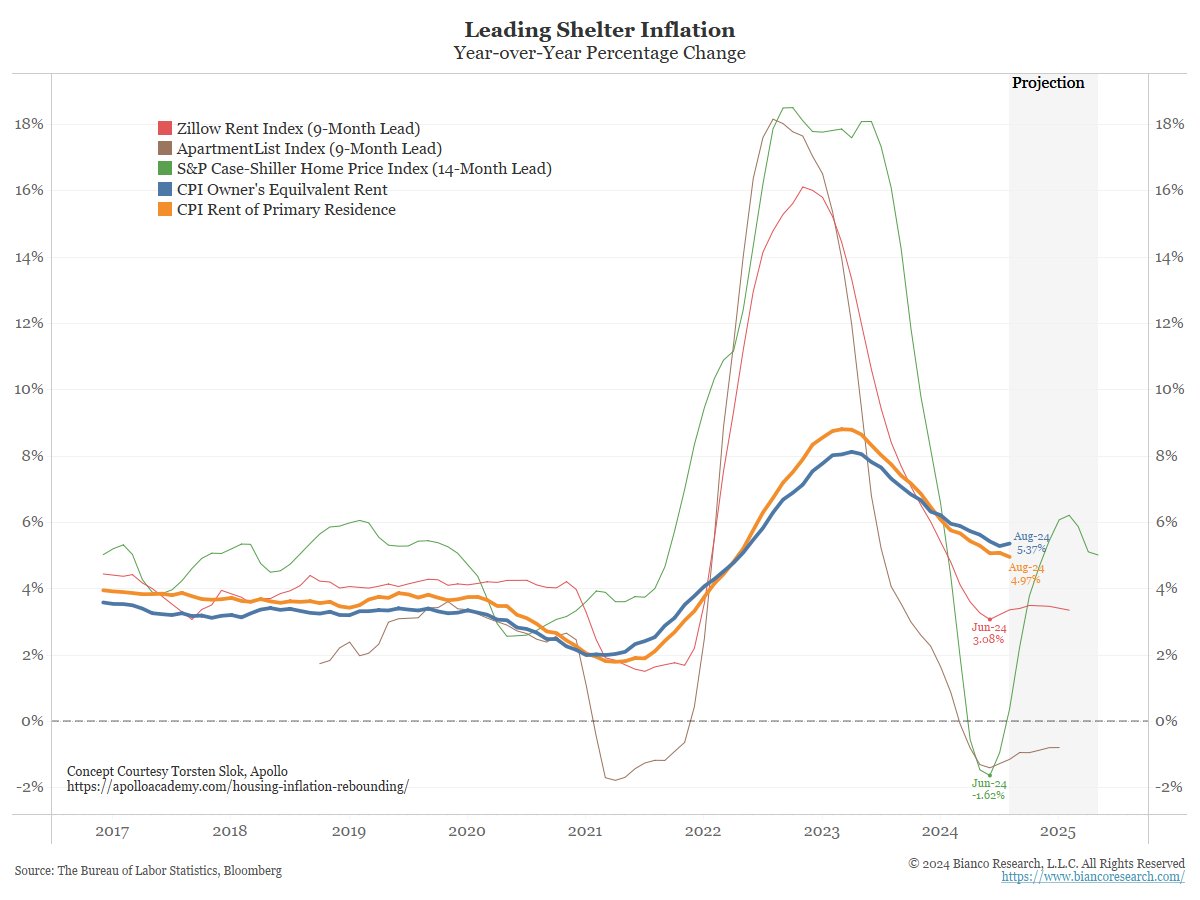

Owners’ Equivalent Rent (OER), which makes up about 27% of the Consumer Price Index (CPI), increased by 0.49% in August 2024, the most significant rise since January. This pushed the year-over-year figure to 5.37%. This marked the first uptick in OER since its peak of 8.13% in April 2023.

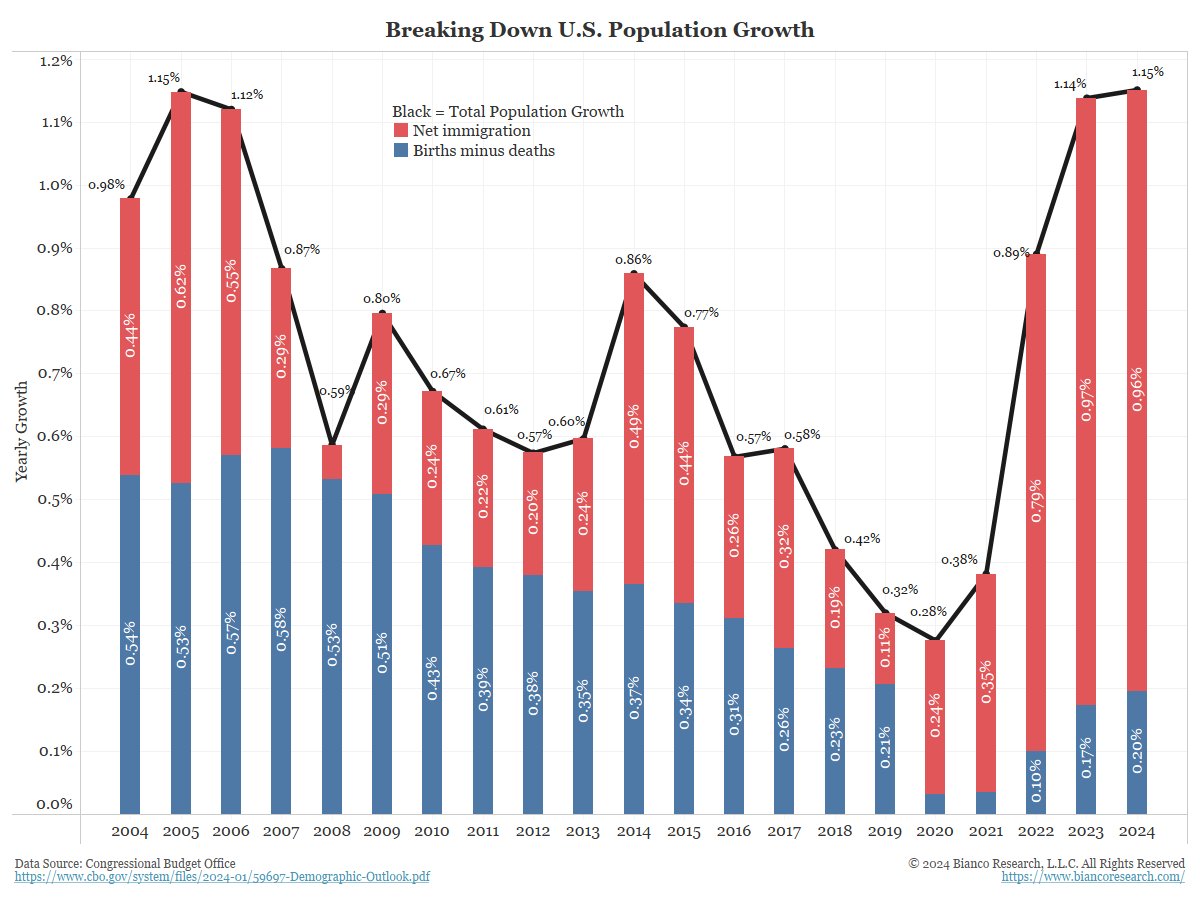

However, Jim Bianco from Bianco Research points out that US population growth has surged, adding between 7 to 15 million people since 2020. This unexpected rise in population has increased the demand for housing, which could contribute to persistent shelter inflation.

The recent shift suggests that OER is, therefore, beginning to reflect trends in leading housing indicators, such as Zillow’s Rent Index and the S&P Case-Shiller Home Price Index, which started rising 9 to 14 months ago.

Bianco notes the predictive power of OER for core inflation metrics. The data signals potential sustained upward pressure on shelter costs, a key inflation component, suggesting that the broader inflation outlook may remain elevated in the near term. Yet, understanding the context of how the numbers are formulated is essential.

Starting in 2023, the Bureau of Labor Statistics (BLS) began updating the CPI spending weights annually rather than every two years, as was done previously. Before the 1980s, the weights were updated approximately once per decade. The most recent weight update occurred in January 2023, reflecting consumer spending patterns from 2021.

Therefore, potential updates to core inflation calculations to accommodate for current population levels could take years to come into effect, if at all.

Analysts monitoring inflation data should factor in these demographic shifts and housing market trends, as they are crucial for understanding ongoing pressures on core CPI.

Those who look to Bitcoin as an inflation hedge should assess how the increasing population could impact their investing strategies.