As Ethereum slows down, will Vitalik Buterin help ETH rise?

09/03/2024 00:00

Vitalik attempts to boost Ethereum engagement as the network continues to lose its dominant grip on the market, amid rising competition.

- Vitalik to the rescue as the Ethereum network experiences noteworthy slowdown.

- Address activity signals low demand for ETH as it continues to give up dominance.

Is the Ethereum [ETH] blockchain experiencing a slow phase? It appears so, as other networks like Solana [SOL] have partially succeeded in stealing its thunder in the last few months.

This outcome that may have prompted action from its founder Vitalik Buterin.

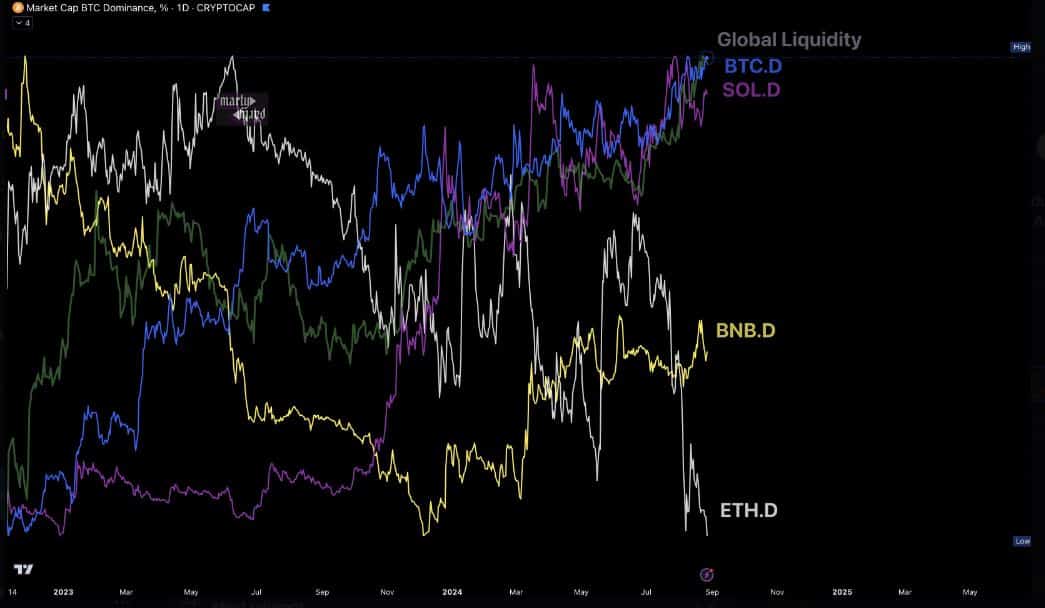

Recent data suggests that the Ethereum network has been experiencing a dominance decline. An outcome that has influenced money flow in favor of other networks such as Solana, Bitcoin [BTC], and the Binance Smart Chain.

Unsurprisingly, Vitalik recently demonstrated more engagement on the X (formerly Twitter) platform.

This was particularly evident since the last week of August, during which there was a spike in his posts, perhaps a move aimed at boosting activity in the network.

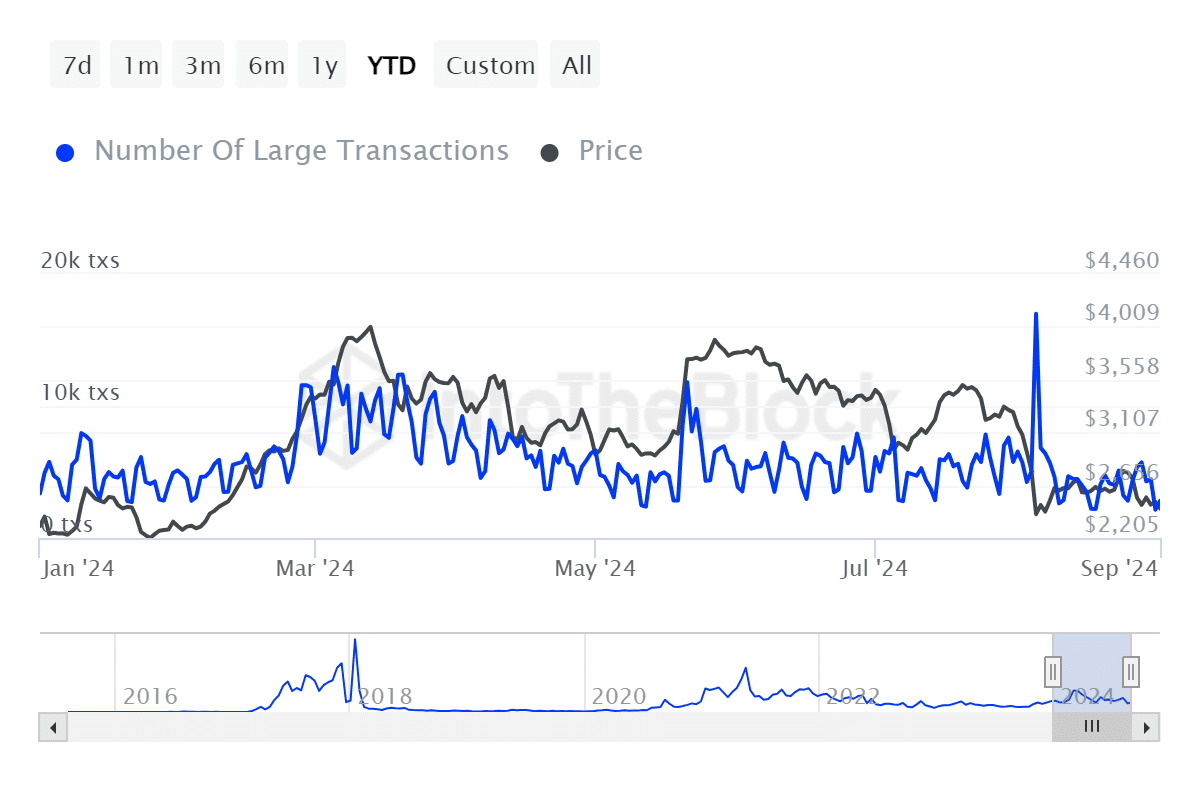

The Ethereum network’s declining popularity is evident in the number of large transactions. The network just concluded August with the lowest number of daily large transactions recorded since the start of 2015.

The number of large transactions clocked at 2,150 TXS, which is the lowest YTD figure that it has achieved so far. Note that these were transactions worth $100,000 and above.

Ethereum addresses show similar sentiments

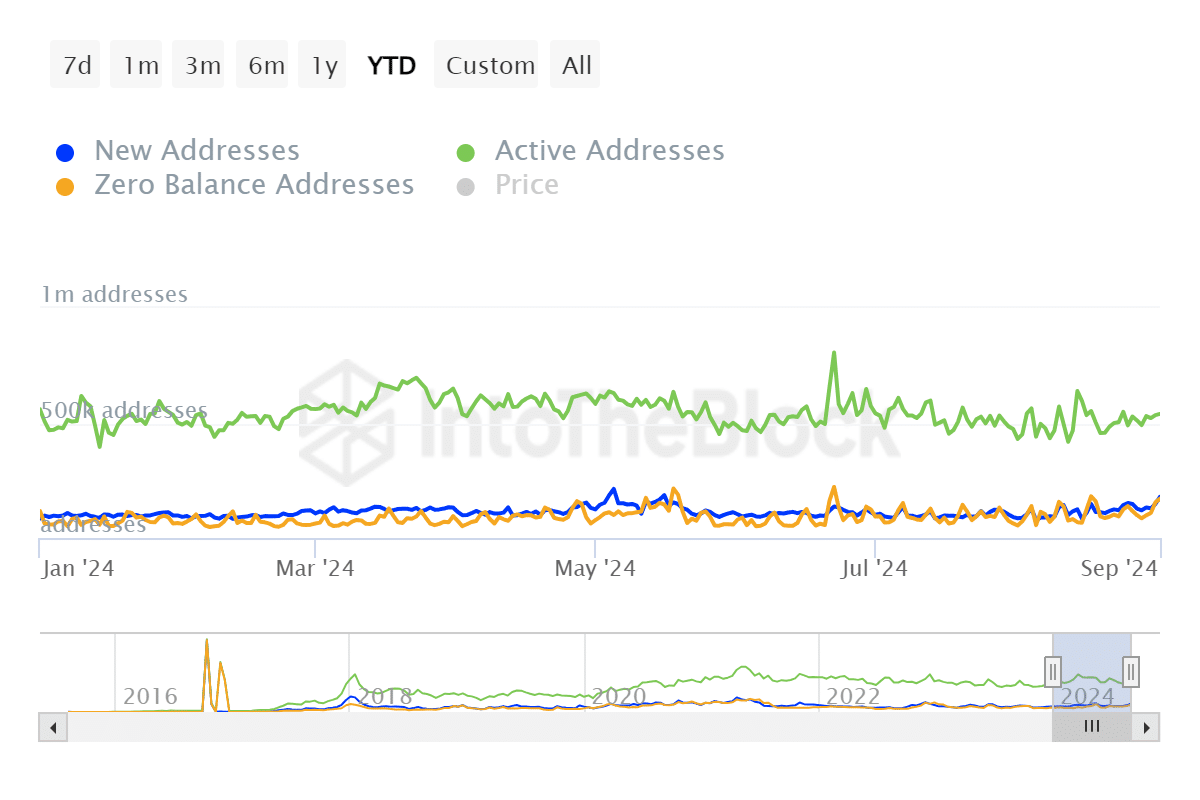

Address balances also painted an interesting picture. The number of zero balances opened September at the third-highest level in the last eight months.

This was after registering a spike since the 28th of August from roughly 85,000 addresses to over 171,000 addresses with zero balance — just over double the number of addresses in a span of three days.

The number of active addresses dropped considerably in between July and August. To put things into perspective, the Ethereum network achieved over 800,000 daily active addresses in July.

This was the highest recorded address activity in 2024. It has since retreated to 500,000 active addresses range as per the latest data.

Impact on ETH

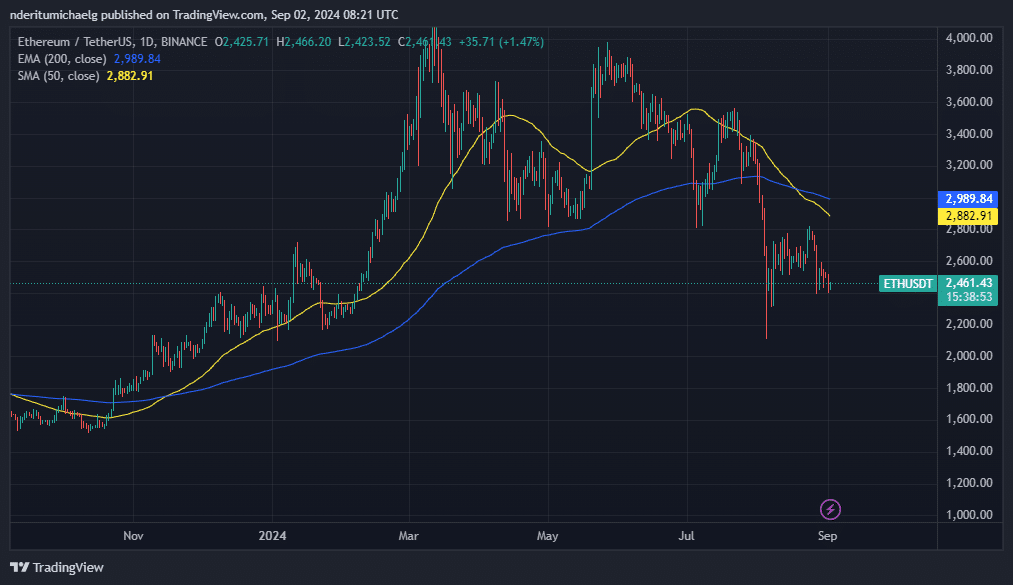

The declining excitement in the Ethereum network also reflected on ETH’s price action. The cryptocurrency has been in an accumulation zone or the last four weeks.

Read Ethereum’s [ETH] Price Prediction 2024–2025

However, it has notably struggled to maintain bullish momentum, especially after a death cross formation about two weeks ago.

ETH is currently within a previously tested support level, but the surge in zero-balance addresses signals a lack of bullish confidence. Whether it will bounce back from the same level remains to be seen.