Ethereum (ETH) Traders Unfazed by Price Decline, Expect Bullish Rebound

08/31/2024 01:00

Traders are betting on an Ethereum (ETH) rebound despite false breakouts. Key metrics suggest a bullish sentiment, but risks remain.

Ethereum traders remain optimistic about a price recovery despite the altcoin’s multiple false breakouts. Their continued confidence indicates that, regardless of ETH’s recent price action, the broader market anticipates the crypto will recover some losses.

On August 24, ETH’s price reached $2,800 but faced rejection at that level. Will the price move in traders’ favor?

Ethereum Bulls Remain Undeterred

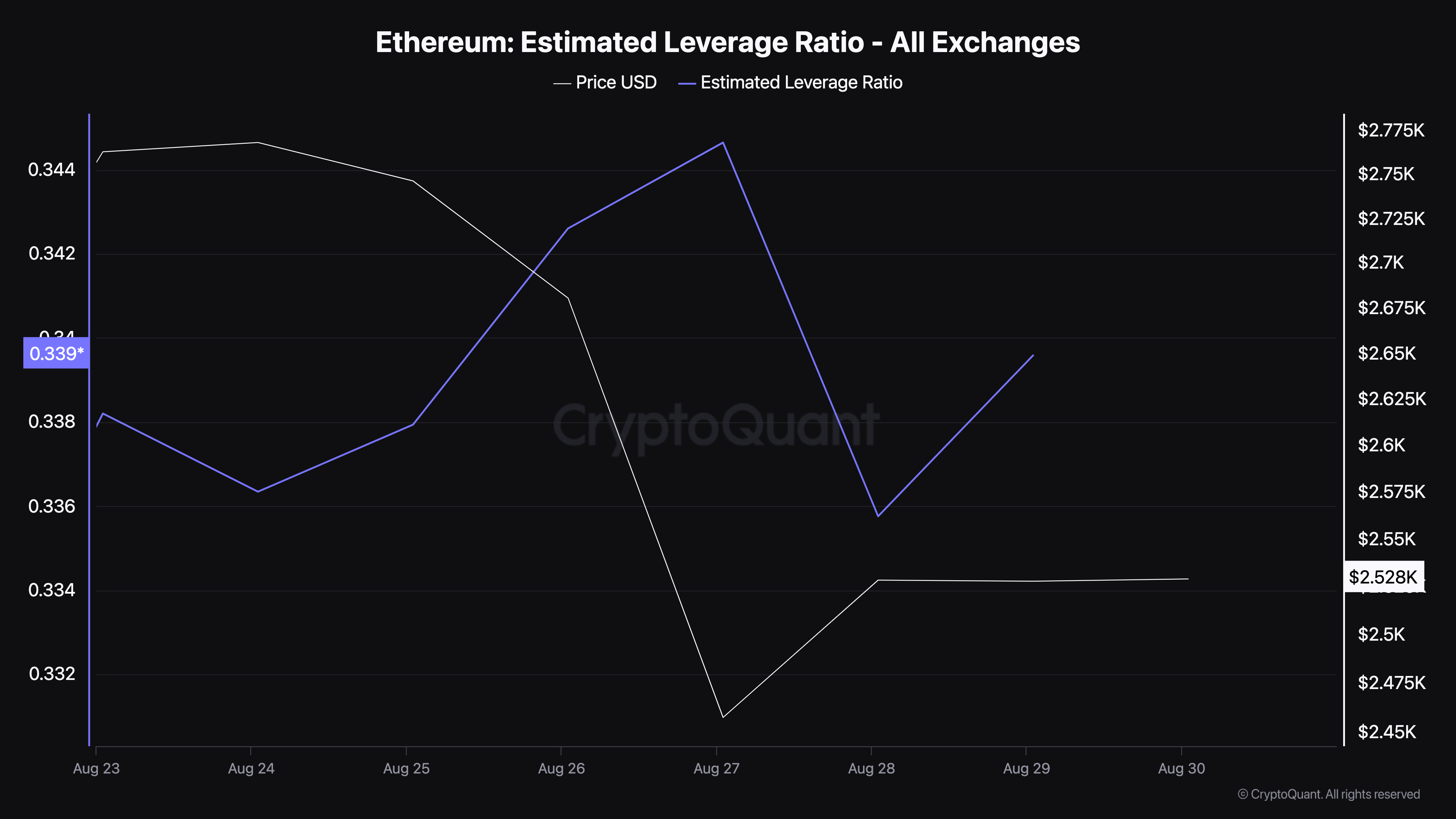

According to CryptoQuant, Ethereum’s Estimated Leverage Ratio (ELR) has recently risen, indicating that investors are increasingly taking high-leverage bets in the derivatives market. This suggests growing confidence in a significant price movement.

Typically, a declining ELR points to cautious sentiment, with traders favoring low-risk bets. In contrast, a rising ELR signals that traders expect the price to move decisively.

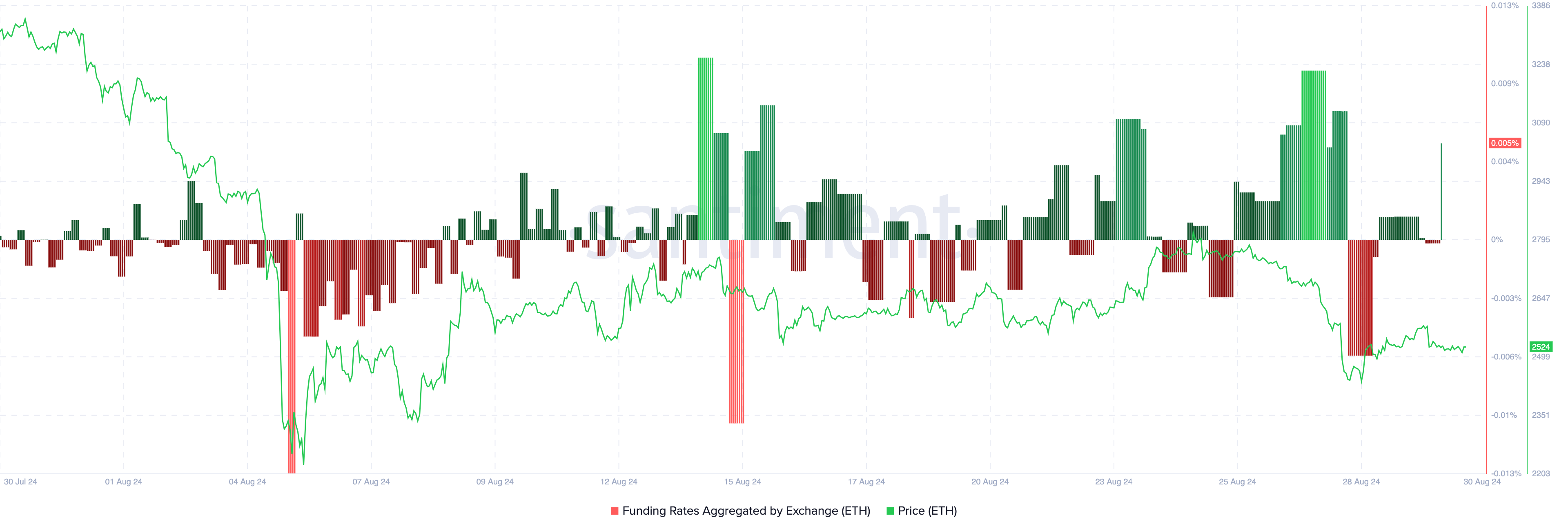

Supporting this outlook, on-chain data from Santiment shows a sudden spike in Ethereum’s Funding Rate, the cost of holding an open position in the perpetual market.

When the Funding Rate is positive, the perpetual futures price trades at a premium to the spot price, indicating bullish sentiment. Conversely, negative funding suggests the cryptocurrency is trading at a discount, with most traders opting for short positions.

Read more: Solana vs. Ethereum: An Ultimate Comparison

It’s important to note that the Funding Rate can also influence price movements. If funding is highly negative while the price is rising, it suggests aggressive shorting, which can be a bullish indicator. However, the recent spike in funding, coupled with the price increase, suggests that Ethereum might experience another bearish round before potentially rebounding.

ETH Price Prediction: Bears Are Not Out of the Way

On the daily chart, Ethereum (ETH) must avoid breaking below the $2,414 level to maintain the possibility of retesting the overhead resistance at $2,726. Successfully holding this support could pave the way for a move higher, potentially reaching $3,014.

The Moving Average Convergence Divergence (MACD) indicator on the chart shows a positive reading, suggesting bullish momentum. The MACD, which measures momentum by comparing the 12 and 26 Exponential Moving Averages (EMAs), indicates that as long as the momentum stays positive, ETH’s price could continue to rise.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, ETH needs to break above the descending trendline to target $2,800. Failure to do so may result in rejection, potentially causing ETH to slide back toward $2,400.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.