Solana Skyrockets 7,600% in Fund Flows Ahead of Solana ETF Debut

09/02/2024 22:47

Solana sees explosive 7,600% surge in fund flows as Solana ETF denial might be blessing in disguise

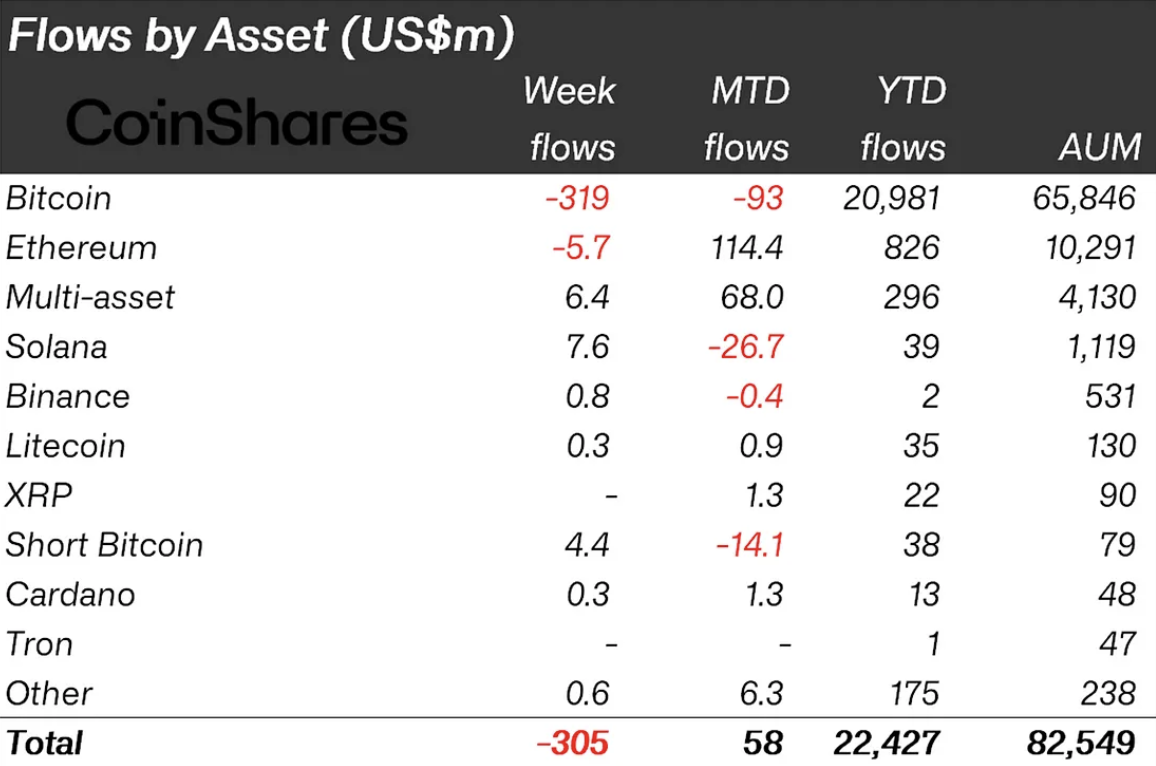

The market for exchange-traded investment products linked to cryptocurrencies saw massive outflows of $305 million last week. This is $838 million less than the week before.

While the reasons for such a poor and disappointing performance lie in the field of two major cryptocurrencies - Bitcoin and Ethereum, the ETP market for altcoins, on the other hand, showed quite remarkable weekly results.

According to the latest report from CoinShares, the standout performer in the field of crypto-oriented investment products was Solana (SOL). During the week, inflows into Solana ETPs literally skyrocketed 7,600%, from $100,000 to $7,600,000. This brings the year-to-date inflows to $39 million, considering that SOL-related investment products suffered $26.7 million in outflows during the month of August.

In terms of year-to-date performance, Solana is now in first place among digital assets, excluding BTC and ETH.

Solana ETF by 2025?

It is interesting to see what has served as a catalyst for investors to start looking at Solana-focused investment products.

One of the reasons may be the impending launch of full-fledged Solana ETFs. Yes, applications for Solana ETFs from VanEck and 21Shares did not pass the initial challenges from the SEC, so the 19b-4 filings were withdrawn.

As a result, many experts considered the chances of SOL ETFs being approved this year to be close to nil.

However, things could change quickly with the upcoming November elections, and it could be a "one step backward, two steps forward" situation.

In that case, it seems rational for ETP traders to participate in the massive outflows while sentiment is at its lowest. This is just speculation, and maybe those invested in SOL ETPs are just "like the stock."

Still, a 7,600% jump is something to keep an eye on, as there is rarely smoke without fire in these cases.