Ethereum Classic price prediction – Assessing the odds of ETC hitting $20 again

09/01/2024 00:00

Ethereum Classic presented a faintly hopeful bullish case after last week's price surge beyond $20 but the bulls were forced to retreat...

- Market structure flashed hopeful signs, but the longer-term trend was unfavorable for buyers

- Short-term sentiment was bearish and spot buyers were weakened too

Ethereum Classic [ETC] managed to climb past the $20-level on Friday, 23 August. There were bullish expectations for the token, but Bitcoin’s [BTC] correction below $60k saw a market-wide sentiment shift.

Ethereum Classic may have bullish hopes provided it can defend the $18.3 and $17.68 support levels that are close by. In fact, a volume indicator showed a surge in buying pressure. However, is that enough?

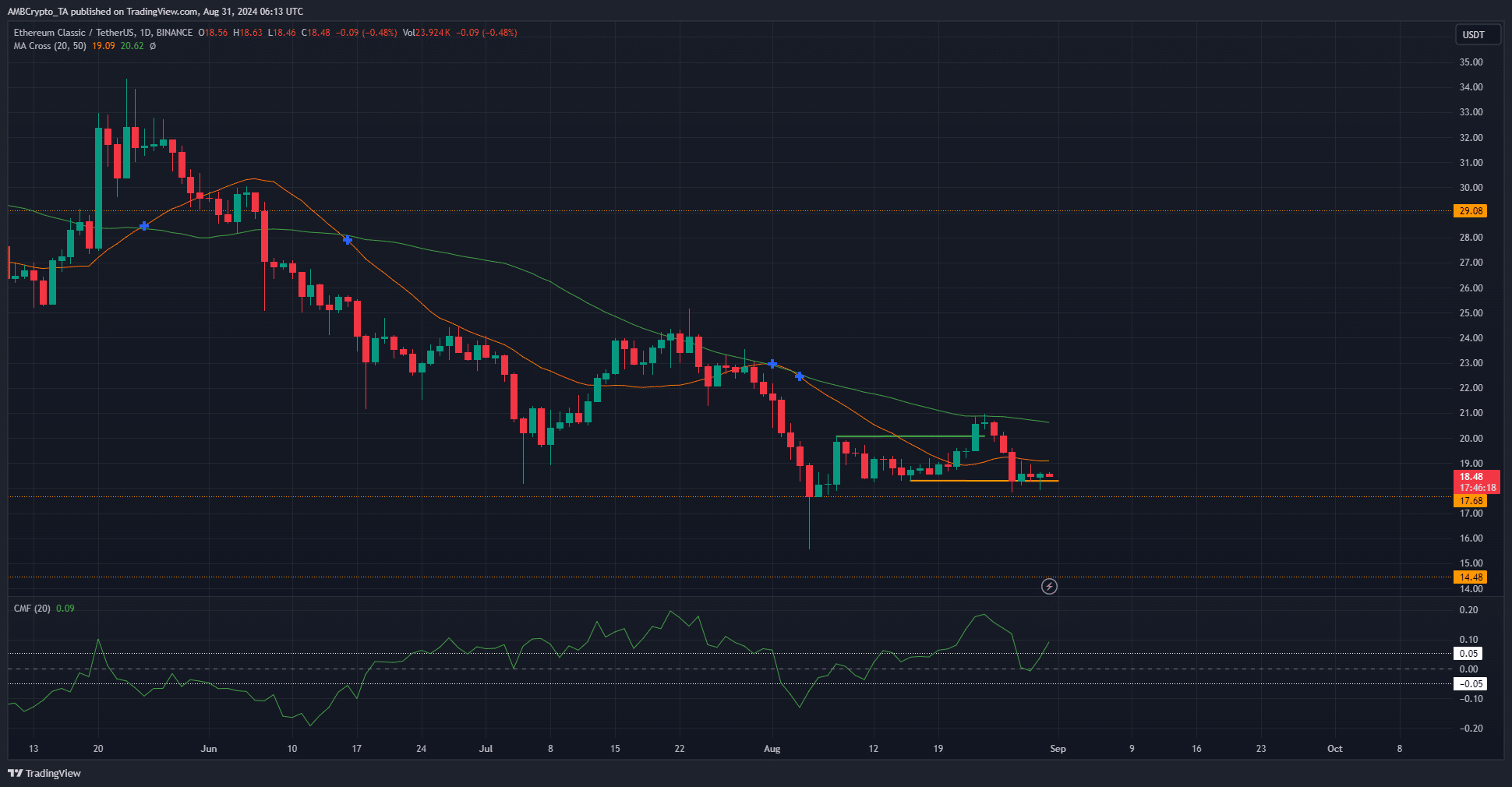

Bullish structure, bearish trend

Ethereum Classic had a bullish market structure on the daily chart after breaking the recent lower high at $20.07. At press time, the higher low at $18.3 was not broken yet. However, since May, the trend has been bearish.

The moving averages indicated the same thing. They had not yet formed a bullish crossover to indicate an uptrend. Additionally, Ethereum Classic faced rejection from the 50-day moving average a week ago.

The CMF was at +0.09 to indicate sizeable capital inflows, but the token was trading beneath its 20-period SMA. Bulls need to be careful of another bearish move and could opt to wait for clearer conditions instead.

Short-term outlook not favorable for ETC bulls

Over the past three days, Ethereum Classic has struggled to breach the $19 level and has crept closer towards $18 instead. This saw the Open Interest drop from $71 million to $65 million, outlining bearish sentiment.

Read Ethereum Classic’s [ETC] Price Prediction 2024-25

The funding rate had been slightly bearish during this time, reinforcing the bearish expectations in the Futures market. The spot traders were not keen on buying ETC either, and the spot CVD has trended south since.

Overall, the trend of the next few days is likely to be sideways or downwards.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion