Thousands of Bitcoin Leave Binance in Mysterious Bull Whale Activity

09/09/2024 18:31

Big players just bought $157 million in Bitcoin: Are they predicting comeback?

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

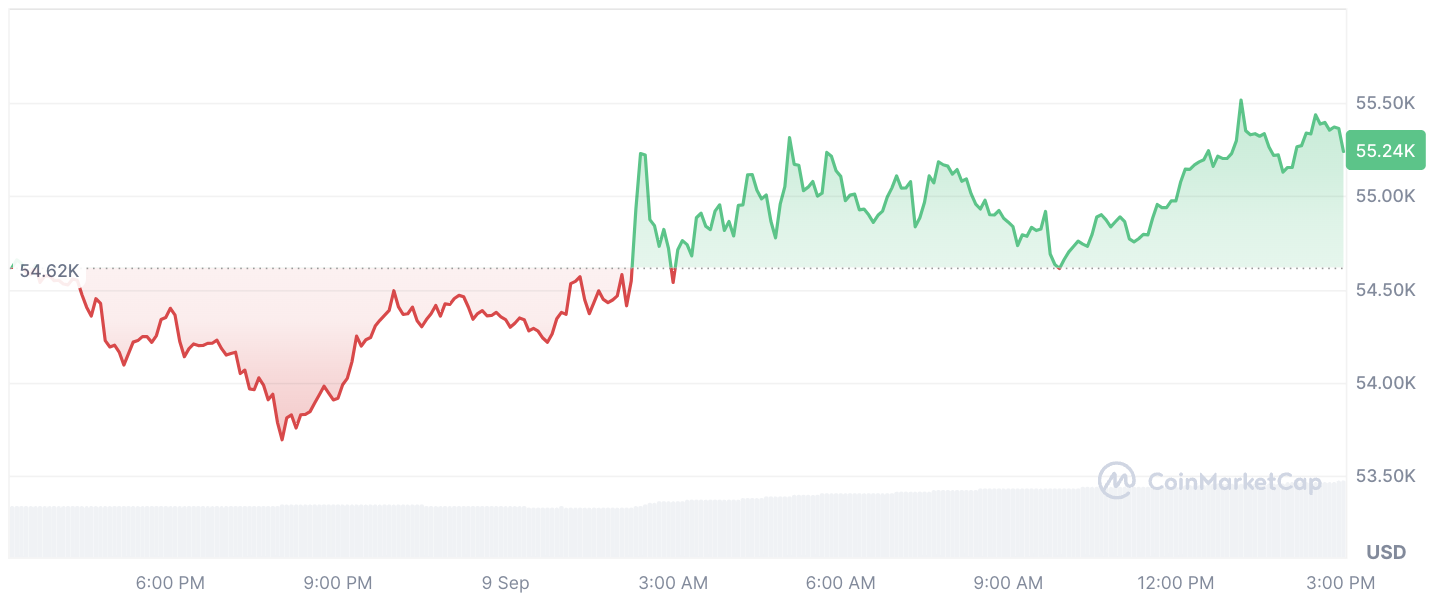

Lookonchain reports that there has been a big increase in Bitcoin (BTC) following a major drop in the market last week. Starting on Sept. 1, three big players in the crypto space collectively amassed a whopping 2,814 BTC, which is equivalent to $157.3 million.

They pulled these funds from Binance at an average purchase price of $55,887 per Bitcoin, which has caught the attention of market watchers, particularly given the pace and timing of these accumulations.

What is interesting is that these three wallets — labeled "bc1qg," "bc1qd," and "36LMb" — have only been around for about a week. Right now, they have a combined total of 2,814 BTC, split across the wallets. The largest wallet has 1,381 BTC, which is worth about $76.28 million. The others have 433 BTC and 1,000 BTC, which are worth about $23.92 million and $55.24 million, respectively.

— Lookonchain (@lookonchain) September 9, 2024Whales are accumulating $BTC after the market drop!

Since Sept 1, 3 whales have accumulated ~2,814 $BTC($157.3M) from #Binance at an average price of $55,887.

Address: bc1qg32kay34ma85prkvxwtx3gxlm9w5yaeffz8djs bc1qd565stuuglgze8lmegv29662357meetprgjlx4… pic.twitter.com/cnivyiqAlR

What makes this even more interesting is what is going on behind the scenes. Bitcoin had dropped 12% from its weekly high, falling to $52,550, which had a knock-on effect on the whole cryptocurrency market. This resulted in a nearly 4% contraction in overall market capitalization, which equates to about $73 billion lost.

What's next?

Despite the pessimism, the market narrative shifted as Bitcoin rebounded slightly to $55,350 just days after the decline. This makes one wonder: is this just a short-lived "dead cat bounce," or could it be the first sign of a renewed bull market, given these significant whale purchases?

Even though there is still a lot of uncertainty, it is worth keeping an eye on what these new crypto wallets are up to. They have made some big purchases even though the market is down. This shows that some big players are willing to bet on Bitcoin's resilience - at least for now.