BONK’s price can possibly hike by 30% – When, where, how can it happen?

09/07/2024 22:00

BONK may be gearing up for a significant 30% rally due to its bullish on-chain metrics and potential descending trendline breakout...

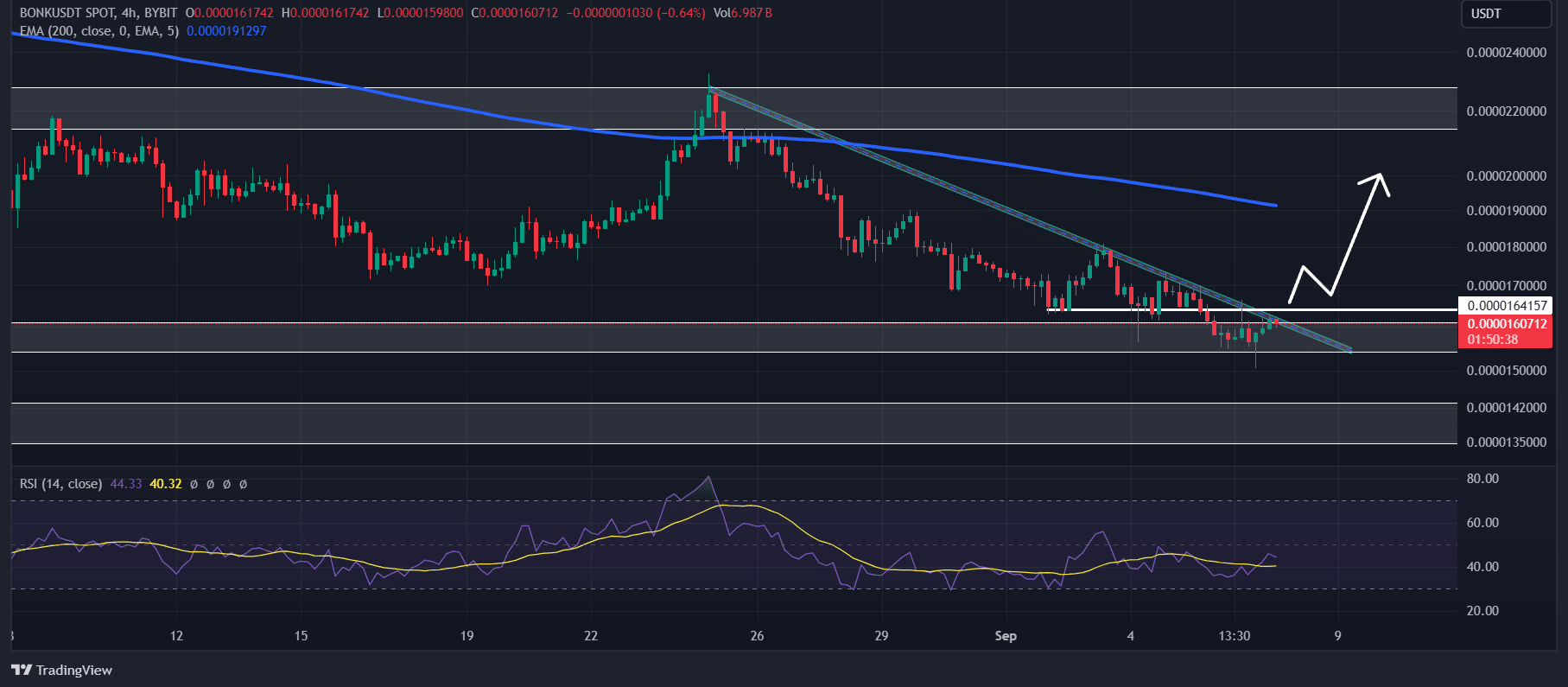

- BONK could soar by 30% to the $0.000021-level if it closes a four-hour candle above $0.0000165

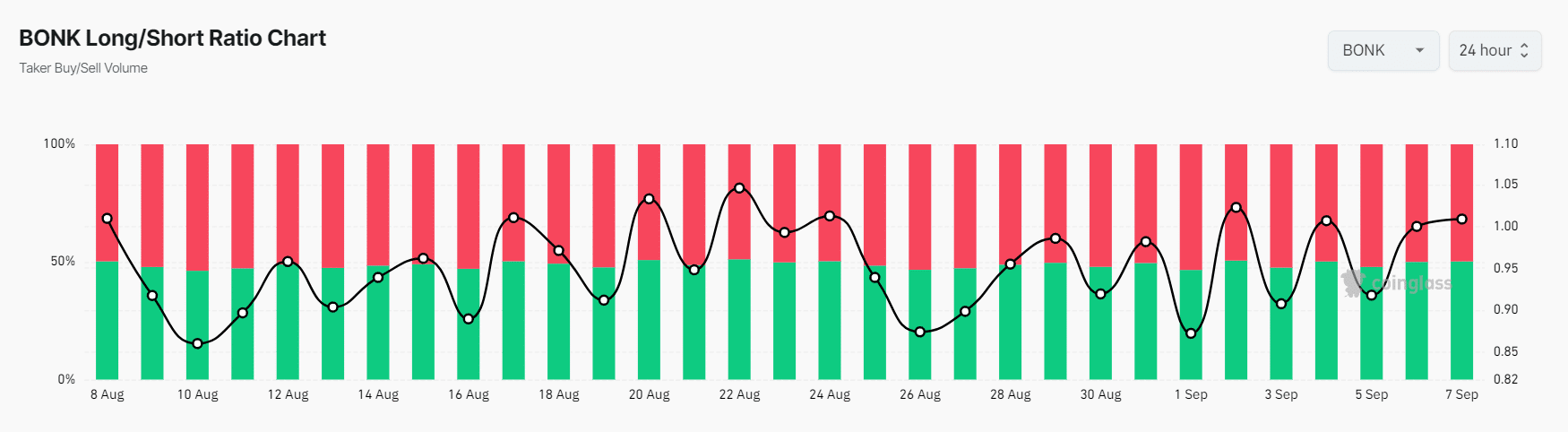

- Coinglass’s BONK long/short ratio suggested that traders’ sentiments have been bullish

BONK, the popular Solana-based memecoin is poised for a significant price surge due to its bullish on-chain metrics and potential breakout. In fact, despite the ongoing bearish market sentiment, BONK has outperformed top cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

BONK’s price performance

At press time, BONK was trading near the $0.0000161-level, following a hike of over 2.5% in the last 24 hours. Meanwhile, its trading volume increased by 46% over the same period. This pointed to higher participation from traders.

Technical analysis and upcoming levels

A look at the memecoin’s charts revealed that BONK seemed to be trading near the crucial support level of $0.0000155. It was trading below the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating a downtrend.

However, there’s a chance for a bullish move here. On the four-hour timeframe, BONK may be on the verge of breaking out from a descending trendline. If it breaks out and closes a candle above $0.0000165, there is a high possibility it could soar by 30% to $0.000021 in the coming days.

BONK’s Relative Strength Index (RSI) supported this bullish outlook as it was in oversold territory, potentially indicating a bullish reversal.

However, this bullish thesis will only work if BONK closes a candle above the $0.0000165 level. On the other hand, if it fails to break this level and falls below $0.0000152, there is a high chance it could turn bearish and drop by 12% to $0.0000134.

On-chain metrics signal bullish sentiment

Coinglass’s BONK long/short ratio suggested that traders’ sentiments have been bullish. At the time of writing, the ratio had a value of 1.0264 (A value above 1 signals bullish sentiment).

Additionally, BONK’s Futures Open Interest has been continuously rising. In the last 24 hours, for instance, it climbed by 11%.

A hike in Open Interest and a long/short ratio above 1 are potential buying signals and, traders often follow this combination to bet on trades in either direction.

At press time, 51.05% of top traders held long positions while 48.98% held short positions.