Ethereum’s latest downtrend – Examining how weak ETH really is against BTC

09/14/2024 03:00

Ethereum (ETH), at press time, seemed to be showing some weakness against Bitcoin (BTC), with the ETH/BTC price action chart...

- Ethereum’s bullish divergence has been invalidated

- Institutions are now selling ETH, with trading volume decreasing too

Ethereum (ETH), at press time, seemed to be showing some weakness against Bitcoin (BTC), with the ETH/BTC price action chart deep in the red. In fact, the bullish divergence for ETH looked invalidated as it approached the 0.04 BTC level.

If Bitcoin continues to gain momentum towards the $61k-$62k range after reclaiming $57k, ETH can be expected to drop further.

Currently, ETH lacks a solid support level, and traders will need to wait for better market conditions before any significant rebound. Now, the ongoing inflows might help ETH regain stability. However, for now, it remains weaker than Bitcoin.

The ETH/BTC Relative Strength Index (RSI) highlighted this divergence, with the price action declining while the RSI formed higher lows – A sign of a potential reversal.

The decreasing volume also signals that ETH may soon dip below the 0.04 BTC level. If Bitcoin weakens, this could present a chance for ETH to reverse. Until confirmed otherwise though, the bearish trend for ETH will remain the most likely scenario.

Global institutions are selling ETH

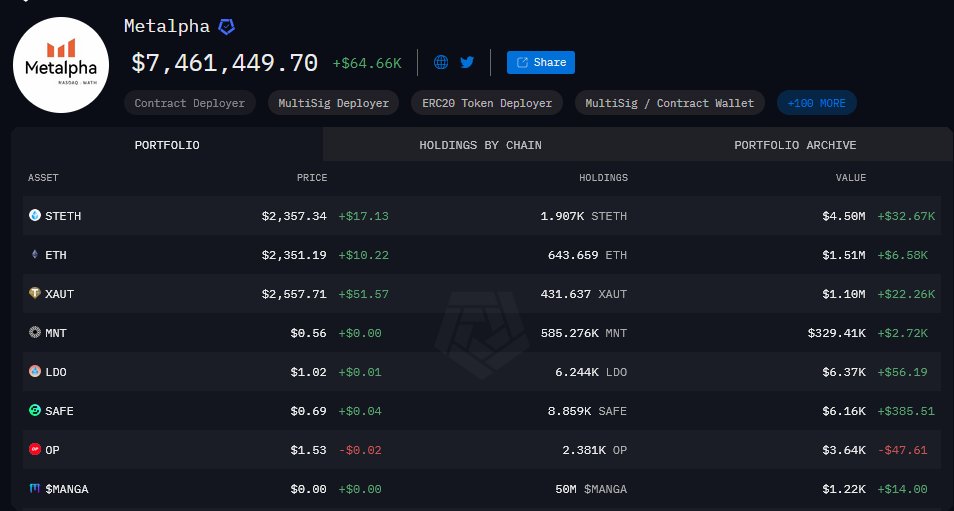

That’s not all though, with major global institutions now selling off their Ethereum holdings, as per Lookonchain on X.

For instance, Metalpha recently deposited 6,999 ETH, valued at $16.4 million, into Binance, contributing to their total deposits of 62,588 ETH worth $145.1 million over the last six days.

Their remaining ETH holdings now stand at just 23.5k ETH, worth $55 million. Metalpha has also liquidated its Layer 2 tokens such as Optimism (OP), while also reducing its staked ETH (stETH) holdings to 1,907 stETH.

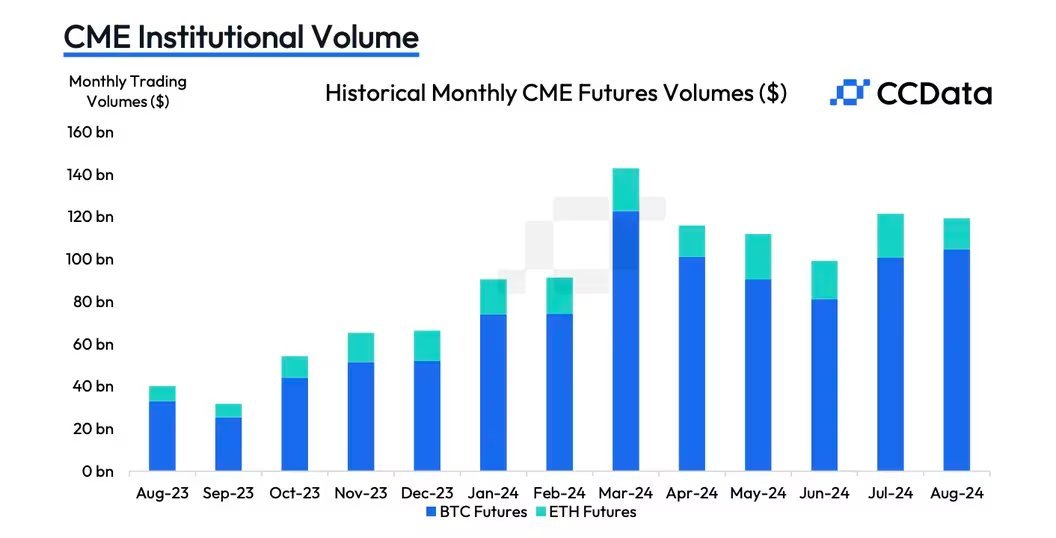

Ethereum CME trading volume

Additionally, ETH is likely to remain weak against BTC due to declining Futures trading volume on the Chicago Mercantile Exchange (CME). In fact, it fell by 28.7% to $14.8 billion in August, marking its lowest level since 2023.

Year-to-date, ETH’s price is also negative, with its exchange-traded funds (ETFs) having recorded negative net cumulative flows. The Ethereum Foundation is also selling ETH, adding further pressure on the price.

This means that ETH may continue to decline before potentially rebounding, possibly in Q4 2024.

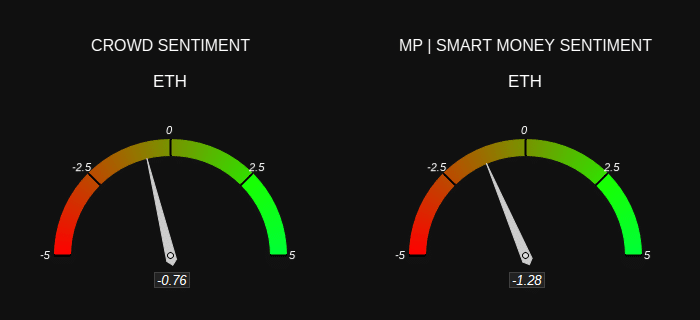

Crowd and smart money sentiment

Finally, crowd and smart money sentiment also indicated bearishness for ETH. Both retail traders and institutional investors agree that ETH remains bearish in the current market environment.

This alignment between small and large players suggests that Ethereum’s downtrend may persist until market dynamics shift or a significant catalyst emerges to support a price recovery.

Hence, ETH is expected to remain weak against Bitcoin. Especially until broader crypto market conditions improve.