Investors trust Binance, Coinbase most for security, says AMBCrypto report

08/29/2024 20:30

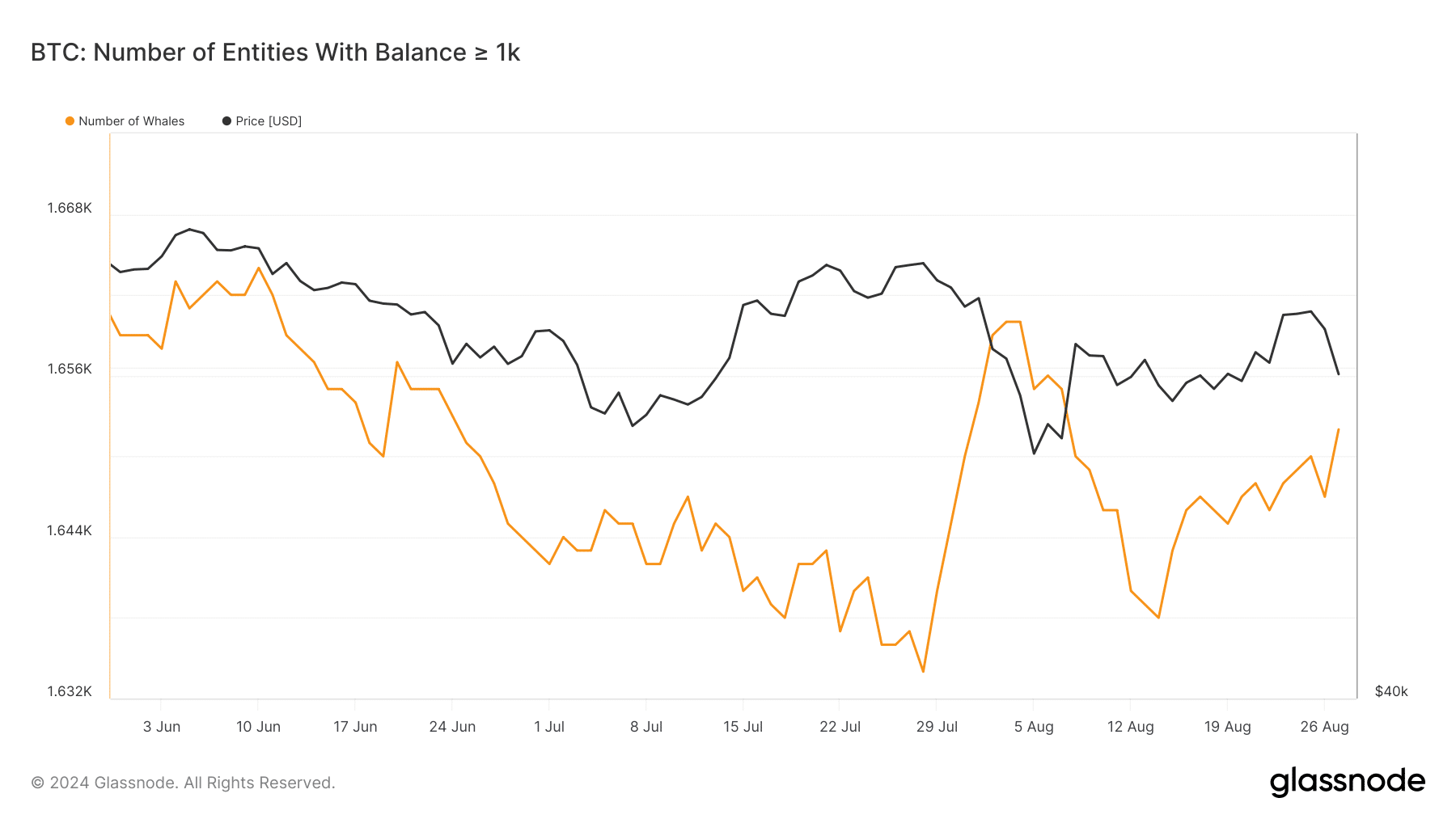

AMBCrypto's August 2024 market report found that whales have been buying the dip and adopting a HODLing strategy.

The markets expect the Federal Open Market Committee to cut interest rates at its next meeting on 18 September. However, escalating geopolitical tensions in the Middle East and Africa are making investors fearful.

Consider this – After the easing of U.S inflation, traders expected BTC to change hands at a premium. However, the coin instead lost its $60,000 psychological support and was trading at a discount of 3.10%, at the time of writing.

A silver lining emerges

Interestingly, AMBCrypto’s August 2024 report found that whales have been buying the dip and adopting a HODLing strategy. In fact, the number of whales, after falling to a low of 1,638, has also been gradually increasing.

Most definitely, big-pocket investors are seeing the current market condition as an opportunity to go long.

Despite the whales’ bullish conviction, interest in trading Bitcoin declined in early August as retail investors favored altcoins over the king coin. But, after 25 August, the sentiment changed in favor of BTC since active addresses noted a sharp uptick.

On the other hand, BRC-20 inscription activity cooled down in August from its April peak of 18,085. Although August recorded a hike in new inscriptions (552), the overall volume was still far below its previous high.

Amidst all the on-chain developments, a concerning factor emerged on 28 August when the BTC OI-Weighted Funding Rate moved to the negative side. This implied that perpetual contract traders were leaning towards a bearish outlook.

Factors that could spark a short-term bullish reversal

In an exclusive conversation with AMBCrypto, 21Shares’ Head of U.S Business Federico Brokate revealed that ETF inflows could be a turning point for Bitcoin’s price trajectory. According to the exec,

“The players that will be the longest or the largest buyers long-term actually haven’t even started participating in BTC spot ETFs.”

So, once pension funds and asset managers start allocating more money to the risk-on assets, BTC’s $100k goal won’t be too far. The imminent launch of Solana-based ETFs could also significantly affect the broader crypto market.

In anticipation of this, AMBCrypto asked 21Shares about the possibility of SHIB or DOGE ETFs. While acknowledging the cultural influence of memecoins, Brokate stated that the company is prioritizing more established cryptocurrencies for its current ETF offerings.

Although not dismissing the potential for future memecoin ETFs, the exec stressed the need for clear utility and value propositions in ETF product development.

Headwinds for the crypto market

While on-chain indicators and the macroeconomic outlook seem to be favoring cryptocurrencies, incidents of hacks, thefts, and ransomware attacks are emerging as the biggest challenge for the crypto market.

Crypto hackers made a dramatic comeback in 2024, stealing over $1.58 billion in digital assets through July. This marked an 84% increase, compared to last year when hacking activity had significantly declined.

To closely understand investors’ defense mechanism against crypto hacks, AMBCrypto conducted an exclusive survey. The results revealed that 78% of respondents considered Binance and Coinbase to be the most secure cryptocurrency exchanges.

And, over 43% prioritize hardware wallets for safeguarding their digital assets. AMBCrypto’s August 2024 report discussed this insightful survey in full detail.

Dive into AMBCrypto’s August 2024 crypto market report

This comprehensive report dives deeper than just Bitcoin and security. It explores emerging trends like the surge in staking and restaking on Ethereum, and the growing popularity of memecoins on Solana.

The report even talks about a big development in the world of stablecoins and discusses factors that might help the NFT market recover.

You can download the full report here.