Solana falls below the Ichimoku Cloud: What’s next for SOL in September?

09/01/2024 13:00

Solana has faced consecutive declines, causing cash inflow and open interest to decrease and reflecting cautious trading sentiment.

- SOL has continued declining.

- SOL has fallen further into a bear trend due to its price decline.

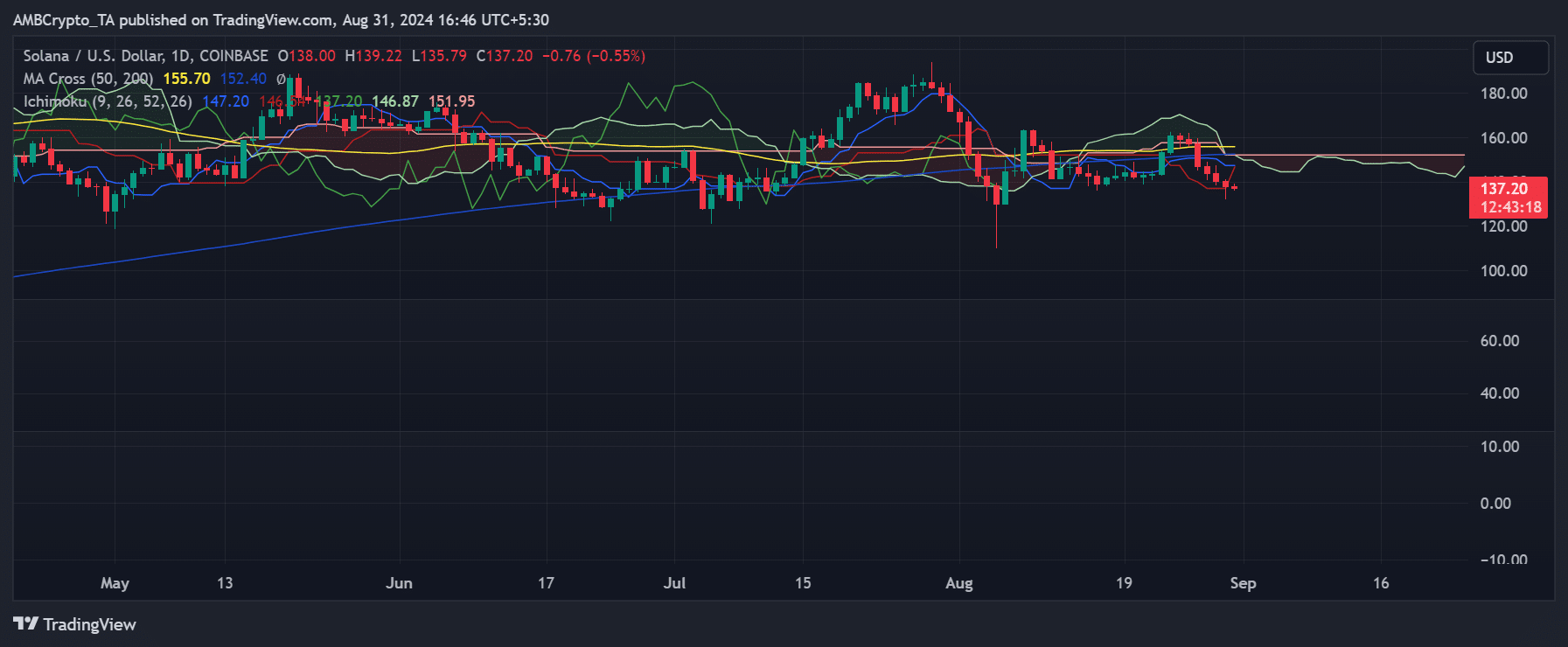

In recent days, Solana [SOL] has experienced consecutive declines, leading to a significant reduction in its value. The Ichimoku cloud indicator highlights the extent of this decline.

It provides insight into where Solana’s price might be headed next. As the price has dropped, cash inflow into Solana has also decreased, with traders adopting a more cautious stance.

Analysis of Solana revealed that it has experienced consecutive declines over the past seven days, bringing its price down to approximately $137.14 as of this writing.

Further analysis using the Ichimoku Cloud indicator showed that the cloud, or Kumo, is relatively thin and transitioning from a flat to a slightly downward-sloping direction.

This shift indicates weakening support and the potential for further declines. Additionally, the price is below the cloud, generally considered a bearish signal.

The green and red lines (Senkou Span A & B) that form the cloud represent future support and resistance levels. With the cloud positioned above the current price, it acts as a resistance zone, suggesting that Solana may face challenges in breaking through this level soon.

Where the SOL price could go from here

The analysis indicates that Solana’s next significant support level is around $130, based on previous lows observed in June. If the price breaks below this level, it could decline further, with the next target around $120.

On the resistance side, the Ichimoku Cloud presents the first major resistance zone, ranging from approximately $146 to $152. If Solana’s price attempts a reversal, this area would be the initial hurdle to overcome.

Beyond the cloud, the 50-day moving average, currently around $155, serves as another critical resistance level. Overcoming these resistance zones would be crucial for Solana to shift from its current bearish trend and begin a potential recovery.

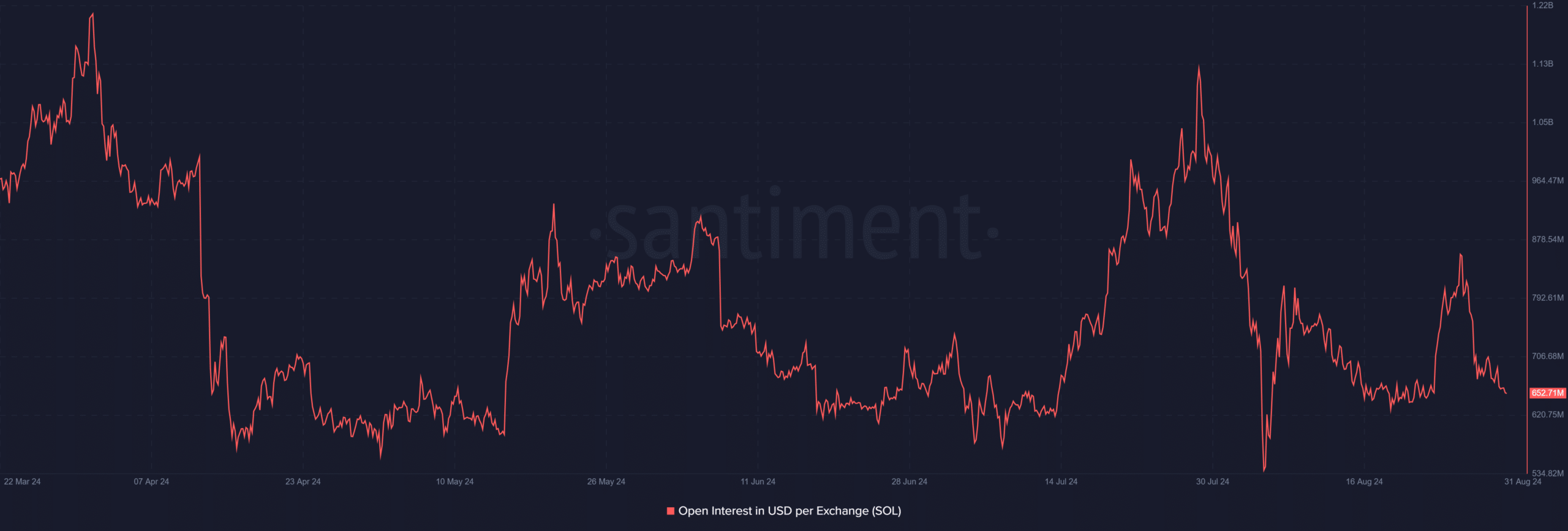

Open Interest in Solana declines

The recent consecutive declines in Solana [SOL] have significantly dampened interest in the cryptocurrency, as evidenced by data from Santiment.

An analysis of the open interest chart reveals a marked decline over the past five days. On August 27th, SOL’s open interest was over $817 million, but it has since dropped to around $652 million as of this writing.

This decline in open interest indicates a reduced cash inflow. It suggests fewer traders currently engage in SOL trades, reflecting waning enthusiasm and participation.

Read Solana (SOL) Price Prediction 2024-25

Additionally, data from CoinMarketCap shows that Solana has declined by over 13% in the last seven days, making it the biggest loser among the top five cryptocurrencies.

Within the top ten, Solana ranks as the second-largest loser, just behind Toncoin (TON), which has suffered a more substantial loss of over 20% in the same period.