Polygon drops 20% in a week – Are MATIC whales to blame?

08/30/2024 21:00

MATIC holdings are seized by whales who control 70% of its total circulating supply. Could it come to its rescue during market volatility?

- MATIC whales have accumulated 70% of the total circulating supply, with one address holding 3.6 billion tokens.

- How could this whale accumulation prove to be both beneficial and detrimental?

Polygon [MATIC], amidst broader market swings, may end the last week of August on a sour note, with a roughly 20% decline in value over the past seven days, trading at $0.4255 at press time.

Interestingly, MATIC saw a strong bullish rally in mid-August, breaking out of its two-month consolidation even as Bitcoin struggled with weak bull support.

According to AMBCrypto’s analysis, strong whale interest may have fueled MATIC’s mid-August rally, pushing it to test the $0.58 resistance level.

However, it was not the first time whales came to MATIC’s rescue. Does this suggest a hidden pattern?

Whales hold a dominant share of MATIC supply

It is no shocker that Bitcoin’s wild swings often dictate the direction for altcoins, shaping their value.

Yet, contrary to popular belief, MATIC has shown frequent instances where its price diverged from the broader market trends.

Driven by this anomaly, AMBCrypto investigated large holder activities to determine if strategic factors were behind the divergence.

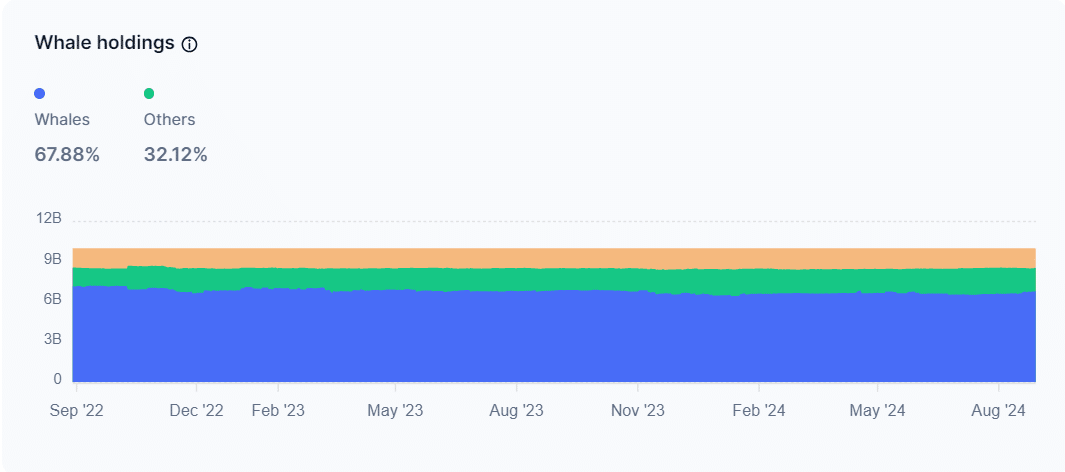

Unsurprisingly, large holders control a substantial share of MATIC’s circulating supply, which totals 9.9 billion.

The chart above revealed that whales hold over 6 billion of that supply, accounting for approximately 70% of the total.

This concentration of holdings significantly impacts the token’s market dynamics — So, has it?

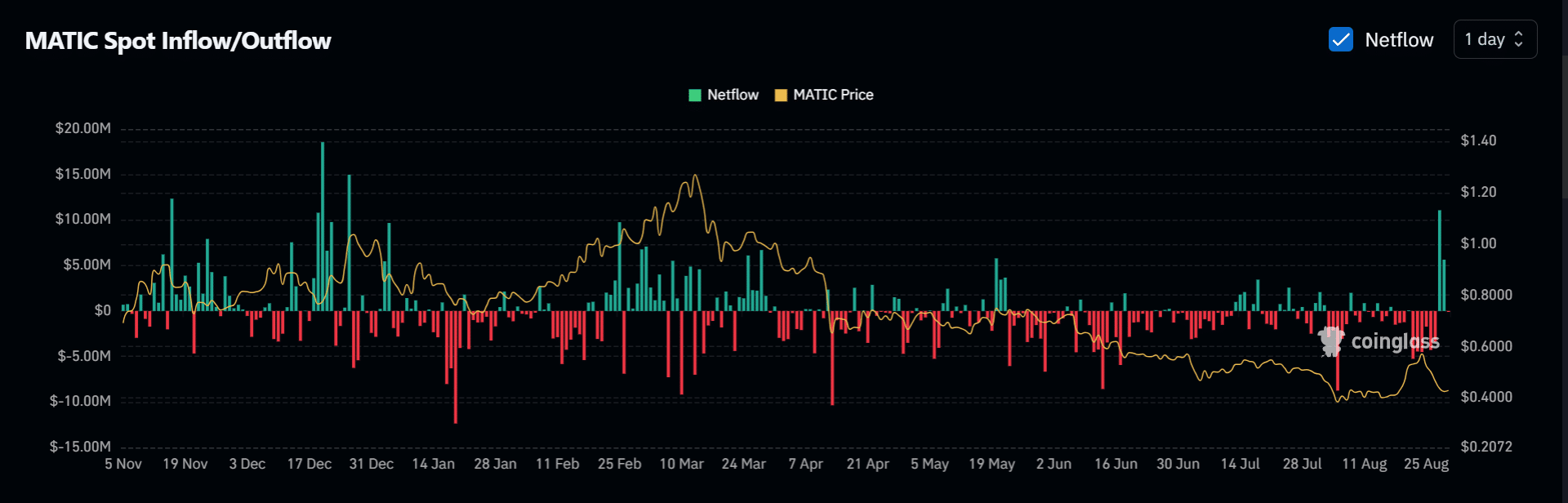

Looking at the chart below, AMBCrypto noted MATIC’s late December rally, where it approached the $1 ceiling with a 26% surge, despite $14 million in net inflows.

This indicated that despite market panic from BTC’s drop, MATIC’s price remained strong, likely due to whales absorbing the selling pressure.

In a stunning discovery, AMBCrypto also found that a wallet address linked to a top MATIC whale holds 36.36% of the total circulating supply, with a balance of 3.6B tokens.

This highlighted that a single whale controls a massive portion of MATIC’s supply, potentially influencing its price.

Moreover, MATIC has seen a downward trend over the past week, dropping over 20% from its earlier price of $0.58.

As shown in the chart above, the $11 million net inflow, indicating more MATIC entering exchanges, could have contributed to the price drop, potentially driven by Bitcoin falling below $60K.

Or alternatively, it might suggest whales are selling off their holdings — which one is it?

Stakeholders doubtful in MATIC’s recovery

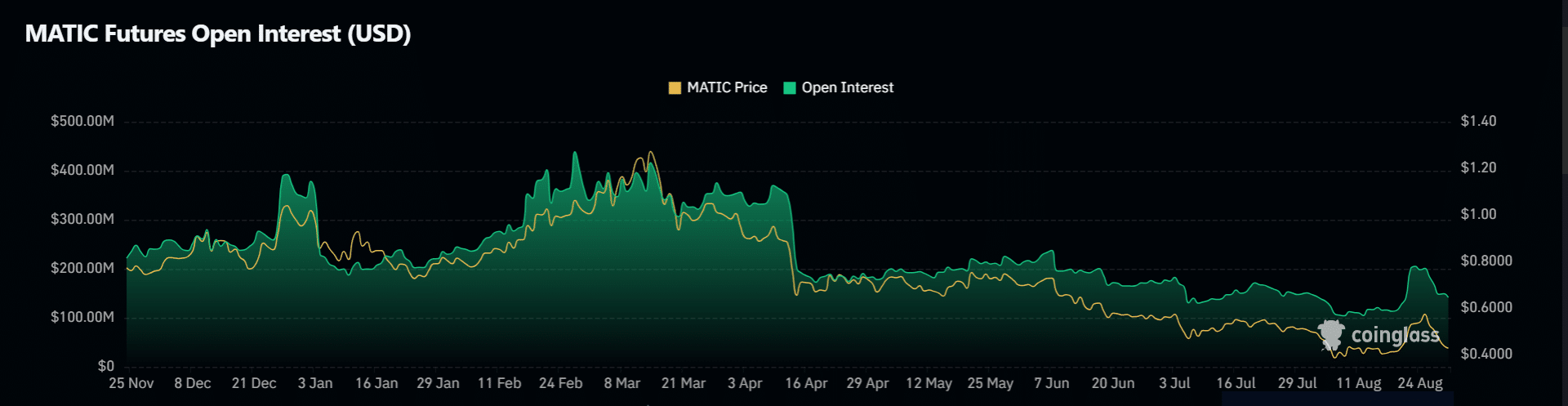

According to AMBCrypto’s analysis, the perpetual market for MATIC appeared doubtful about its rebound potential, mirroring the cautious sentiment prevailing in broader market trends.

Additionally, MATIC’s Open Interest (OI) has dropped 7% in the past 24 hours. From a peak of $490M on the 24th of August, it has fallen to $420M.

This decline suggested that following broader market panic, future traders have been closing their positions.

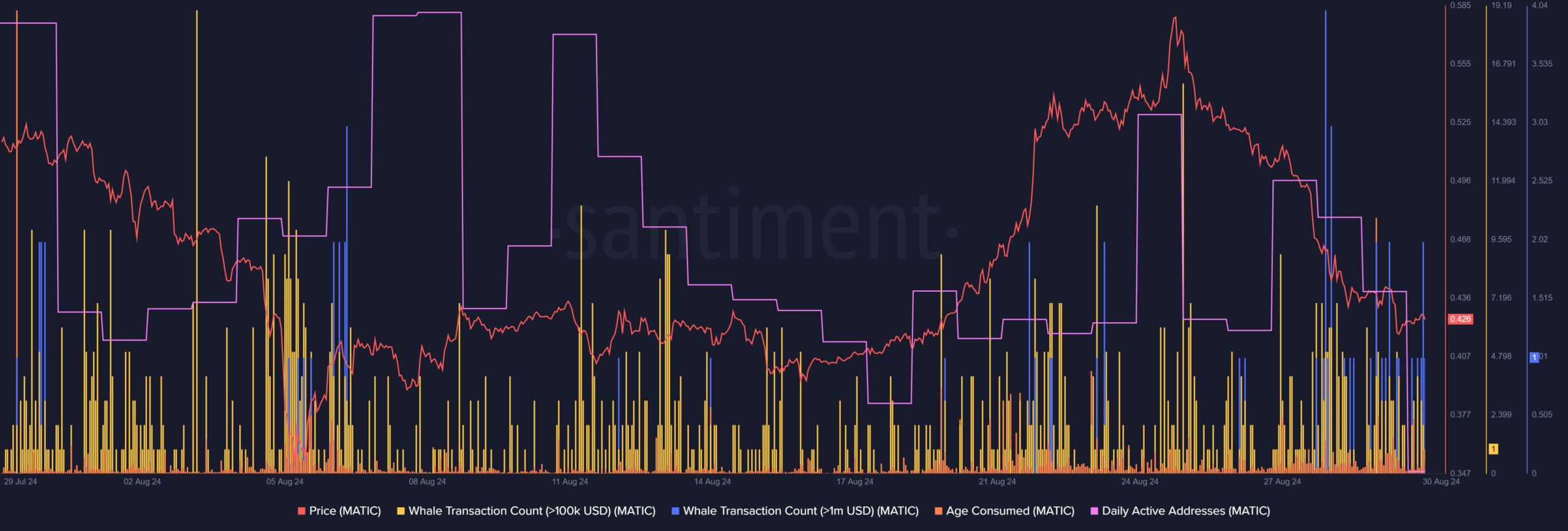

Conversely, AMBCrypto’s analysis of the chart below showed no clear signs of significant selling activity from top MATIC holders.

However, the age consumed indicator recorded that 872 million MATIC were moved on the 29th of August.

This indicated that a significant portion of previously dormant tokens were transacted.

Realistic or not, here’s MATIC’s market cap in BTC’s terms

Although the whale transaction count remained below average, determining if whales executed these large-volume dormant transfers is challenging.

Nonetheless, given their dominant holdings, AMBCrypto predicts that MATIC will likely continue to face volatility until a more equitable distribution of supply is established.