this upgrade could impact the Stacks and Bitcoin network

Stacks is recognized as the largest Layer 2 network on Bitcoin. It has a Total Value Locked (TVL) of over $99 million, according to data from CoinMarketCap.

This achievement is particularly significant given that Bitcoin was not originally designed as a decentralized finance (DeFi) network. However, Layer 2 solutions like Stacks have innovatively expanded Bitcoin’s capabilities, enabling DeFi activities on the network.

One of the primary challenges faced by Stacks and other Layer 2 networks on Bitcoin has been speed. The Nakamoto upgrade aims to address this issue by significantly enhancing transaction speeds and reducing settlement times from minutes to seconds. This upgrade is expected to improve the Stacks network and have a positive ripple effect on other related networks built on Bitcoin.

As a result of the Nakamoto upgrade, the Bitcoin network is likely to see increased activity, as faster transaction times make it more attractive for various use cases, particularly in DeFi.

This surge in activity could lead to greater demand for Stacks’ native token, STX, as more users engage with the network and its associated services.

How STX has fared in the last 24 hours

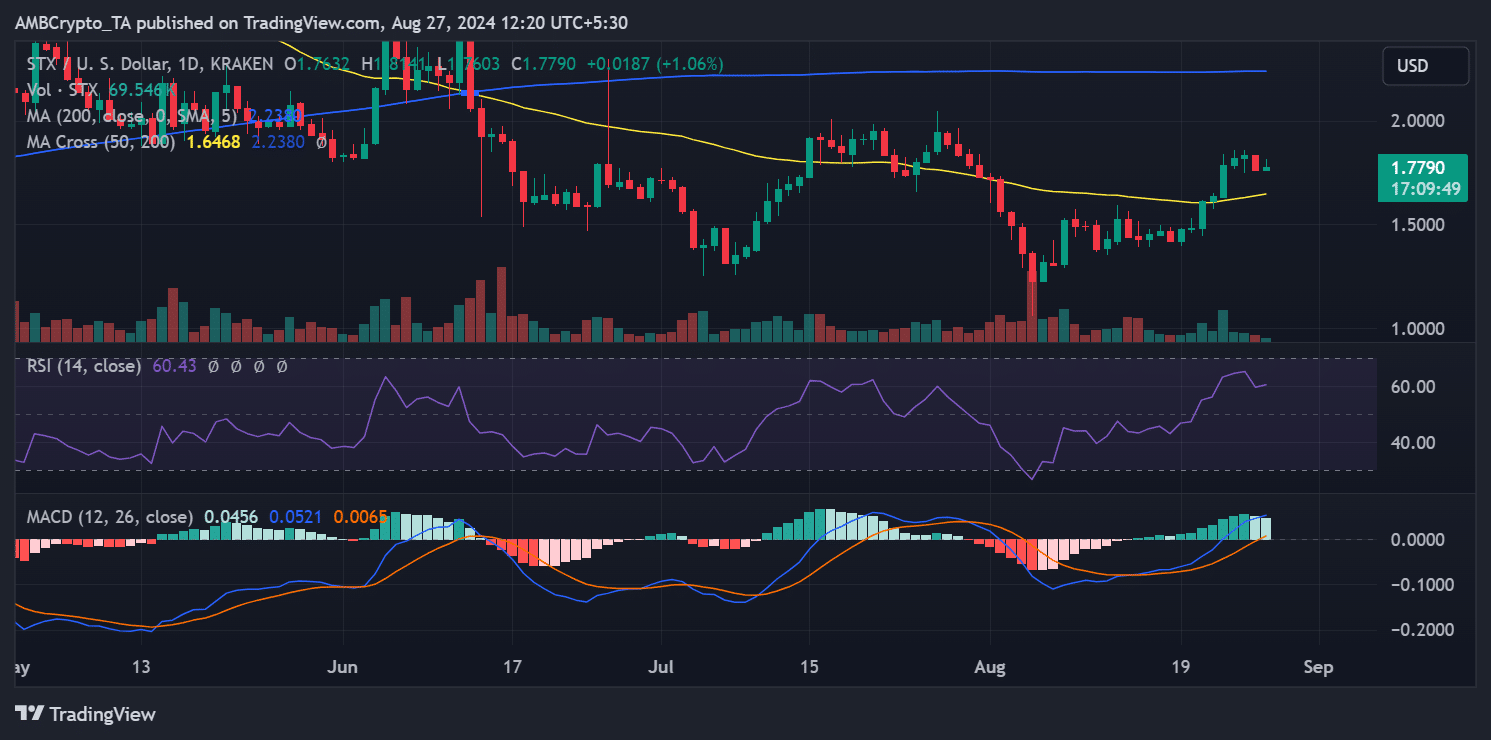

Stacks [STX] has recently experienced significant positive momentum, but this trend was briefly interrupted on 26th August. According to AMBCrypto’s analysis of its daily chart, STX saw a decline of over 4%.

The decline caused its price to drop from around $1.83 to approximately $1.76. Despite this pullback, STX quickly regained some ground, with its price rising by over 1% as of this writing, bringing it to around $1.77.

Realistic or not, here’s STX’s market cap in BTC’s terms

Importantly, the decline on 26th August did not disrupt STX’s overall bullish trend. The Relative Strength Index (RSI) remains around 60, signaling that the asset is still bullish.

The RSI level suggests that despite a brief correction, the broader positive sentiment and buying pressure for STX continue to support its upward trajectory.