Quick Take

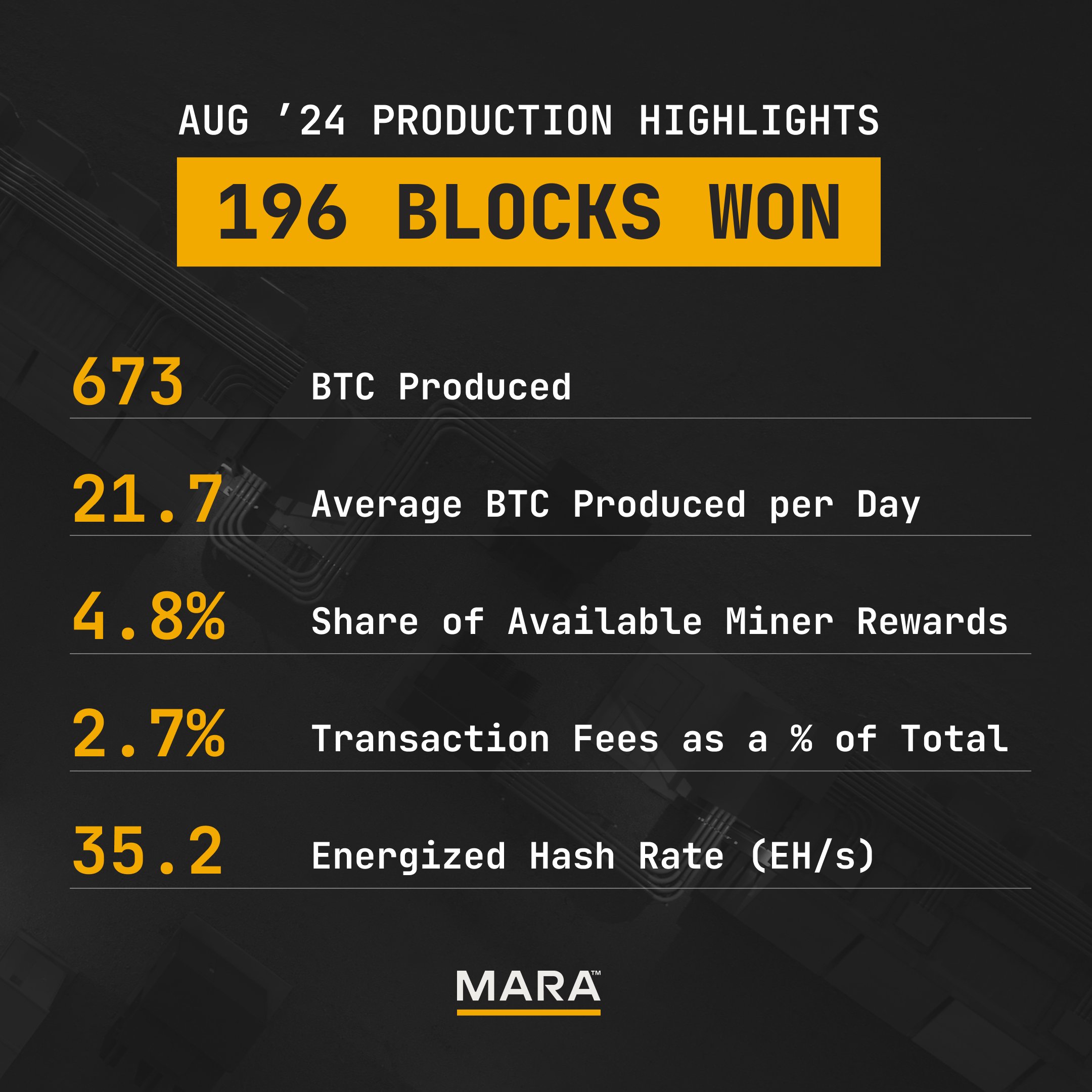

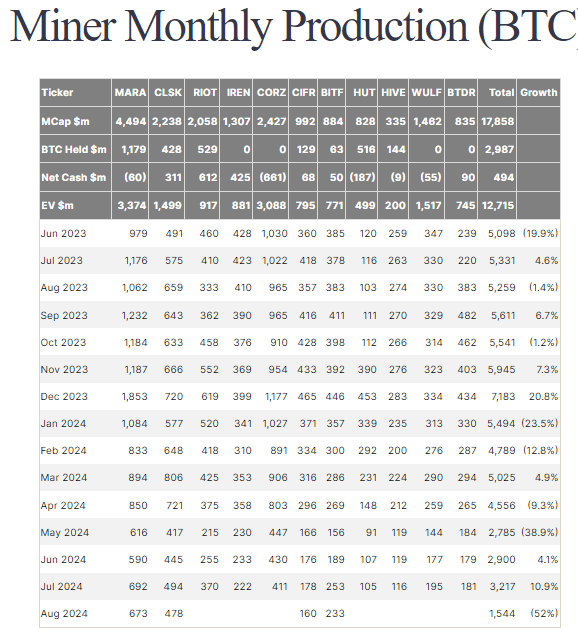

In August, several publicly traded Bitcoin mining companies reported monthly production, reflecting slight declines in production. Marathon Digital Holdings, the leading miner by market cap, produced 673 BTC, a 3% month-over-month (MoM) decrease, with 196 blocks mined, down by 2%.

Despite the lower production, the company reported an energized hash rate of 35.2 EH/s. Transaction fees accounted for 2.7% of Marathon’s total BTC earnings. CEO Fred Thiel remains optimistic, reaffirming the company’s goal to reach 50 EH/s by the end of 2024.

According to Marathon Digital Holdings, as of August 31, 2024, Marathon Digital Holdings held 25,945 unrestricted BTC, choosing not to sell any Bitcoin during August.

Farside data shows that other major miners also reported declines in August. CleanSpark mined 478 BTC, a 3% drop MoM, while Bitfarms produced 233 BTC, reflecting an 8% decline. Cipher Mining saw an 11% decrease, mining 160 BTC, and TeraWulf mined 184 BTC, down 6%.

The broader Bitcoin mining sector is facing downward pressure, as demonstrated by the performance of WGMI, an ETF tracking public mining companies, which is now down more than 9% year-to-date. This slowdown in production and the corresponding share price pressure highlights miners’ challenges amidst depressed BTC prices.