Cardano Chang hard fork goes live – So why is ADA down?

09/02/2024 17:30

The Cardano Chang hard fork has gone live boosting ADA's utility through decentralized governance. ADA price is down by over 3%.

- The Cardano Chang hard fork upgrade has gone live, bringing decentralized governance to the network.

- However, ADA’s price has plunged in a possible sell-the-news event.

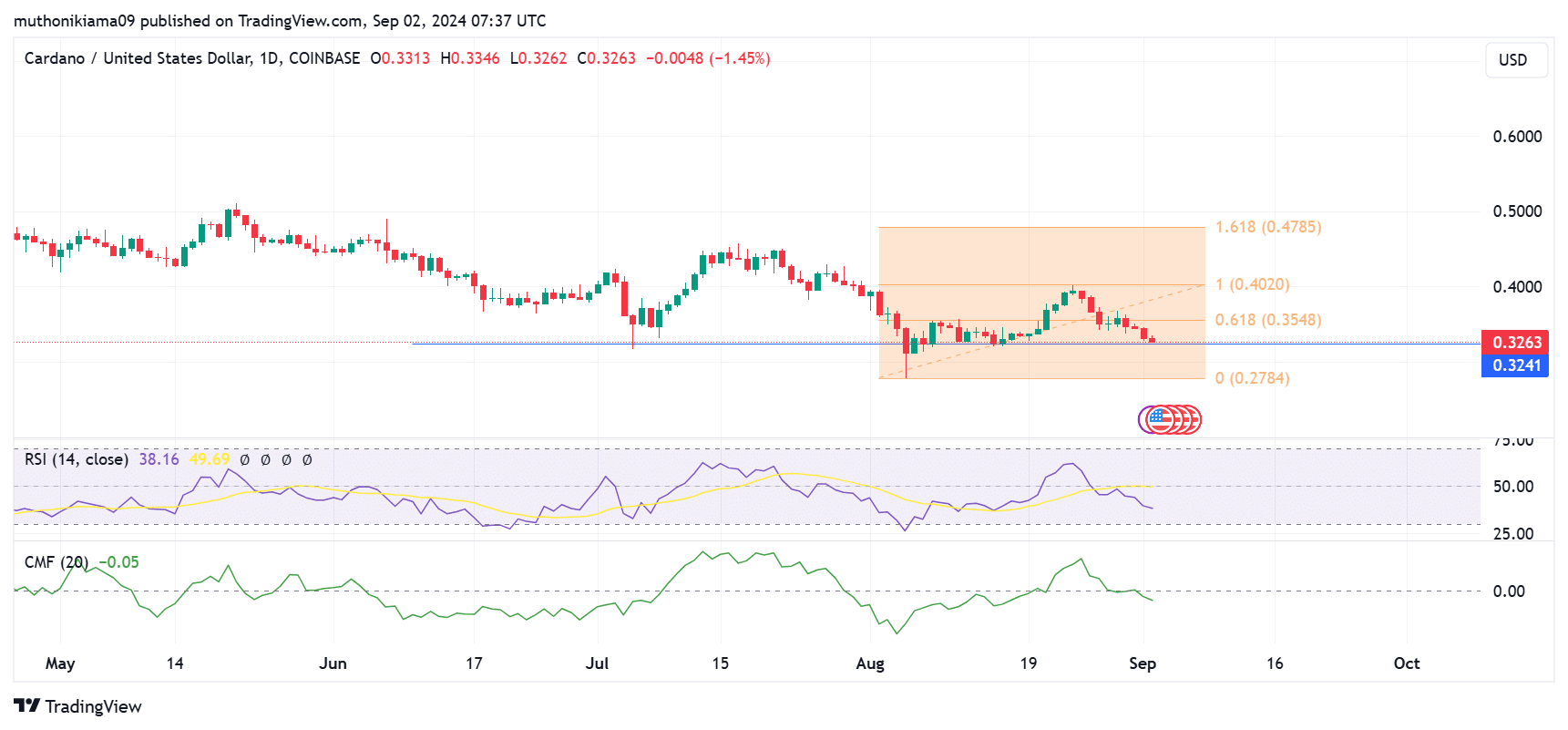

Cardano [ADA] was trading at $0.329 at the time of writing. The price has succumbed to the bearish pressure across the broader crypto market and dropped 3.3% in the last 24 hours.

This drop comes despite a key upgrade on the network to boost ADA’s utility.

The Cardano network has completed the Chang hard fork upgrade. This upgrade seeks to introduce decentralized governance to the Cardano ecosystem.

The new governance structure will involve a Constitutional Committee, Delegate Representatives, and Stake Pool Operators. This allows ADA holders to vote on key decisions on the network.

The Cardano Foundation said,

“Today’s Chang hard fork marks a major milestone for the Cardano blockchain, ecosystem, and community – fulfilling the promise of a truly self-governing, decentralized network.”

While the Chang hard fork has expanded utility for ADA holders, the token has failed to react positively.

Sell the news event?

The Chang hard fork upgrade turned out to be a sell-the-news event.

Trading volumes have soared by more than 60% in the last 24 hours, per CoinMarketCap data. These volumes are likely due to selling activity.

The Relative Strength Index (RSI) was at 39 on the daily chart, indicating that sellers were in control. This index has formed lower lows over the past week, suggesting that buyers remained hesitant.

The RSI line also crossed below the signal line, further proving that the bearish momentum remained strong.

A further look at the Chaikin Money Flow suggested that selling pressure as the indicator has shifted to the negative region.

The RSI and the CMF saw a spike in late August as the rest of the market rallied. This showed that ADA’s uptrend relied on the broader market sentiment.

More dips could be in for ADA if the price loses critical support at $0.324. Failing to hold levels above this support could see the token plunge lower to the August 5 level at $0.27.

On the other hand, if traders take advantage of the dip to accumulate, ADA could aim for the next resistance at $0.402. The return of a bullish sentiment across the broader market could further support the token’s rally to $0.47.

Read Cardano’s [ADA] Price Prediction 2024–2025

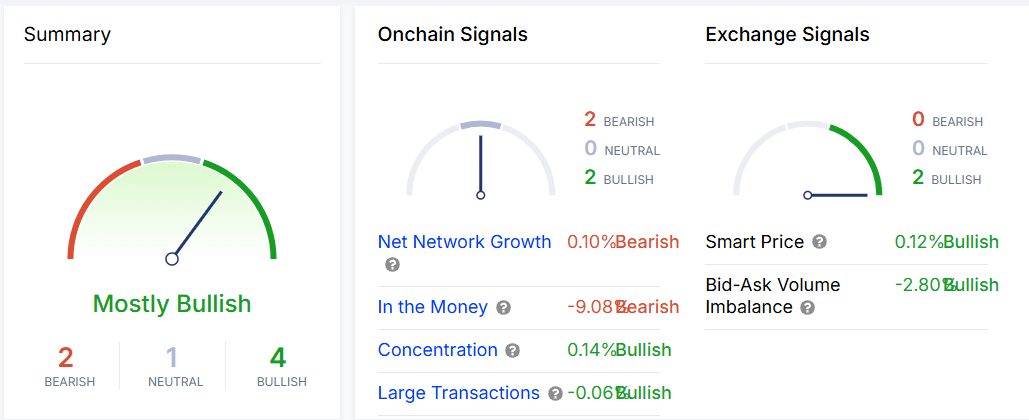

While the technical indicators are currently bearish, on-chain data via IntoTheBlock painted a bullish picture, suggesting that the downtrend could be short-lived.

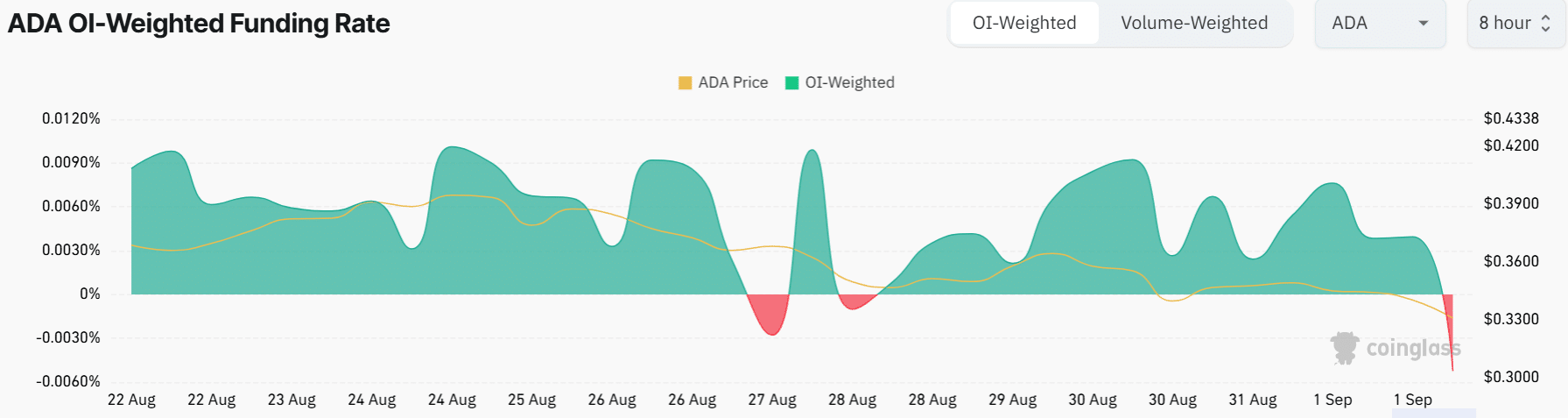

However, data from Coinglass strengthened the bearish thesis. ADA’s Funding Rates have flipped negative for the first time in nearly a week, showing the dominance of short traders.