Quick Take

Bitcoin continued its sell-off overnight, dropping another 5% and settling back into the $58,000 – $59,000 range. This sharp decline is mirrored in perpetual funding rates, which have swung from extremely positive levels to negative, highlighting the rapid shift in market sentiment whenever Bitcoin either goes above or falls below the $60,000 mark.

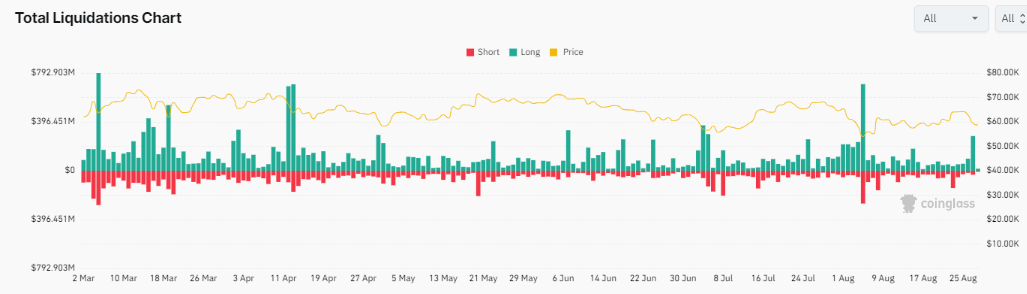

Over the past 24 hours, the digital asset ecosystem has experienced significant liquidations totaling $324 million. Both Bitcoin and Ethereum have seen around $100 million each in liquidations, with long positions accounting for $290 million. This marks the largest long liquidation event since Aug. 5, indicating heightened volatility in the market, according to Coinglass.

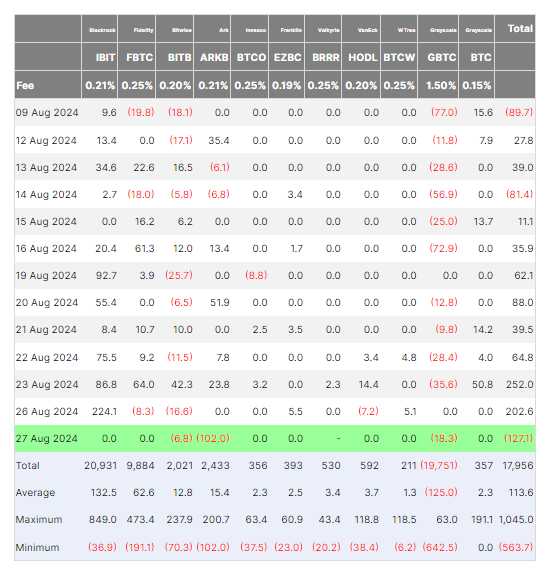

Adding to the bearish sentiment, Bitcoin ETFs recorded their largest outflows since Aug. 6, with a total of $127.1 million being pulled out. The majority of these outflows came from Ark’s ARKB, which saw $102 million in withdrawals. Grayscale’s GBTC and Bitwise’s BITB also experienced outflows, losing $18.3 million and $6.8 million, respectively. Total ETF outflows have now reached $18 billion, according to Farside data.

According to Farside data, Ethereum ETFs have also been under pressure. The ninth consecutive trading day saw outflows totaling $3.4 million. Ethereum is currently trading under $2,500.