Bitcoin at $56K – Here’s what can trigger BTC’s next bull run

09/11/2024 23:00

BTC bulls defied bearish odds, triggering a short-squeeze. How could a bearish pullback be the next key to a bull rally?

- Bitcoin bulls defied bearish odds, triggering a short-squeeze.

- However, the surge lacked momentum, leaving room for the next “dip” to spark renewed hope.

Bitcoin [BTC] kicked off the second week of September with bullish momentum, defying bearish expectations and closing above $57K. However, the rally was short-lived, with BTC trading at $56,407 at the time of writing.

Surprisingly, the drop followed a surge in long positions, raising speculation of a short-squeeze-driven hype.

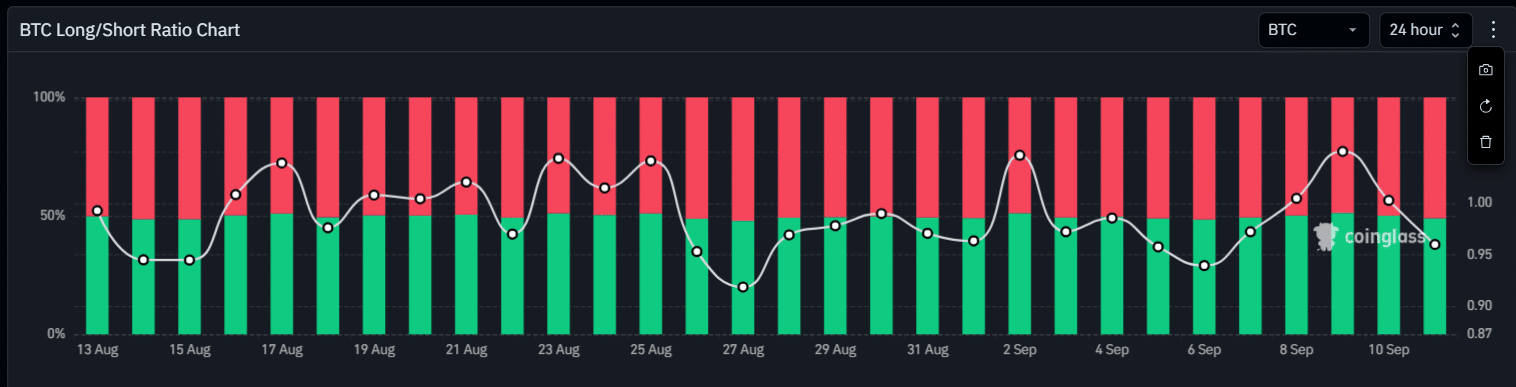

As anticipated, longs outperformed shorts, remaining confident in an impending reversal.

Additionally, a surge in Futures traders going long has aligned with the price rise. For instance, during the mid-August rally to $64K, longs consistently prevailed, keeping shorts at bay.

However, since then, the ratio has become more erratic, keeping the price consolidated below $60K. The $56K support is now crucial. If market shorting intensifies, the chances of a rebound may falter.

LTH confidence alone may not suffice

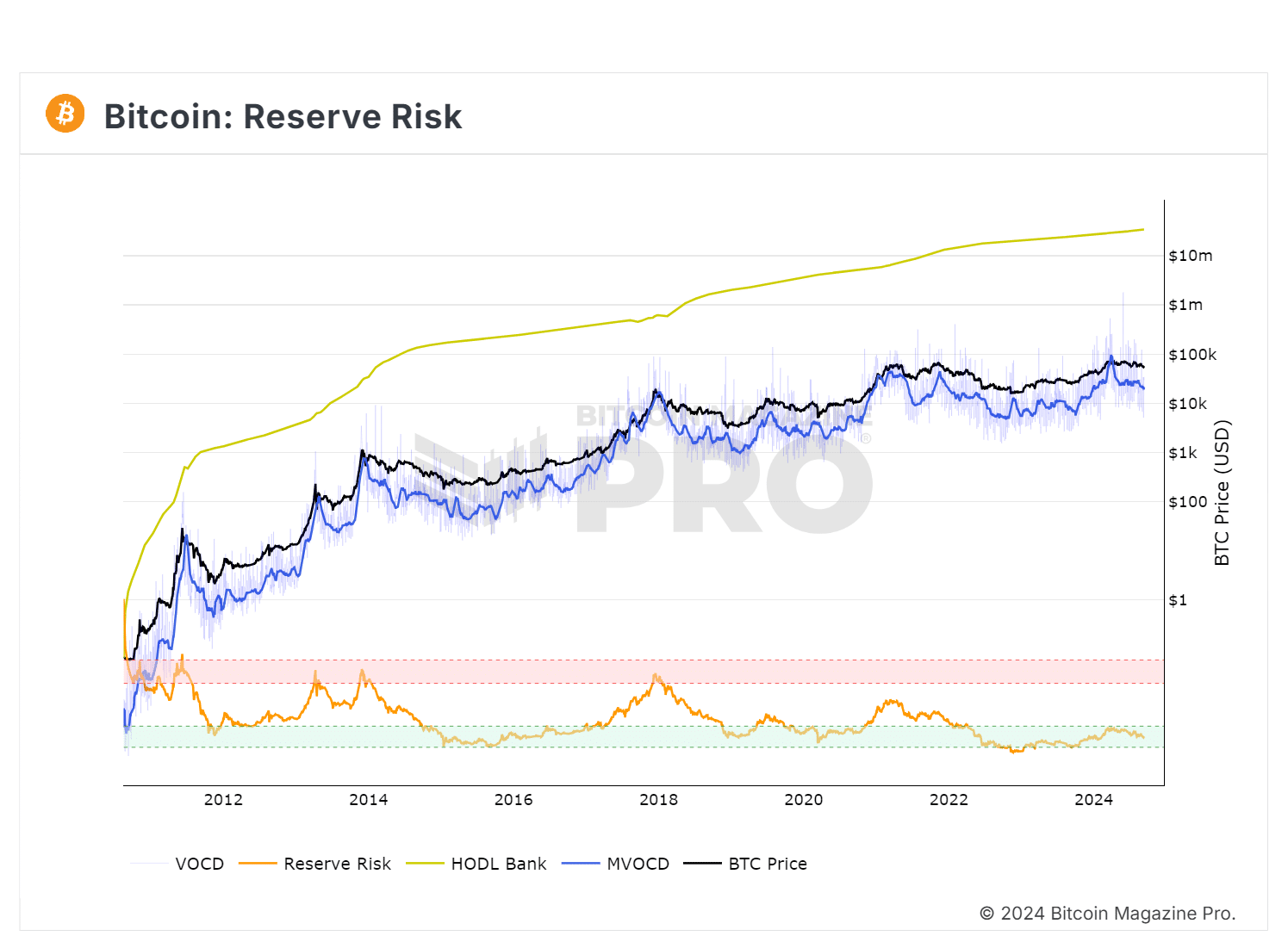

Reserve risk indicated long-term holders are confident relative to Bitcoin’s price. Investing during green zone periods has historically yielded outsized returns.

Moreover, when confidence is high and price is low, then there is an attractive risk/reward to invest in Bitcoin at that time.

Put simply, investors monitor LTH activity to gauge market sentiment. If this sentiment shows optimism, it may attract more traders.

However, despite this, short-term holder’s lack of confidence, evidenced by the $850 million BTC sell-off, reinforces AMBCrypto’s short-squeeze analogy.

In short, with the market slipping into high fear, where is the price likely to settle?

Identifying BTC’s price bottom

As mentioned earlier, holding the $56K range is crucial. Monitoring this level closely will indicate BTC’s next direction.

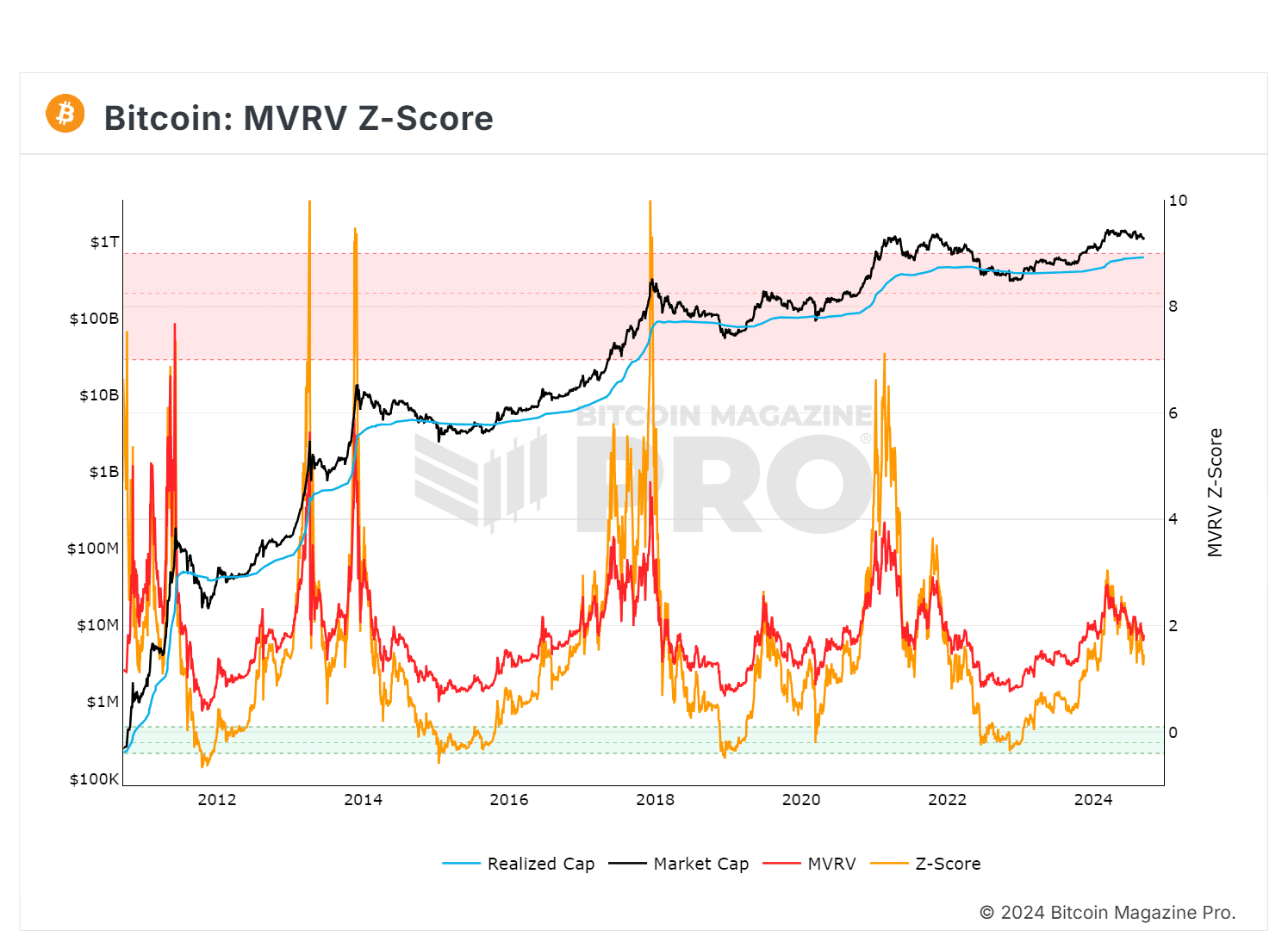

An MVRV ratio of 1.8 shows Bitcoin’s market value is 1.8x its realized value, indicating average holder profit. If realized, this could create selling pressure.

Hence, a market top is unlikely unless a Fed rate cut weakens the Dollar index, prompting an outright bull momentum.

However, a price bottom, occurring when market value falls below realized value, could signal capitulation and set up the next cycle.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

According to AMBCrypto, BTC is likely to dip to around $40K before a potential reversal, with a bearish pullback needed for a rebound.

Without this, consolidation could continue.