Justin Sun Calls Coinbase’s cbBTC "A Dark Day For Bitcoin"

09/13/2024 18:16

Justin Sun slams Coinbase’s cbBTC as a threat to Bitcoin and DeFi. Meanwhile, MakerDAO may remove WBTC from its platform.

Tron founder Justin Sun slammed the recently launched cbBTC, Coinbase’s Bitcoin wrapper offering, saying it is the beginning of a dark age for the pioneer cryptocurrency.

Coinbase launched the cbBTC in response to issues surrounding BitGo’s Wrapped Bitcoin (WBTC). It is available on Ethereum and Coinbase’s Base network and can be used in various decentralized finance (DeFi) platforms.

Justin Sun Slams Coinbase cbBTC

According to Justin Sun, cbBTC marks “a dark day for Bitcoin,” fronting risks to DeFi because of centralized issues relating to Coinbase.

“cbBTC lacks Proof of Reserve, no audits, and can freeze anyone’s balance anytime. Essentially, it is just ‘trust me.’ Any US government subpoena could seize all your BTC. There is no better representation of central bank Bitcoin than this. It’s a dark day for BTC,” Sun wrote.

One wouldn’t expect Justin Sun to support cbBTC, as it threatens WBTC’s market share. This comes after BitGo’s partnership with Hong Kong-based BiT Global, which effectively links WBTC to Sun. An X user challenged Sun’s concerns, highlighting that similar decentralization risks exist on Sun’s Tron blockchain.

“How is Tron any different? You constantly mint WBTC / USDT with no reserves. The Chinese government owns you,” the user said.

Read more: What Is Bitcoin? A Guide to the Original Cryptocurrency

Justin Sun’s involvement with BitGo’s WBTC sparked controversy due to his past issues with operational practices and transparency. This led to increased interest in alternatives, such as 21shares’ Bitcoin wrapper, 21BTC. However, Coinbase’s cbBTC has emerged as the next frontrunner in the space.

“cbBTC was inevitable and super strategic to Coinbase. Frankly, I am surprised they did not ship it years ago. Predictions: – 0 fees on mint/redeem – 0 fees to withdraw to Base – Passes WBTC in supply within 6 months of launch (unless acquisition falls through),” venture capitalist Dan Elitzer said recently.

These comments follow Coinbase’s launch of its Bitcoin wrapper on Thursday, advertised as an ERC-20 token backed 1:1 by Bitcoin. The token is currently supported on Base and Ethereum, with plans to expand to more chains. Coinbase introduced cbBTC as part of its ongoing effort to increase economic freedom.

“As the oldest and most widely held crypto asset, Bitcoin plays an important role in onboarding users to crypto. Coinbase has been increasing utility for Bitcoin, first through the integration of the Lightning Network to drive instant low-cost payments, and now with cbBTC. Starting today, millions of Coinbase customers can seamlessly and securely access financial apps within the Ethereum ecosystem using Bitcoin they already hold,” Coinbase told BeInCrypto.

According to the announcement, cbBTC will provide access to secure and deep liquidity and enable users to do more with Bitcoin on-chain. Coinbase warned users to remain vigilant of bad actors purporting to be cbBTC.

MakerDAO to Vote On Abandoning WBTC

As BeInCrypto previously reported, MakerDAO (now Sky) was one of the aggrieved parties in BitGo’s new multi-jurisdictional and multi-institutional custody model. The DeFi platform has been exploring potential risks associated with BitGo’s new WBTC custody strategy.

“Maker is planning to offboard WBTC due to the change in custody from BitGo,” DeFi dashboard builder at DefiLlama said at the time.

A governance report shared on Thursday revealed that Sky is planning to vote on removing WBTC from its ecosystem, largely due to concerns surrounding Justin Sun’s involvement. This decision could have major implications for the DeFi space, as the lender currently has up to $200 million in loans collateralized by WBTC.

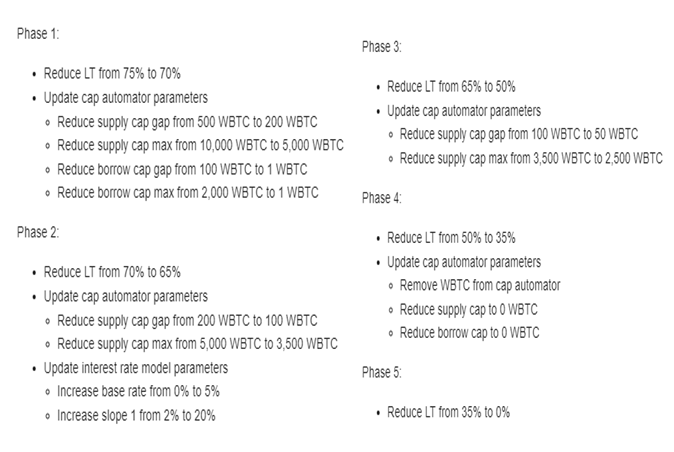

Aware of the potential risks, BA Labs, a DeFi risk management firm and key participant in Sky protocol’s governance, proposed a cautious approach to removing WBTC exposure from collateral assets. The firm outlined a gradual five-step process, with the first phase set for September 26, pending a vote.

Read more: Wrapped Bitcoin (WBTC) Price Prediction 2024, 2025, 2026, 2027, 2028

If the proposal passes, more wrapped Bitcoin alternatives, such as dlcBTC, tBTC, and FBTC, among others, could join the platform based on BA Labs’ recommendations.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.