Ethereum’s supply crisis – Is this a potential set-up for a new rally?

08/31/2024 12:00

Ethereum's supply crisis and strong fundamentals are great set-ups and catalysts for ETH's price to moon. Is that all that's needed though?

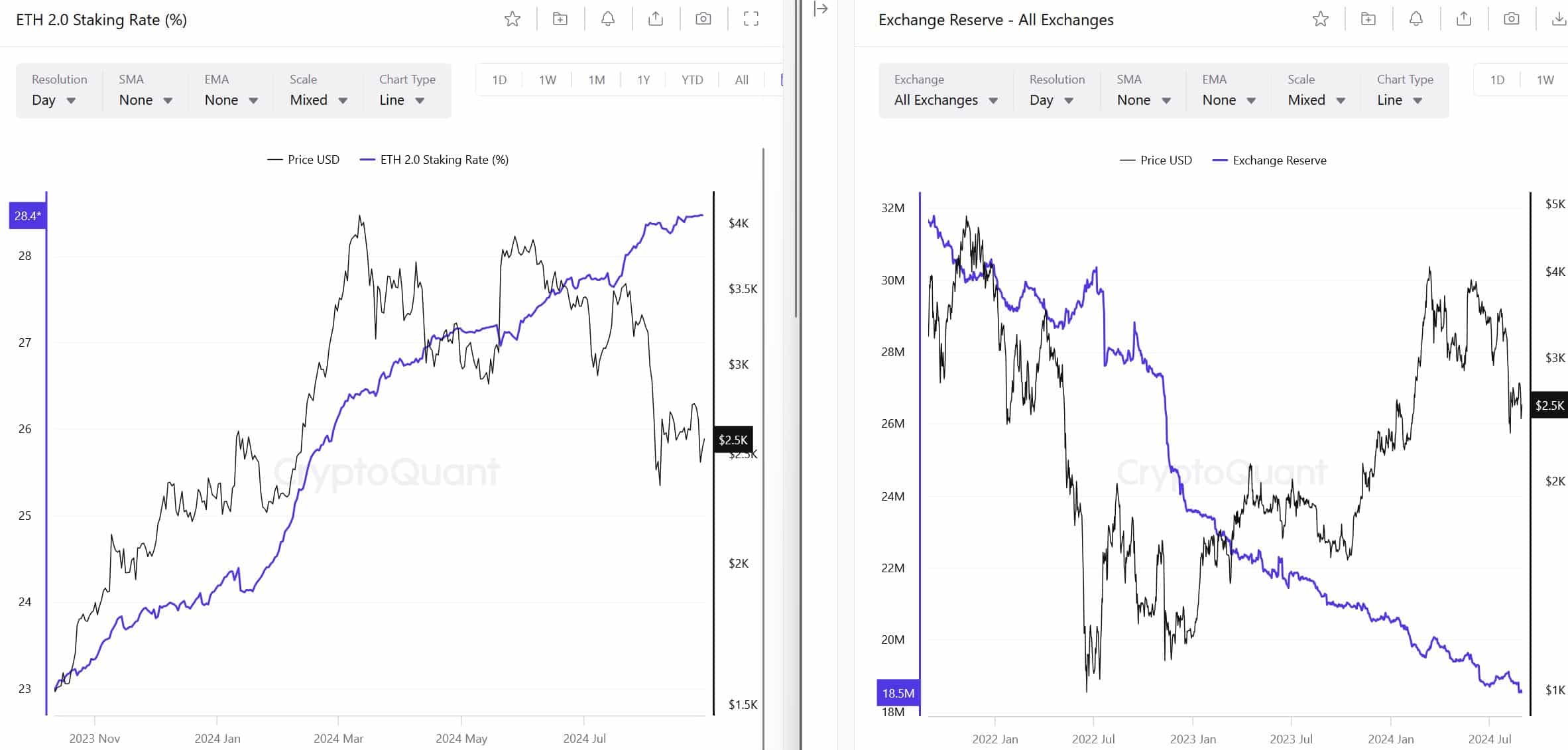

- ETH’s supply crisis intensified as staking demand spiked and exchange reserves fell

- ETH fundamentals remained strong despite weak market sentiment

Ethereum[ETH]’s supply crisis continues to intensify and could be a set-up for a possible strong rebound for the world’s largest altcoin.

In fact, according to on-chain analyst Leon Waidmann, ETH’s supply crisis has been compounded by declining exchange reserves and growing investor appetite for ETH staking. He projected that ETH could “fly” amid the supply crunch.

“The #ETHEREUM SUPPLY CRISIS is getting more SERIOUS by the day. With staking rates soaring and exchange reserves plummeting, as soon as sellers are exhausted and demand increases, #ETH will fly!📈”

Here, it’s worth pointing out that ETH exchange reserves hit a new low of 18.5M over the last 24 hours. This, down from a peak of 35M recorded in 2020.

ETH fundamentals were strong, but…

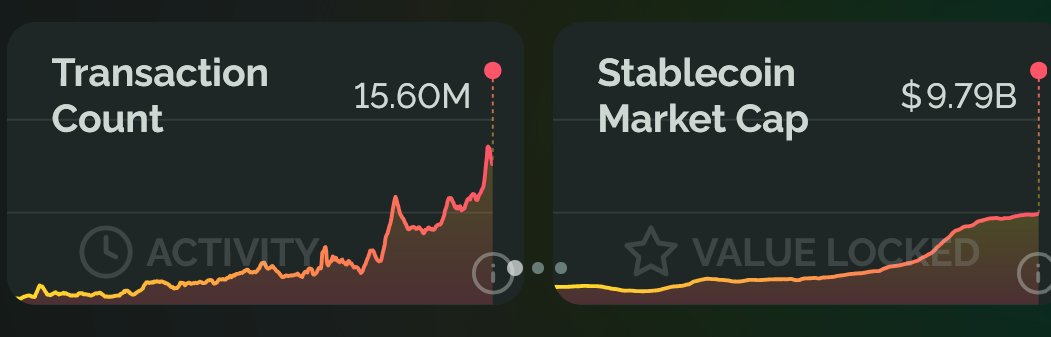

Additionally, the analyst highlighted the ETH ecosystem’s strong fundamentals, citing record-high stablecoin and transaction counts.

“Transaction Count: ALL-TIME HIGH at 15.60M. Stablecoin Market Cap: ALL-TIME HIGH at $9.79B. The fundamentals are stronger than ever!”

This is a sign of strong network growth for ETH, which could be a positive catalyst for an upswing in normal circumstances.

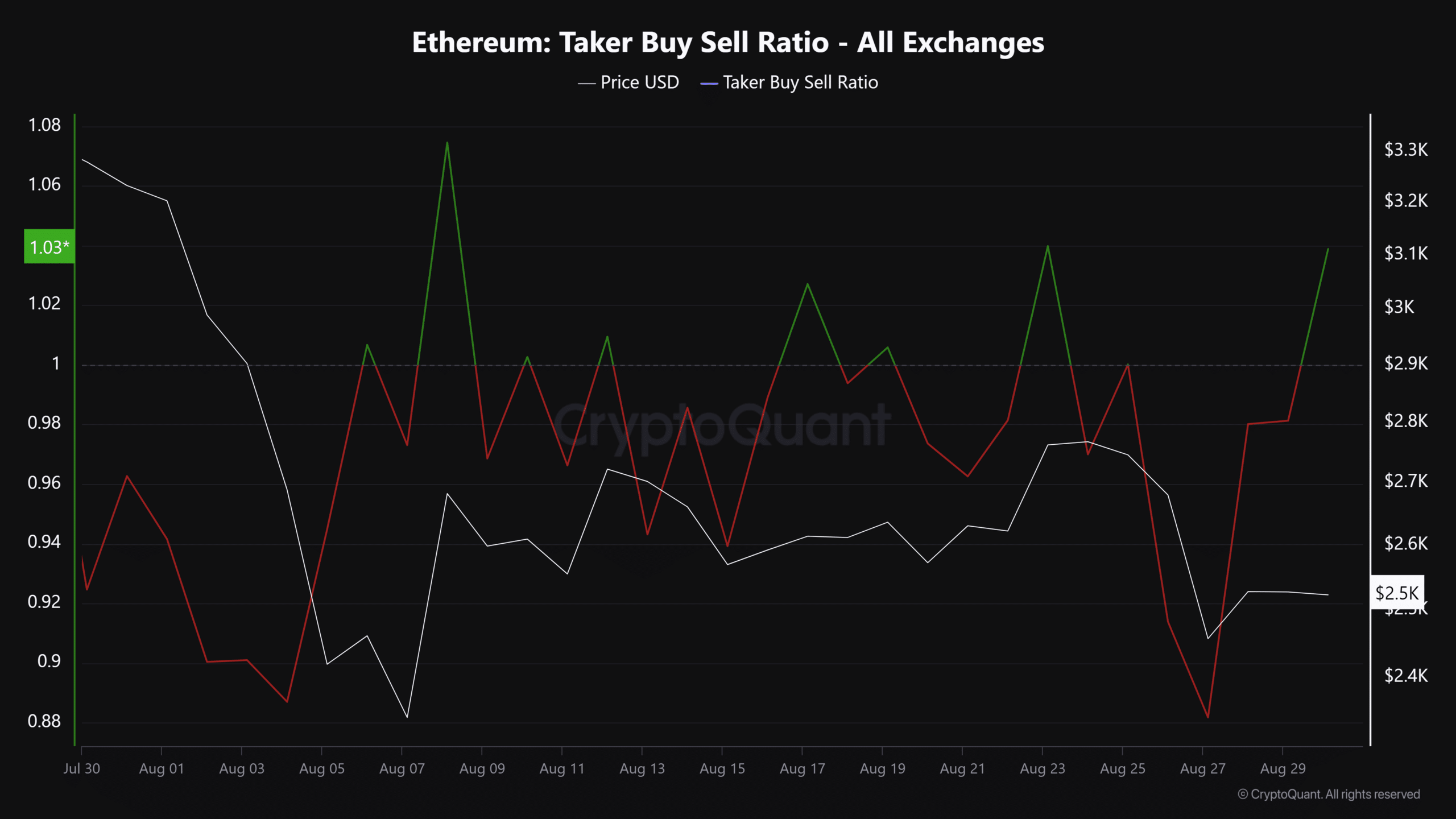

However, the altcoin has been dragged by negative market sentiment for most of August, as shown by the Taker Buyer Sell ratio. This metric tracks the altcoin’s buying vs. selling volume on the derivatives market.

The overwhelmingly negative reading in August indicated that sellers dominated the market. Negative sentiment on this front can partially explain the altcoin’s muted price action on the charts.

Part of the negative sentiment has also been driven by perceived low fees and inflationary concerns in the ecosystem. Especially since the introduction of blobs, which made the chain transaction costs cheaper.

According to Ethereum community member Ryan Berckmans’s statement, revenue for the chain will improve as blob utilization rises.

“For Ethereum L1 revenue, the future is extremely bright.”

He isn’t the only one either, with another analyst echoing the outlook and foreseeing ETH hitting $10k from blob space utilization alone.

At the time of writing, ETH was trading at $2.5k, down by nearly 5% on the weekly charts from a recent high of $2.8k last weekend.