Crypto exchanges Binance and Bybit have hinted at launching a new Solana-related product, sparking speculation that they may enter the Solana liquid staking market.

On Aug. 13, Binance’s official X account posted a cryptic “BNSOL” message followed by “coming soon” in a subsequent comment.

Shortly after, Bybit announced the introduction of a new product, “bbSol,” on its platform, stating:

“We are welcoming a new 👶 to the family #bbSOL.”

Although neither exchange provided specific details about the product, the crypto community quickly speculated that these posts indicate a move into Solana’s liquid staking sector, potentially through a partnership with the Solana-based liquid staking protocol Sanctum.

Neither Binance nor Bybit has responded to CryptoSlate’s request for comment as of press time.

Liquid staking

Unlike traditional staking, liquid staking allows users to earn additional yield while maintaining liquidity through a derivative token for DeFi activities. According to DefiLlama data, protocols in this sector collectively manage over $42 billion in crypto, with Ethereum-focused Lido leading the market.

However, interest in Solana liquid staking has recently surged, driven by the growing DeFi activities on the Solana blockchain.

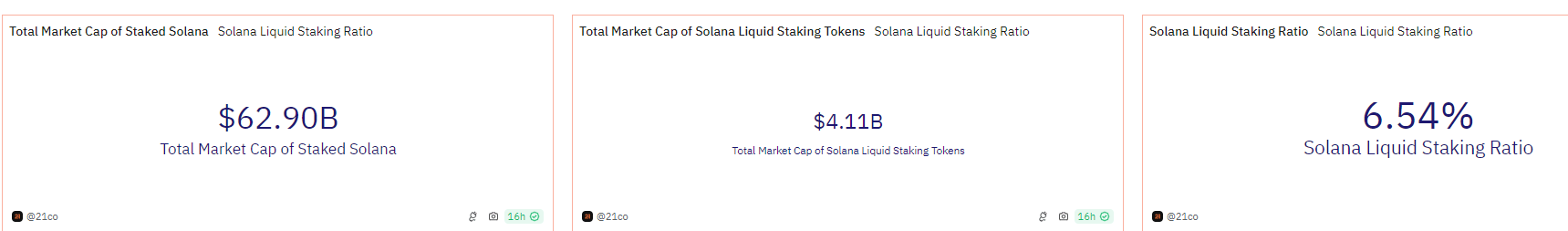

Data from Dune Analytics shows that more than $4 billion of SOL tokens are currently staked via liquid staking platforms. However, this accounts for only about 7% of the total market cap of staked Solana tokens, which stood at $62 billion at the time of writing.

This gap suggests significant growth potential in Solana’s liquid staking market. If Binance and Bybit launch SOL-based liquid staking products, it could further accelerate the sector’s expansion and drive retail access to the market.

Notably, Tom Wan, an analyst at 21Shares, previously noted that the sector’s growth could have a broader impact on Solana’s DeFi ecosystem. He stated:

“The boom in LSTs can definitely fuel the DeFi growth on Solana!”