Solana eyes $120: Will THIS be SOL’s price catalyst?

09/03/2024 08:00

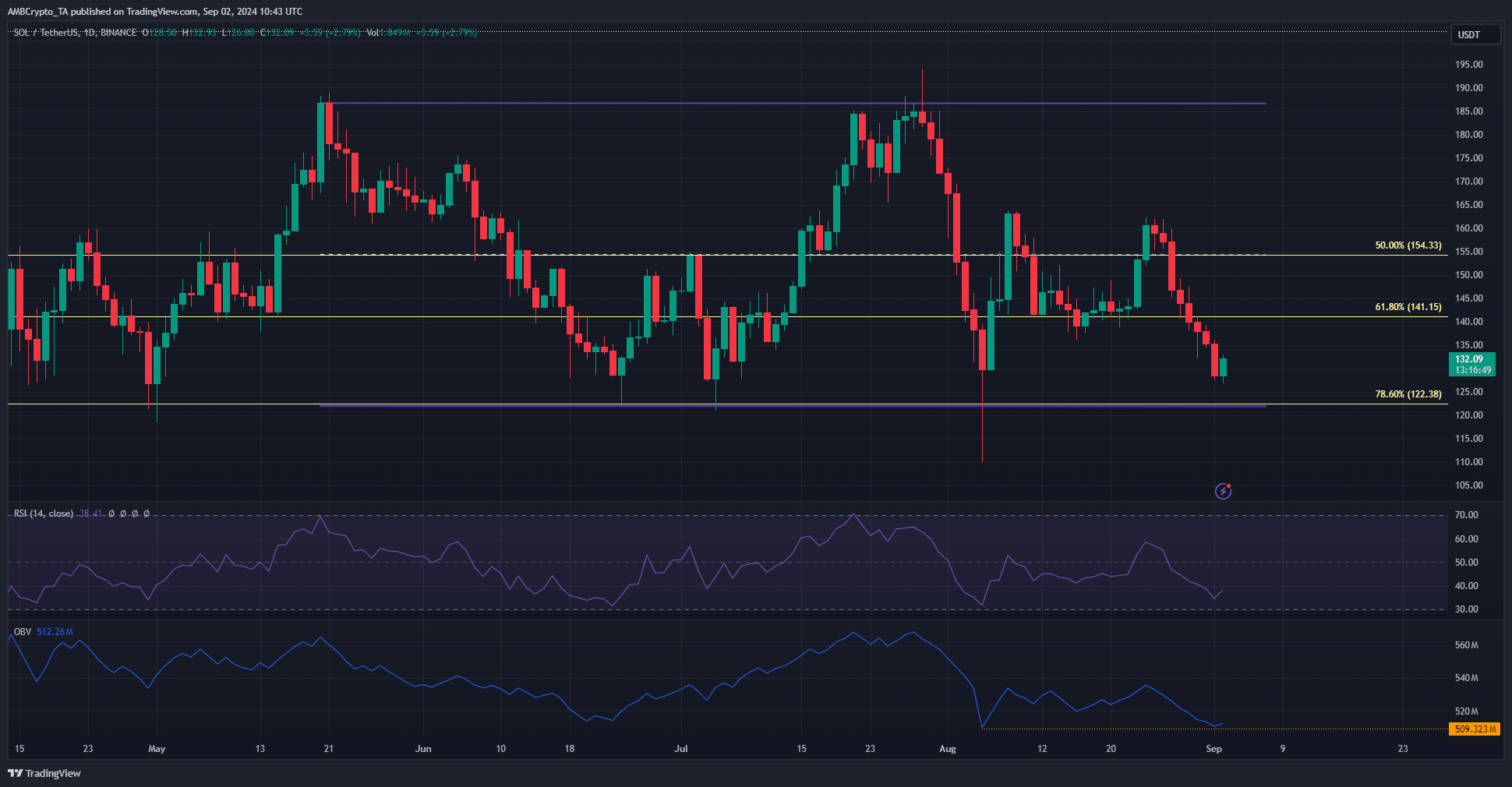

Solana has a bearish short-term outlook as momentum and selling pressure threaten to push prices toward the $120 support zone.

- A liquidity run for Bitcoin could spur Solana’s prices higher.

- The local highs at $160 was a strong magnetic zone.

Solana [SOL] was trading in a higher timeframe bear pennant, and analysts believed the prices would consolidate within a tight range over the next 4–6 weeks. This expectation appeared to be playing out.

Once again, the token was headed toward the range lows, but a short-term price bounce could be possible. A Bitcoin [BTC] liquidity run was anticipated in the short term and could aid the SOL bulls.

Solana falls toward the Fibonacci retracement level again

The range formation from $122-$187 was still in play, and the lows of the range were not yet breached. The OBV has been in a steady decline over the past ten days to indicate heavy selling pressure.

Solana had lost 21.7% from the 25th of August but has begun Monday well and was up by 2.58% at press time. Yet, the OBV being near the local lows was a worrying sign that SOL bulls lacked strength.

The RSI was also at 38 on the daily chart to indicate downward momentum was superior.

A revisit to the $120 region would likely present a buying opportunity, but traders and investors have to be careful. A much deeper price correction could be brewing.

Magnetic zones to pull prices higher?

The liquidation levels to the north at $140 and $150 could attract prices higher in the short term, especially if Bitcoin embarks on its liquidity run in the coming hours.

Realistic or not, here’s SOL’s market cap in BTC’s terms

However, this was no guarantee, and a small bunch of liquidation levels were also building up at $126.

This meant that Solana could see more volatility and another dip to $126 and possibly lower if the market-wide sentiment continues its bearish trend.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion