RENDER retraces gains, but stays above key $4.1 support – What’s next?

09/07/2024 12:00

Render has a strongly bearish bias in the short-term but according to technical analysis and on-chain metrics, a recovery was possible.

- RENDER’s price trend has been bearish in recent months.

- The retest of the $4.4 support zone could offer a buying opportunity.

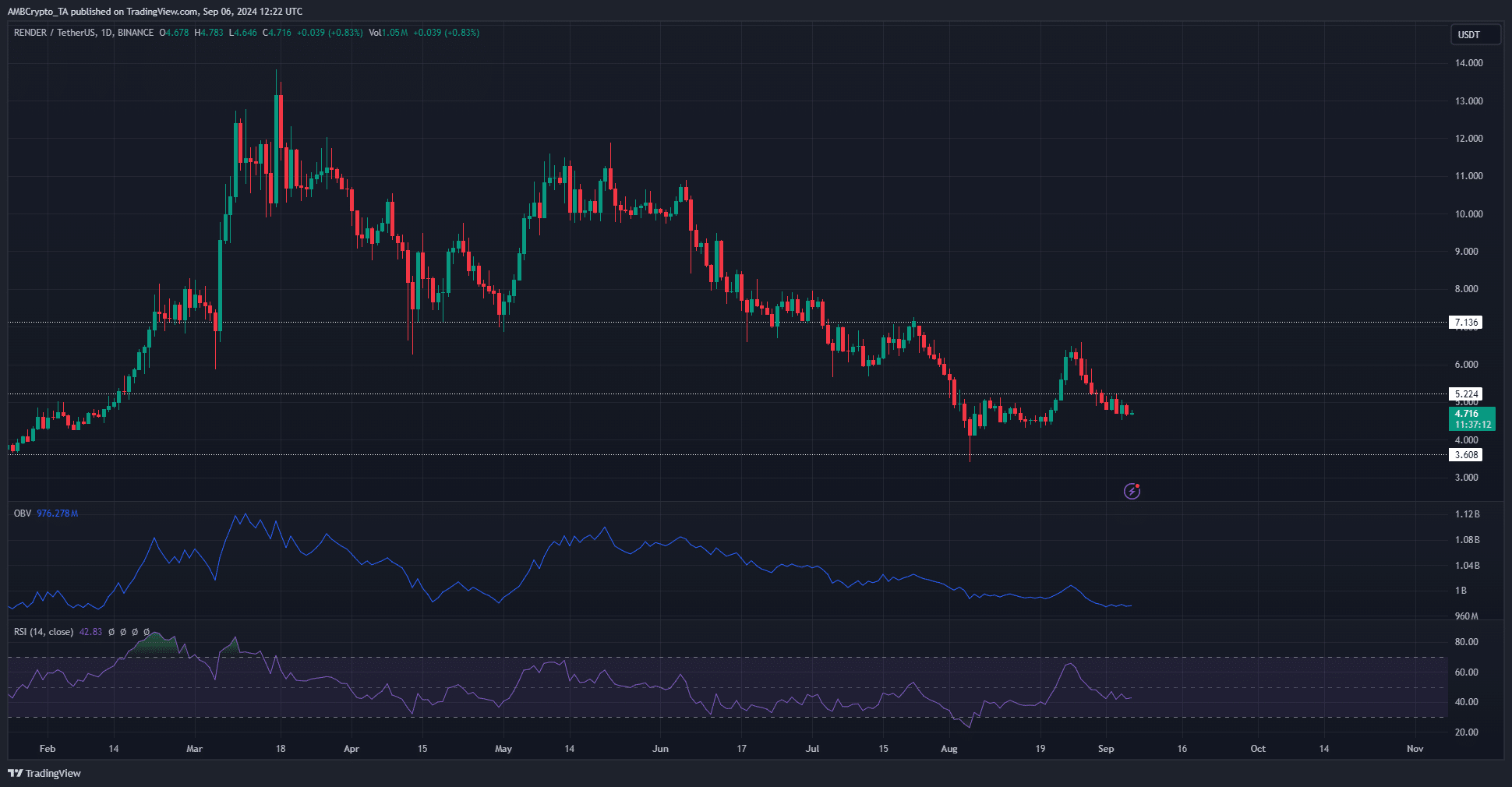

Render [RENDER] has retraced almost all the gains it made during the price bounce from the 21st to the 26th of August. It was trading at $4.716 at press time, close to the $4.1-$4.4 support zone.

The technical indicators had turned bullish during the price surge, but the buyers could not sustain the pressure. The OBV resumed its downtrend and the RSI also fell below neutral 50.

However, some on-chain metrics gave more positive signs.

Buying opportunity for RENDER

The daily active addresses have been in a downtrend since the surge in July. This was disappointing, as lowered network participation indicates reduced demand.

Yet, the mean coin age has been trending upward for the past six weeks.

The inference was network-wide accumulation. Moreover, the 30-day MVRV has fallen below zero to show short-term holders were at a minor loss.

Therefore, the token was undervalued but undergoing accumulation, presenting a good buying opportunity.

AMBCrypto found that over the past month, the longer-term holders have been increasing in number. Data from IntoTheBlock showed that holders and cruisers have increased, while the traders have decreased.

Implications for the price trends and market sentiment

The decline in active traders from the metric above meant that speculators and short-term holders were far less interested in holding onto the coin that is in a short-term downtrend.

The Open Interest in the derivatives market has also been on a slide in recent days, together showing short-term bearish sentiment.

Is your portfolio green? Check the Render Profit Calculator

The spot CVD has also been in a persistent downtrend. The lack of demand in the spot market agreed with the OBV’s evidence that buying pressure was weak.

Overall, though RENDER presented a buying opportunity, investors might want to wait for a drop into the $4.1-$4.4 zone before looking to enter.