Will September break Bitcoin’s bearish trend? Why BTC can defy history

08/29/2024 09:00

September is almost here and while it has historically been bearish for Bitcoin, things are different this time as bullish factors align

- Bitcoin has historically been bearish for the most part in September, but this time could be different.

- NASDAQ embracing Bitcoin and improving global liquidity conditions could favor a bullish outcome in September.

Bitcoin [BTC] will close August in the red compared to its monthly opening price, if it does not rally above its current weekly high in the next three days.

This means the burden of delivering positive monthly gains will push forward into September.

So, should we expect a bullish month for Bitcoin in September? Historically, this has been one of the most bearish months for the cryptocurrency.

The king coin delivered a bearish performance in eight out of 11 Septembers since 2013.

This suggests that Bitcoin has a bearish bias in September, but will this play out similarly this year? There are key factors that point to the possibility that BTC may turn out extremely bullish in the coming month.

Recent data revealed that global liquidity is recovering and is now at new highs. While Bitcoin has not received a huge share of that liquidity so far, the fact that liquidity is back on a positive trend is positive for the market.

The rising global liquidity coupled with the expect rate cuts in September could provide the boost that Bitcoin needs for positive returns during the month.

A CryptosRus analysis suggested that a combination of rate cuts, growing liquidity, the halving and the U.S. elections closely resembled Bitcoin in 2016 and 2020. BTC went through a robust rally in both instances.

Bitcoin is breaking into mainstream markets

Access to Bitcoin is now higher than ever before, especially with ETFs launching earlier this year. This expanding access could soon come to the stock market courtesy of the latest NASDAQ filing.

The latter seeks to roll out Bitcoin options trading, which could further boost positive sentiment among investors.

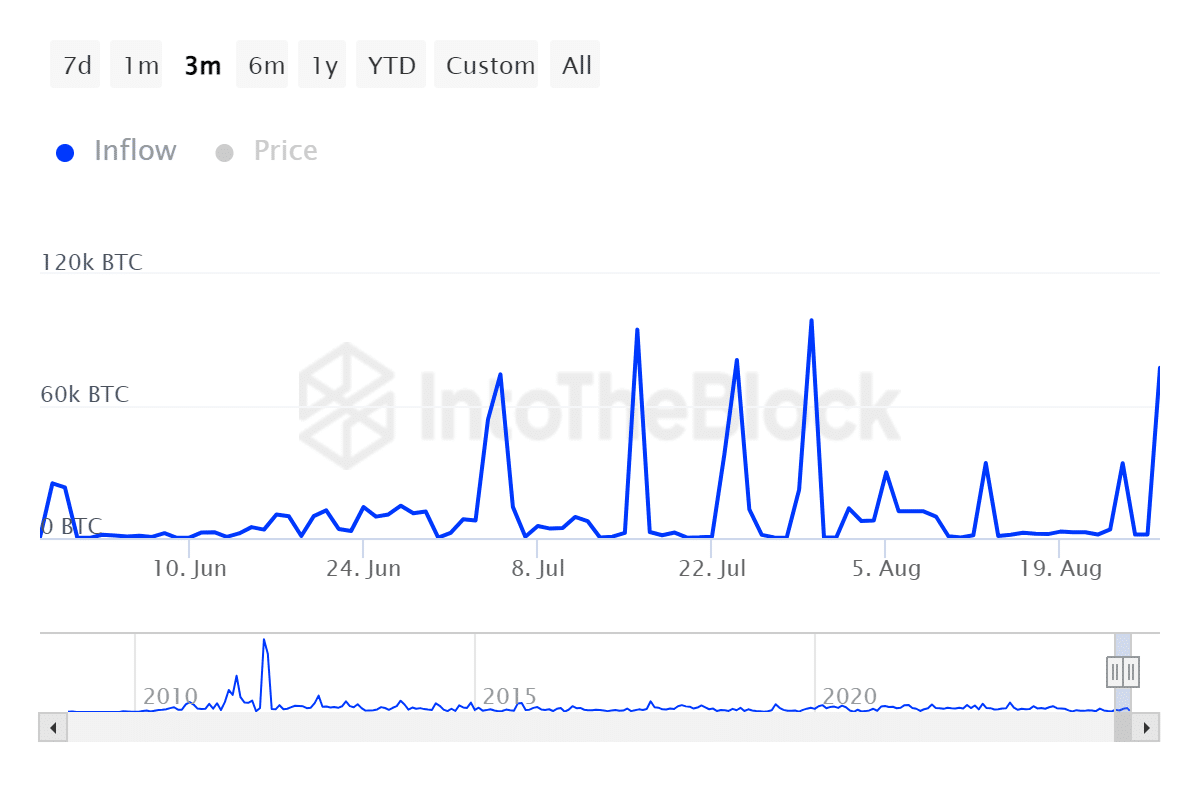

Bitcoin investors may also be preparing for a price rally in September. Large holder inflows spiked in the last 24 hours, to the fourth-highest level observed in the last three months.

Inflows peaked at 77,400 BTC during the same period, with only 11240 in outflows recorded during the same period.

This comes after Bitcoin dipped below $60,000 once again, after previously raising hopes that the price will head towards $70,000. So, investors’ optimism remained high, judging by the intensity of accumulation at lower prices.

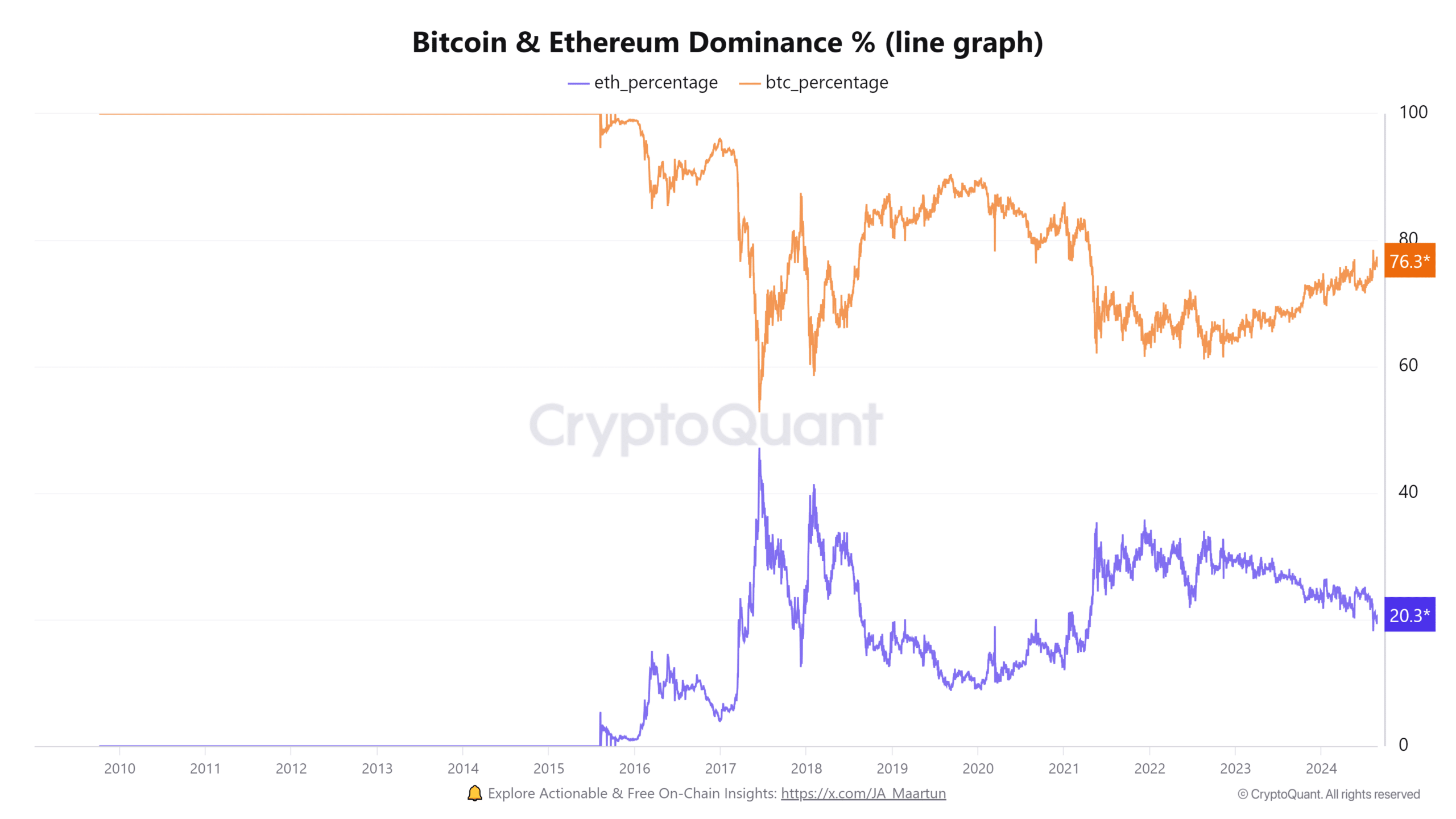

Bitcoin has also maintained significant dominance against Ethereum [ETH] and other altcoins. This means it is strategically positioned to take advantage of most of the liquidity flowing into the crypto market.

Thus, Bitcoin still commanded most mainstream attention despite the presence of many altcoins.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In conclusion, Bitcoin is set for a potentially bullish September if interest rates come down.

Improving global liquidity and the improving adoption in the mainstream markets could favor BTC’s performance before the end of the year.