Will Bitcoin break $67K for a rally or stay below $60K?

08/31/2024 11:00

Bitcoin trades near $59K support with mixed signals; will it break $67K for a rally or drop below $60K?

- Bitcoin faced a critical support test at $59K, with potential for a significant move in either direction.

- On-chain data showed that 81% of BTC holders were in profit, with bullish exchange signals hinting at possible recovery.

Bitcoin [BTC] was trading near a critical support level, raising questions about its next move.

As of press time, Bitcoin was priced at $59,340.68, experiencing a slight decline of 0.33% over the past 24 hours and a 2.69% decrease in the past week.

Bitcoin’s market capitalization stood at approximately $1.17 trillion, with a 24-hour trading volume of $34.49 billion.

Analysts are closely watching the $59K-$60K support range. Daan Crypto Trades, a crypto analyst, noted that Bitcoin was “still trading in the lower half of the range,” adding that $66K-$67K was the next resistance level.

If Bitcoin fails to hold above $59K, further declines could be expected. However, a bounce from this level could pave the way for a move toward the mid-range target of $66,092.

Bitcoin shows mixed signals

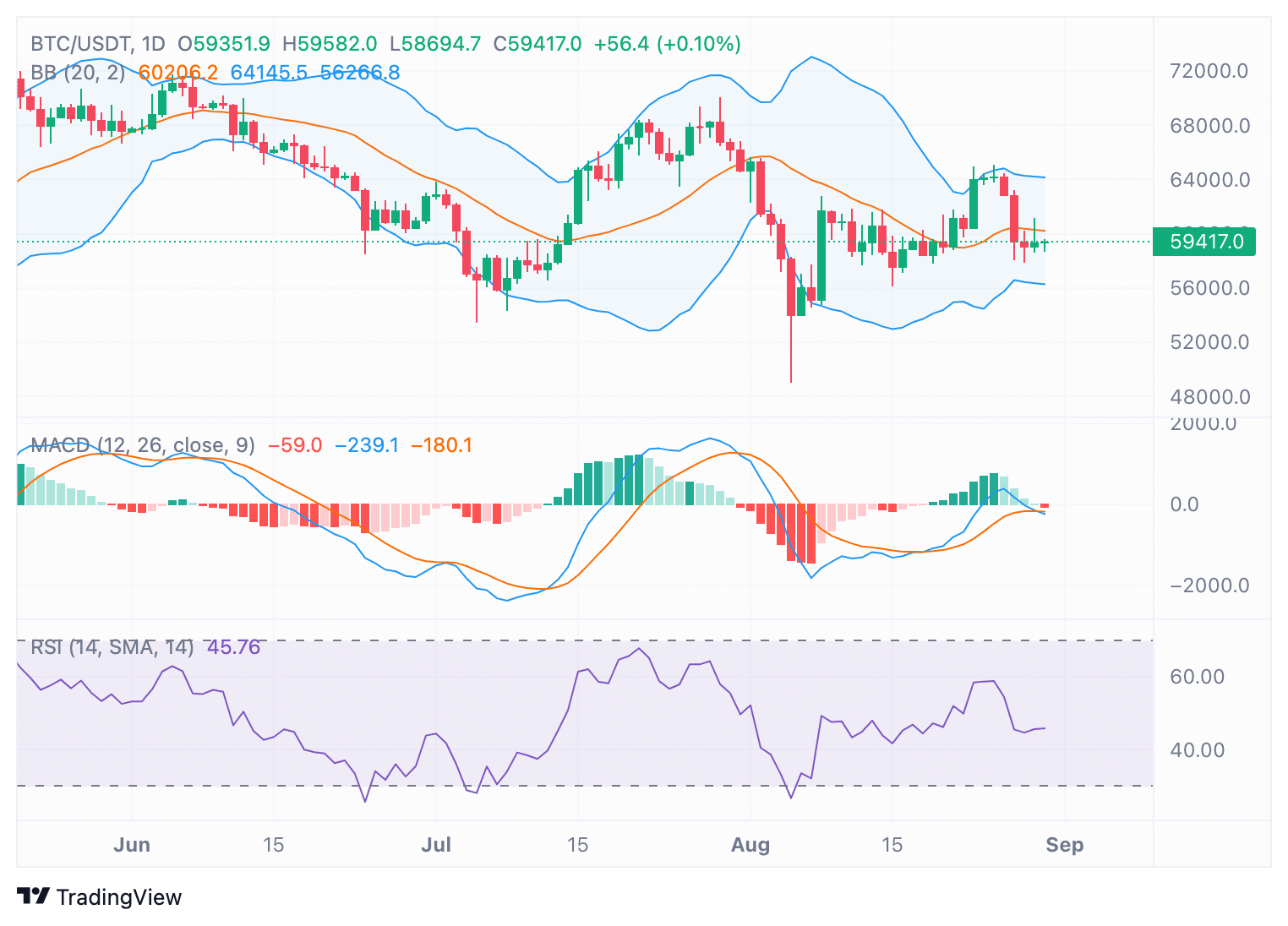

The technical indicators for Bitcoin showed mixed signals at press time. The price was hovering near $59,417, close to the middle of the Bollinger Bands.

The wide bands indicate increased volatility, and the price nearing the lower band suggests potential support.

If this support fails, the next level to watch is around $56,266.

The Moving Average Convergence Divergence (MACD) histogram was showing signs of weakening bullish momentum.

At press time, the MACD line was approaching a bearish crossover with the signal line, indicating a possible shift toward a downward trend. Traders are advised to watch for this crossover, as it could signal further price declines.

At press time, the Relative Strength Index (RSI) was 45.76, which was in the neutral zone but leaning slightly toward oversold conditions.

This suggested that Bitcoin had room to move lower before reaching oversold territory.

A rising RSI could indicate a potential reversal or consolidation before any significant price movement.

Exchange signals: A mostly bullish outlook

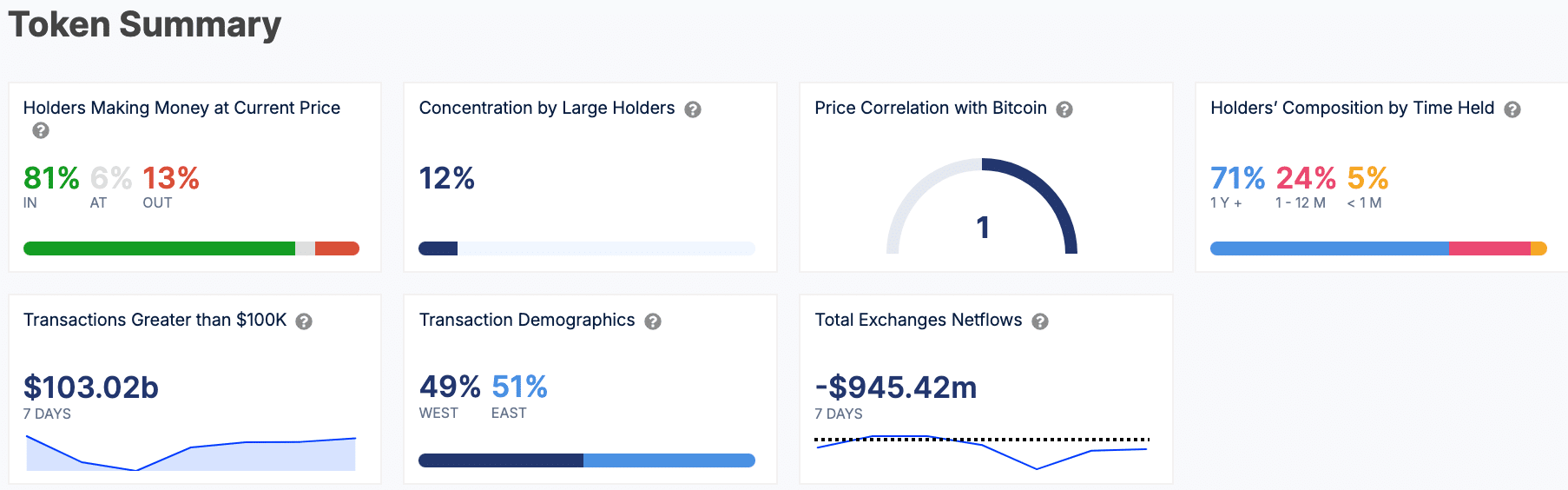

Despite the mixed technical indicators, on-chain and exchange signals presented a mostly bullish outlook. IntoTheBlock data showed that 81% of BTC holders were in profit at press time, while only 13% were at a loss.

Large holders accounted for 12% of the total supply, suggesting moderate concentration.

The net exchange flow for Bitcoin has shown an outflow of $945.42 million over the last seven days. This indicated that more BTC was being moved off exchanges, which could suggest accumulation by holders.

Exchange signals, including the Smart Price and Bid-Ask Volume Imbalance, were both bullish, further supporting the possibility of a positive price movement in the near future.

The total cryptocurrency market cap had slipped by 1.7% in the past 24 hours, settling at $2.183 trillion. This decline reflected a broader market trend that has impacted Bitcoin and other major cryptocurrencies.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Data from DefiLlama showed that the Total Value Locked (TVL) was at $527.89 million. Over the past 24 hours, the DeFi sector recorded $457,690 in fees and $11,017 in transaction volume.

The number of active addresses within the same period stood at 723,280, indicating sustained activity in the DeFi ecosystem.