Sun Token has catapulted to the forefront of the top 300 cryptocurrencies with an impressive monthly rise, yet a drop in open interest and volume suggests its rally may be losing steam.

Justin Sun’s cryptocurrency, Sun Token (SUN), has been one of the top performers over the past 30 days, experiencing a 240% increase as investors responded positively to the ecosystem’s expansion.

SUN serves as the utility token for Sun Pump, a meme coin launch platform on the Tron network, similar to Solana’s Pump.fun memecoin deployer.

Originally launched over four years ago as a Bitcoin alternative, SUN Token faced a significant downturn in 2021 due to an oversupply issue. This led to a shift in focus toward decentralized finance on platforms like Justswap and Justlend. With its new use cases, SUN is now targeting a market capitalization of $1 billion.

On Aug. 25, Sun Token reached a peak of $0.0435, its highest value since December 2021, representing an impressive 731% increase from its lowest point in 2023. Its market capitalization has also seen major growth, rising from $101 million on Aug. 17 to over $326 million.

Justin Sun has played a crucial role in driving this surge by implementing strategies such as capitalizing on memecoins and tweaking network fees. His latest feature, SunPump, quickly surpassed Solana-based Pump.fun in daily active users and revenue as of Aug. 21.

Recently, Justin Sun addressed critics who made negative statements about the SUN token through an X post on his account. He countered the criticism by offering to purchase any SUN tokens from these individuals at a rate of $0.03 each.

Traders are optimistic that Sun’s ecosystem could be a key driver to growth, drawing parallels to Solana’s Raydium network, which saw its own memecoins rise in popularity. During that period, Raydium became one of the top ten decentralized exchanges, handling billions in trading volume each month.

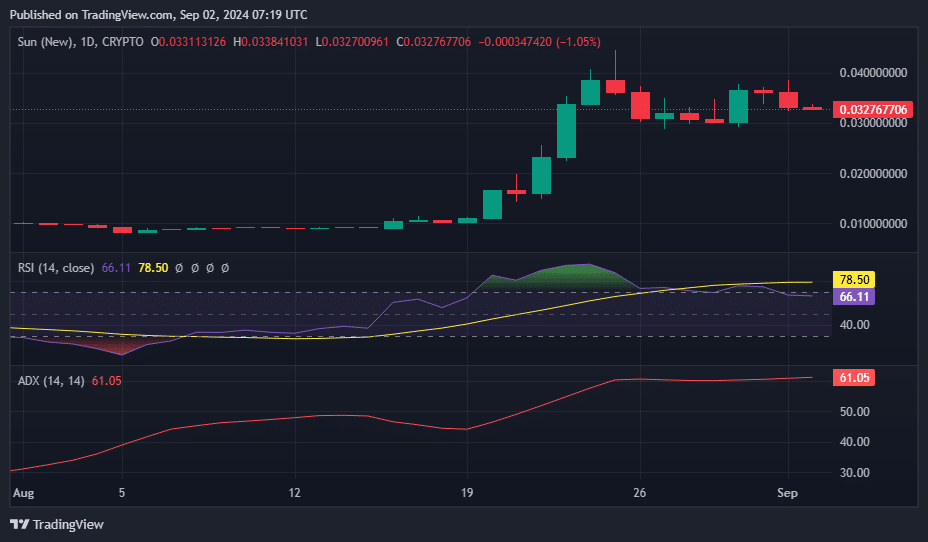

SUN price action

Despite being the top gaining token over the last 30 days Sun Token has dropped 7.2% in the last 24 hours. The crypto asset’s 24-hour trading volume was down 30% hovering around $127 million.

Data from Coinglass reveals that SUN’s total open interest has dropped by 17.89% in the last day, declining from $84.64 million to $69.51 million, reflecting waning trader interest as the broader crypto market experienced a 2.1% dip, bringing its total value to $2.11 trillion.

Data from the market intelligence platform also shows that SUN’s aggregated funding rates are currently at -0.0348%, signaling a bearish sentiment among traders regarding SUN’s price outlook.

The Average Directional Index has climbed to 61.05, the highest since June 6, suggesting strong momentum, as an ADX above 50 typically indicates.

Meanwhile, the Relative Strength Index has entered extreme overbought territory. This suggests that while SUN may continue to rise in the short term, a reversal could be on the horizon as investors start to take profits.

The crucial level to watch is $0.030—if SUN’s price falls to this level, it might present a buying opportunity before a potential rebound. However, if it fails to hold this level, the price could drop to around $0.013. Conversely, if the momentum continues, SUN could rise to $0.050.