1,036% Spike in Shiba Inu Token Transaction Fees Stuns Shibarium

08/29/2024 22:44

Transaction fees on Shibarium have skyrocketed 1,036%, driven by launch of pumpfun platform for Shiba Inu

Transaction fees on Shibarium have skyrocketed 1,036%, driven by launch of pumpfun platform for Shiba Inu

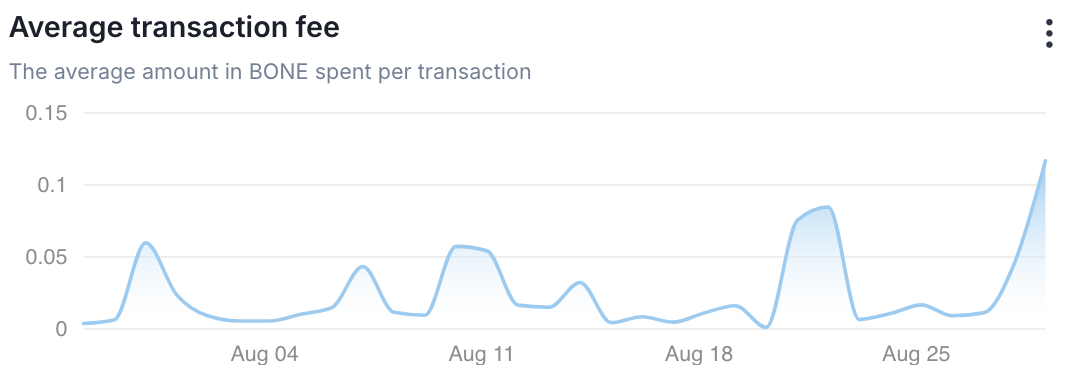

The average transaction fees on Shibarium, the blockchain solution of the Shiba Inu ecosystem, have literally skyrocketed in the past few days, according to data from Shibariumscan. Specifically, there has been a solid 1,036% increase in the number of BONE spent per transaction, from 0.012 to 0.1168 tokens.

BONE is the native token of the Shiba Inu and plays a large role in the functioning of the network. As a transaction fee token, BONE is paid as the cost of each transaction on the Shibarium blockchain.

A bit of each transaction fee is automatically converted into Shiba Inu tokens and sent to a burn wallet. This burns the supply of SHIB, making the popular meme cryptocurrency deflationary.

The rise in transaction fees shows that more people are using the network, but it also raises questions about the cost of using Shibarium.

Pumpfun, but for Shiba Inu (SHIB)

The reason for such an increase may lie in the introduction of pumpfun and sunpump-like applications for Shiba Inu. The principle is simple: list a meme coin, and if it gains the necessary amount of liquidity for the bonding curve, it will be further listed on decentralized exchanges. The newly launched platform runs on Shibarium and uses BONE.

If that is indeed the case, then demand for BONE may gain further traction as the hype around "fair launch" platforms builds.

However, as we have already seen in the pumpfun example, the quality of the assets deployed this way can hardly be called investment-worthy.

So while BONE itself is a somewhat established asset, it may be better not to spend it on some questionable cryptocurrencies with no fundamentals.

About the author

Gamza Khanzadaev

Financial analyst, trader and crypto enthusiast.

Gamza graduated with a degree in finance and credit with a specialization in securities and financial derivatives. He then also completed a master's program in banking and asset management.

He wants to have a hand in covering economic and fintech topics, as well as educate more people about cryptocurrencies and blockchain.

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox