IDEX crypto pumps 25% a week ahead of mainnet DEX debut – What’s next?

08/30/2024 09:00

IDEX crypto has surged 25% on the weekly as traders positioned ahead of the DEX's mainnet debut. What's next for the token?

- IDEX crypto exploded ahead of mainnet launch for perpetual DEX.

- Will the mainnet update be a ‘sell-the-news’ event?

Speculators have been bullish on IDEX crypto, a native token for Idex, an omnichain perpetual DEX (decentralized exchange), ahead of its mainnet launch.

The token surged nearly 25% in the past seven trading days, decoupling from the rest of the market decline.

Idex has been operating on testnet since May, enabling trading for select top assets like Bitcoin [BTC], Ethereum [ETH], and Solana [SOL].

Its mainnet, set to go live on the 29th of August, will add more assets and features. Traders had early positioning for the announcement, as seen by the surge in market cap from $31 million to a peak of $48 million.

As a result, the mainnet debut might act as a sell-the-news event. But where are the key levels to watch as the next chapter for IDEX begins?

IDEX crypto price levels to watch

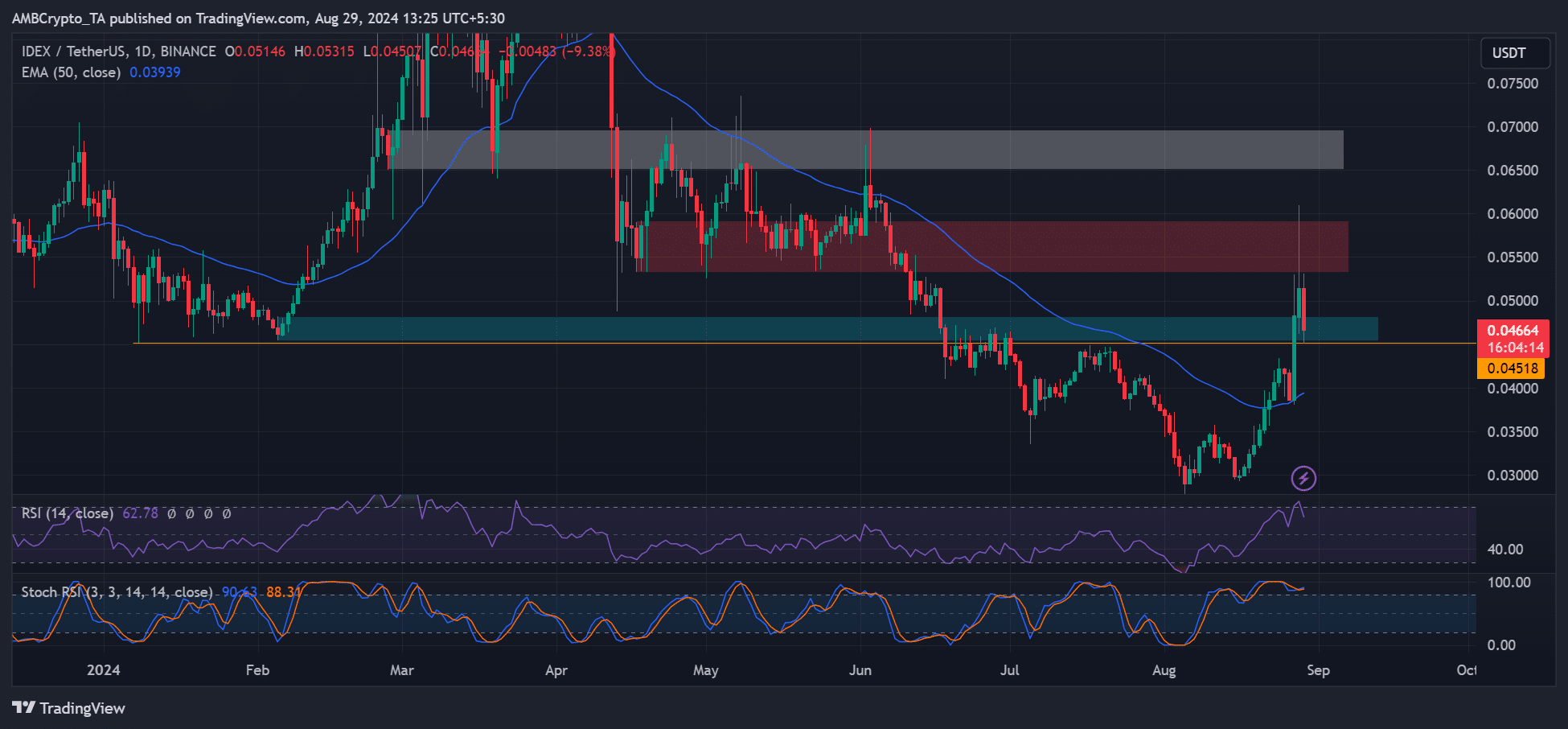

On price charts, the explosive rally that began on the 27th of August, was triggered at the 50-day EMA (Exponential Moving Average). After that, IDEX reclaimed its early 2024 support above $0.045 (marked cyan).

However, at the time of writing, the upswing faced rejection at the supply zone and previous Q2 support within $0.055 — $0.060 (marked red).

The cool-off was back at the previous support at $0.045, which could offer market re-entry for late bulls if it was defended.

The bullish targets for IDEX were the immediate supply zones at ($0.055 — $0.060) and above $0.065 (marked white).

The bullish readings on RSI (Relative Strength Index) and Stochastic RSI supported the bullish outlook.

However, the indicators also flashed overbought conditions. A caution for bulls. A drop below $0.045 would invalidate the bullish thesis. In such case, the dynamic support of 50-EMA would be a key level to watch out for.

IDEX speculators bullish, but…

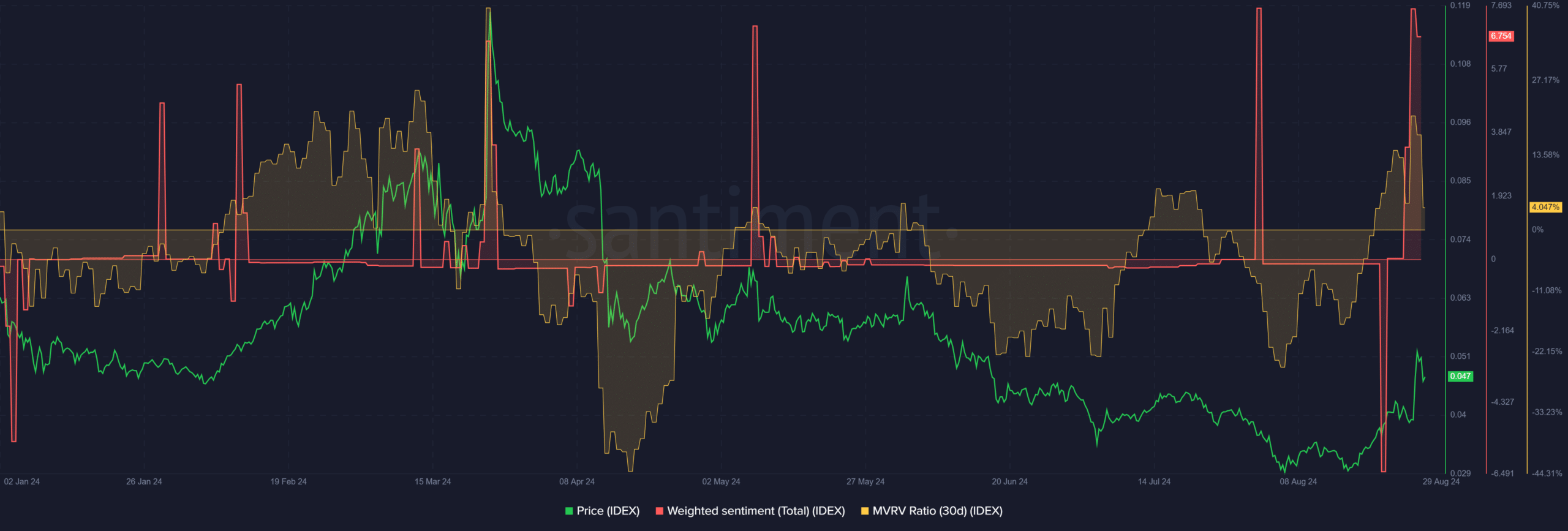

According to Santiment, IDEX speculators were bullish, as illustrated by the massive positive surge in Weighted Sentiment.

However, short-term holders were in profit and could be tempted to take profit, as shown by the positive reading on the 30-day MVRV (Market Value to Realized Value).

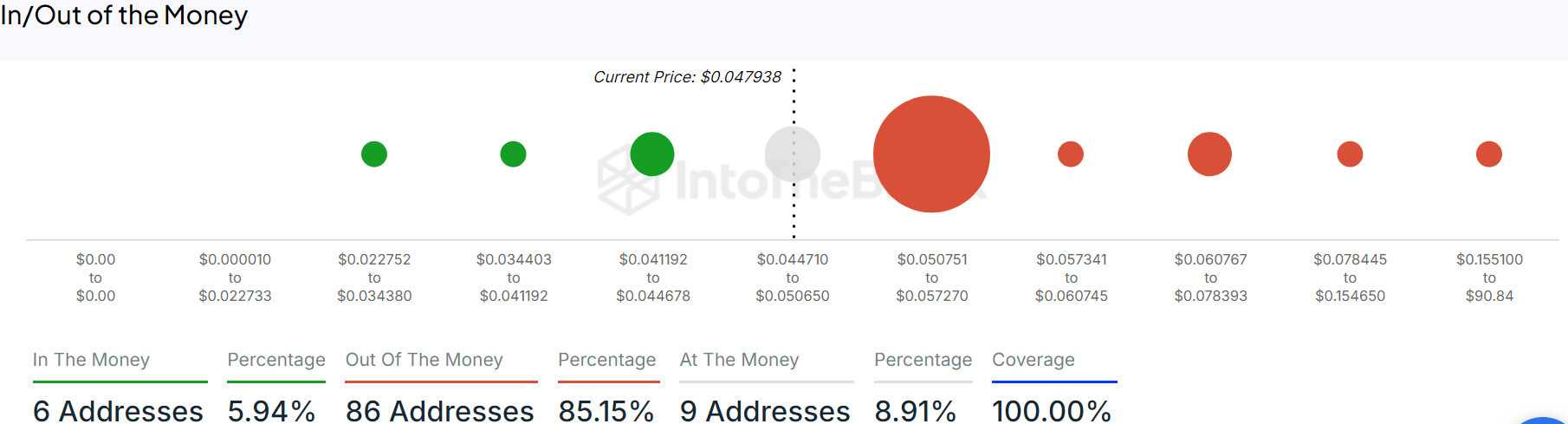

Meanwhile, the most crucial resistance to watch was $0.57, the overhead supply zone on price charts. Per IntoTheBlock data, most of the IDEX tokens were bought at these level and most users were in loss.

So, more sell pressure could be experienced at the level.