Quick Take

In late July, significant developments in the US political landscape coincided with notable digital asset market fluctuations. On July 21, President Joe Biden announced he would not seek re-election, setting off a wave of uncertainty. Bitcoin, trading around $68,000 at the time, saw a swift decline to $63,000 within two days.

As the month progressed, Donald Trump, now a vocal advocate for Bitcoin and cryptocurrencies, made a significant appearance at BTC Nashville. I believe his support pushed Bitcoin to a local high of around $70,000 by the end of July.

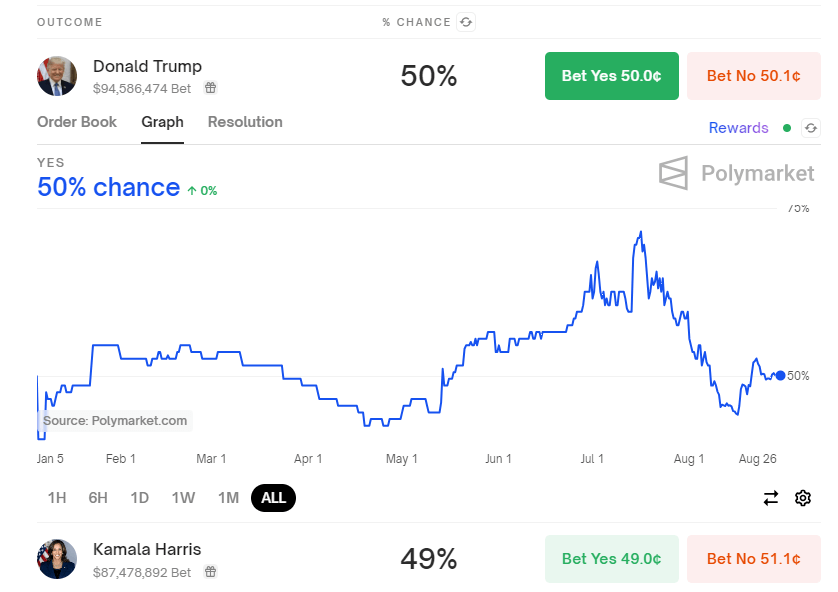

However, the political landscape remains uncertain, particularly regarding Kamala Harris’s stance on crypto should she become the next US president. While there have been statements indicating her administration would support the industry, Harris herself has been silent. Polymarket odds suggest a tight race between Trump and Harris, which I think has added to the headwinds affecting crypto prices.

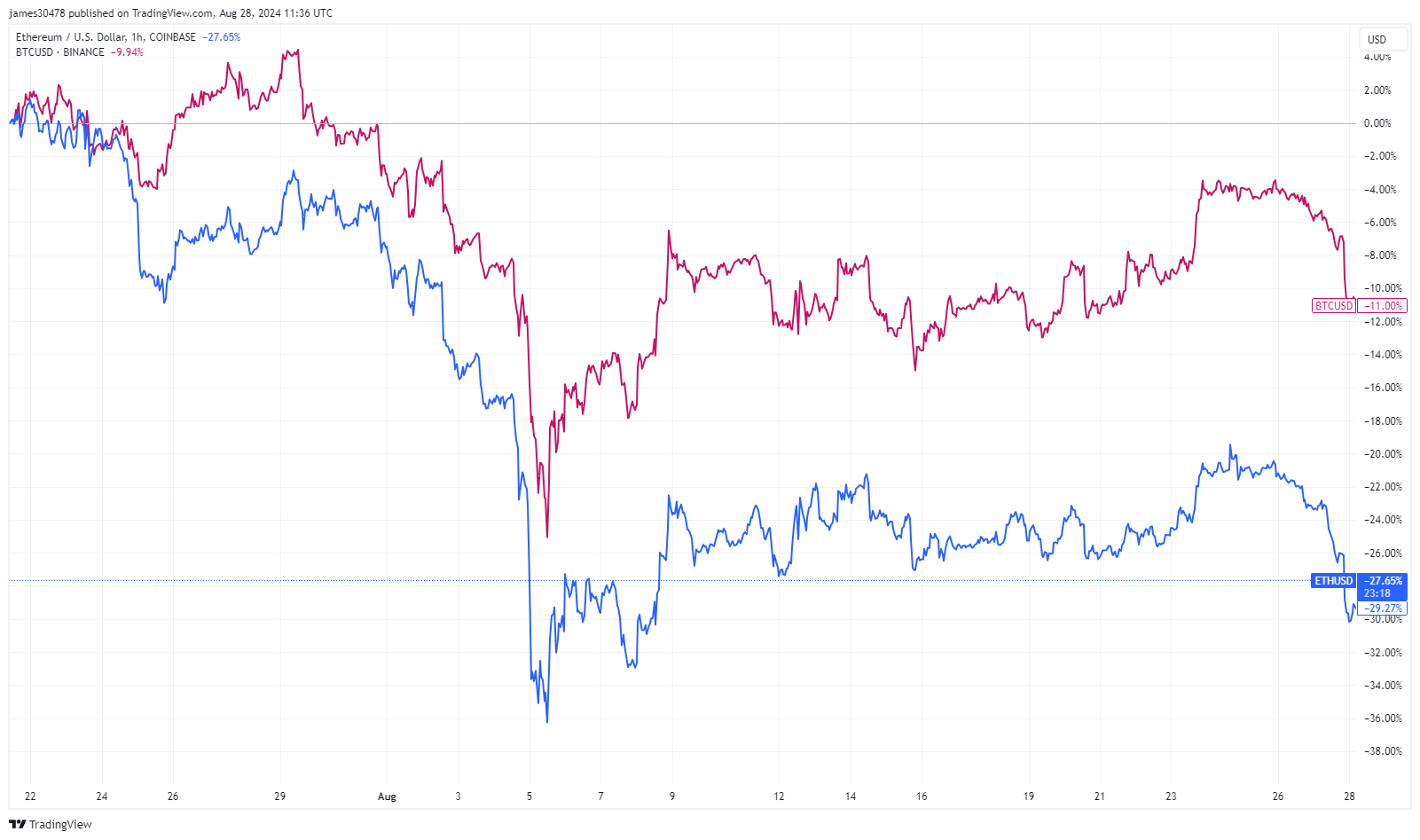

Since Biden’s announcement, Bitcoin has dropped 11%, while Ethereum has seen a steeper decline of 28%.

The ongoing uncertainty, coupled with historical trends showing negative performance for Bitcoin in August and September, has further fueled the bearish sentiment in the market. Additionally, global issues, including the ongoing Middle East conflict and censorship concerns globally following Telegram founder Pavel Durov’s arrest in France, have compounded the market’s unease.