Toncoin’s next move – How whales can and cannot keep TON bullish

09/02/2024 04:00

While most cryptos struggled because of the bearish market condition, Toncoin [TON] acted differently as its daily chart was green.

- Market sentiment around the token improved in the last few days.

- Whales were showing confidence in TON as they increased accumulation.

The crypto market has witnessed a major setback of late, causing most cryptos’ prices to plummet. However, Toncoin [TON] seemed to be performing better than the rest, as it managed to paint its daily chart green.

But will this trend continue further? Let’s find out.

Toncoin turns green again

CoinMarketCap’s data revealed that Toncoin price dropped by more than 5% in the last seven days. But things got better in the past 24 hours as the token seemed to be recovering.

At the time of writing, TON was trading at $5.39 with a market capitalization of over $13.6 billion, making it the 9th largest crypto.

The volatile price action caused the majority of TON investors to bear losses. AMBCrypto’s look at IntoTheBlock’s data revealed that only over 6 million TON addresses were in profit, which accounted for just over 12% of the total number of TON addresses.

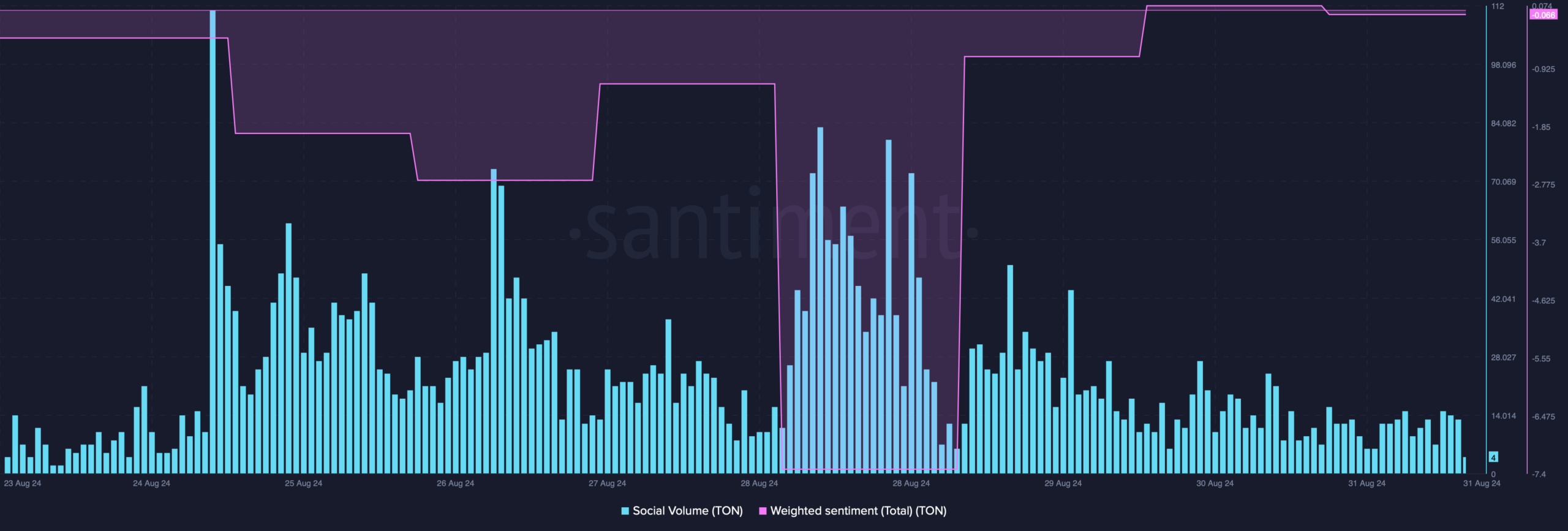

The price increase in the last 24 hours did have a positive impact on the token’s sentiment. According to our look at Santiment’s data, TON’s weighted sentiment improved sharply.

This indicated that bullish sentiment around it increased in the market.

However, its social volume remained low, reflecting a drop in its popularity.

Will TON remain bullish?

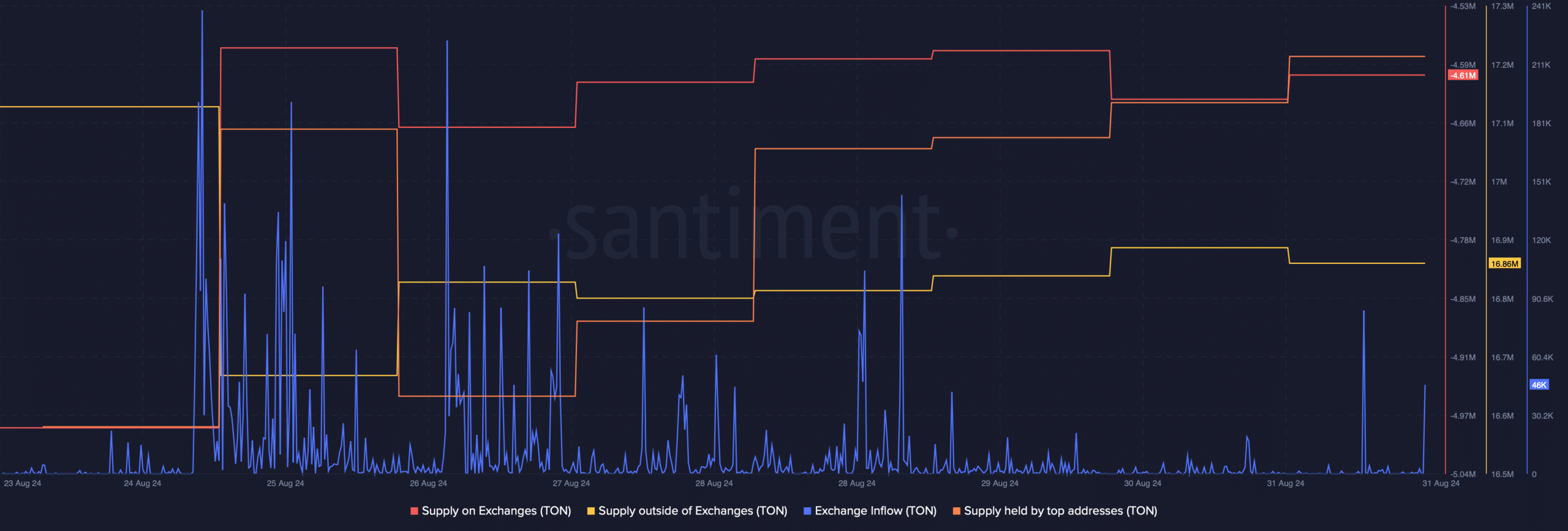

AMBCrypto then checked other datasets to find out the odds of TON remaining bullish in the coming days. As per our analysis, selling pressure on the token increased, which could push its price down.

This was evident from the rise in its supply on exchanges and a dip in its supply outside of exchanges. The fact that investors were selling TON was further provided by the spike in its exchange inflow.

Apart from this, TON’s long/short ratio also dropped, as per Coinglass. This suggested that there were more short positions in the market than long positions.

Nonetheless, the big pocketed players in the crypto space were confident in TON as the supply held by top addresses increased.

Moreover, our analysis of Hyblock Capital’s data revealed that Toncoin’s whale vs retail delta had a value of 99.49. A value closer to 100 is bullish as it indicates that whales are having longer exposure in the market.

Is your portfolio green? Check out the TON Profit Calculator

Since the whales were confident in TON, AMBCrypto then checked the token’s daily chart. The technical indicator MACD displayed a bearish advantage in the market. The Relative Strength Index (RSI) moved sideways, hinting at a price decline.

Nonetheless, the Chaikin Money Flow (CMF) supported the bulls as it registered an uptick.