Bitcoin: U.S inflation holds steady, but will rising Fed rate cut odds help BTC?

08/31/2024 17:00

Fed rate cut odds in September surged to 70% amid steady July inflation. Despite being a potential positive for BTC, its price was unmoved...

- U.S inflation was steady in July, raising Fed rate cut odds

- However, BTC’s price remained subdued and could stay range-bound

U.S inflation continues to be steady, reinforcing market expectations of a likely Fed rate cut in September. This rate cut is expected to help boost Bitcoin [BTC] and other risk assets. According to the U.S Bureau of Economic Analysis (BEA), the July Core PCE (Personal Consumption Expenditure) Price Index came in at 2.5% on a yearly basis.

The PCE Price Index hiked by 0.2% last month, similar to June’s reading, and matched analysts’ estimates. The data measures price changes for goods and services, excluding food and energy, and is the Fed’s favorite variable for tracking inflation and making monetary policy decisions.

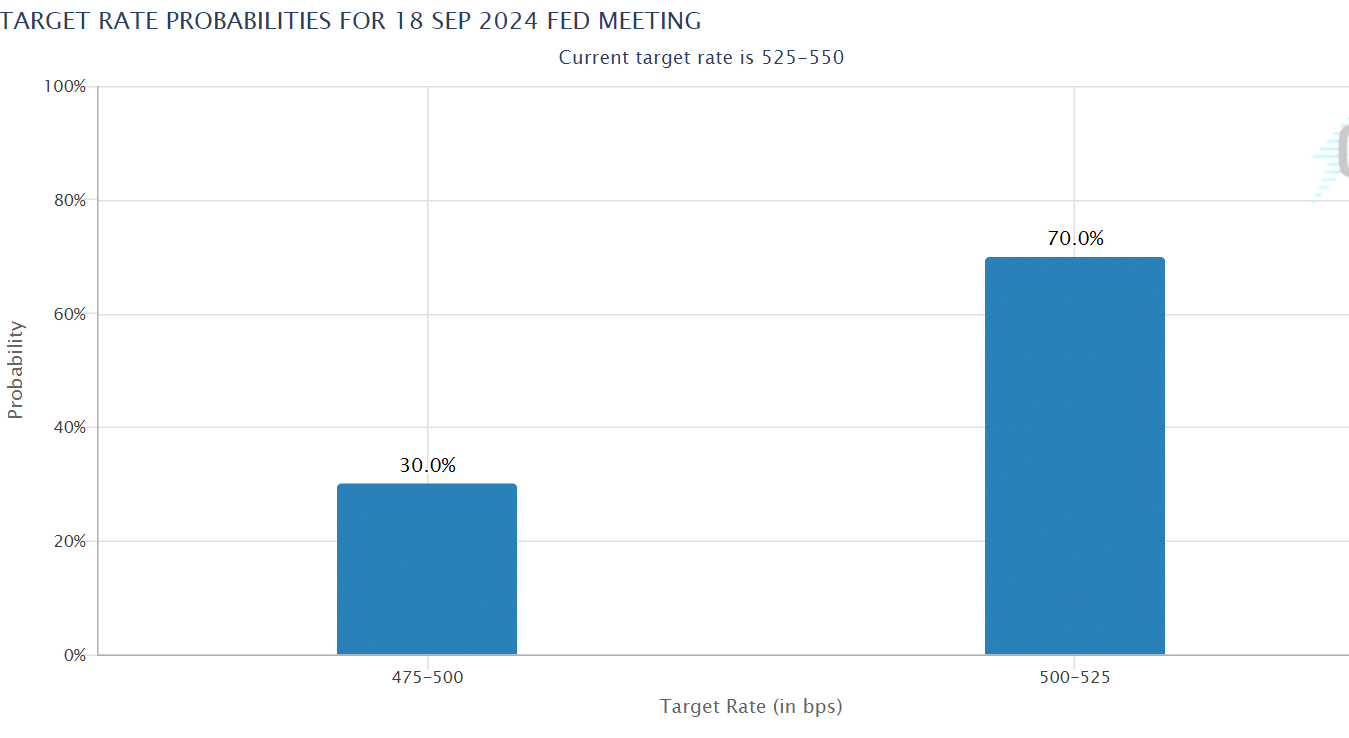

September Fed rate cuts jump to 70%

That being said, the steady July inflation data reinforced the market’s conviction of a likely 25 basis point (bps) Fed rate cut in September. According to the CME FedWatch tool, interest traders are now pricing odds of 70% on a September rate cut.

That would translate to a 4% jump from the 66% odds seen before the July inflation data was released. Meanwhile, some traders have been pricing a 30% chance for a 50 bps rate cut during next month’s Fed meeting.

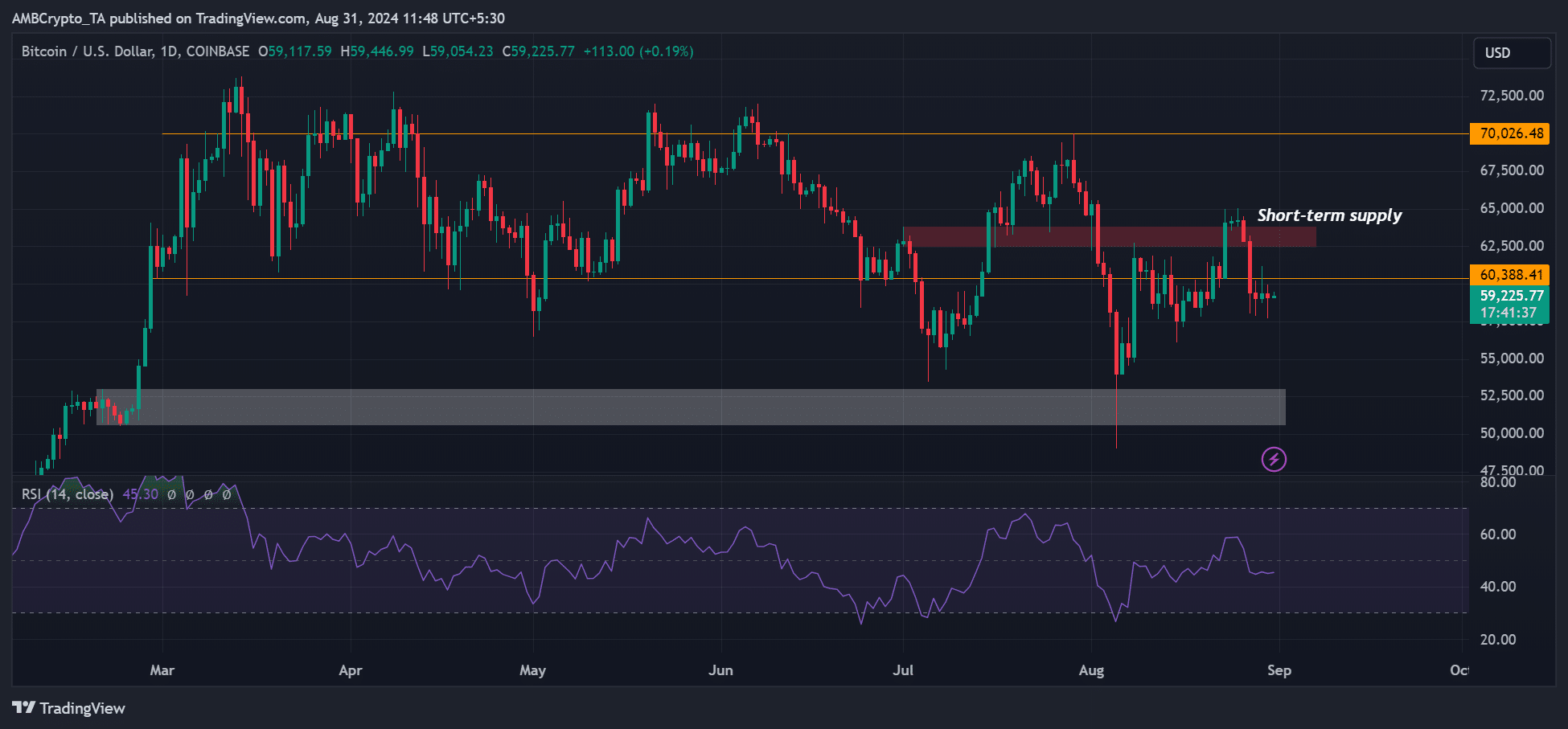

Bitcoin’s price remains muted

The data tipped U.S equities to edge higher while BTC and the crypto markets tanked and consolidated. BTC moved slightly to $59.9k, before dropping to $57k on Friday after the inflation data was first released.

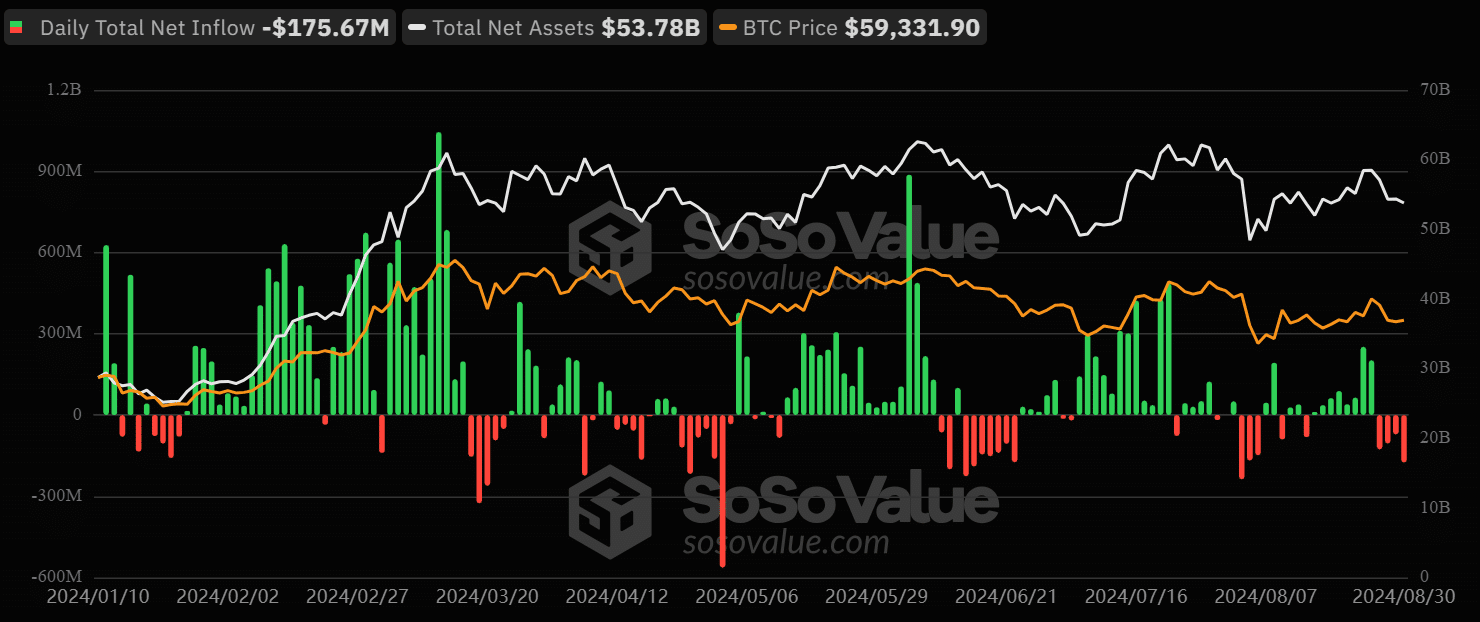

At the time of writing, the cryptocurrency was trading at $59.2k, marking the fourth day it has remained below $60k. The weak sentiment and risk-off investors’ approach was also evident across U.S spot BTC ETFs.

Since Tuesday, the products have recorded net outflows of $277 million, illustrating that the steady July inflation wasn’t enough to break the weak trend.

However, crypto trading firm QCP Capital noted that a possibly weaker U.S jobs report next week could confirm a ‘strong case’ for a Fed rate cut in September. In the meantime, the trading firm projected that BTC could remain range-bound.

“With the recent macro news proving to have little effect on the crypto market, we believe BTC is likely to remain range-bound within 58k-65k in the short term as the market awaits positive catalysts to break out of this range.”