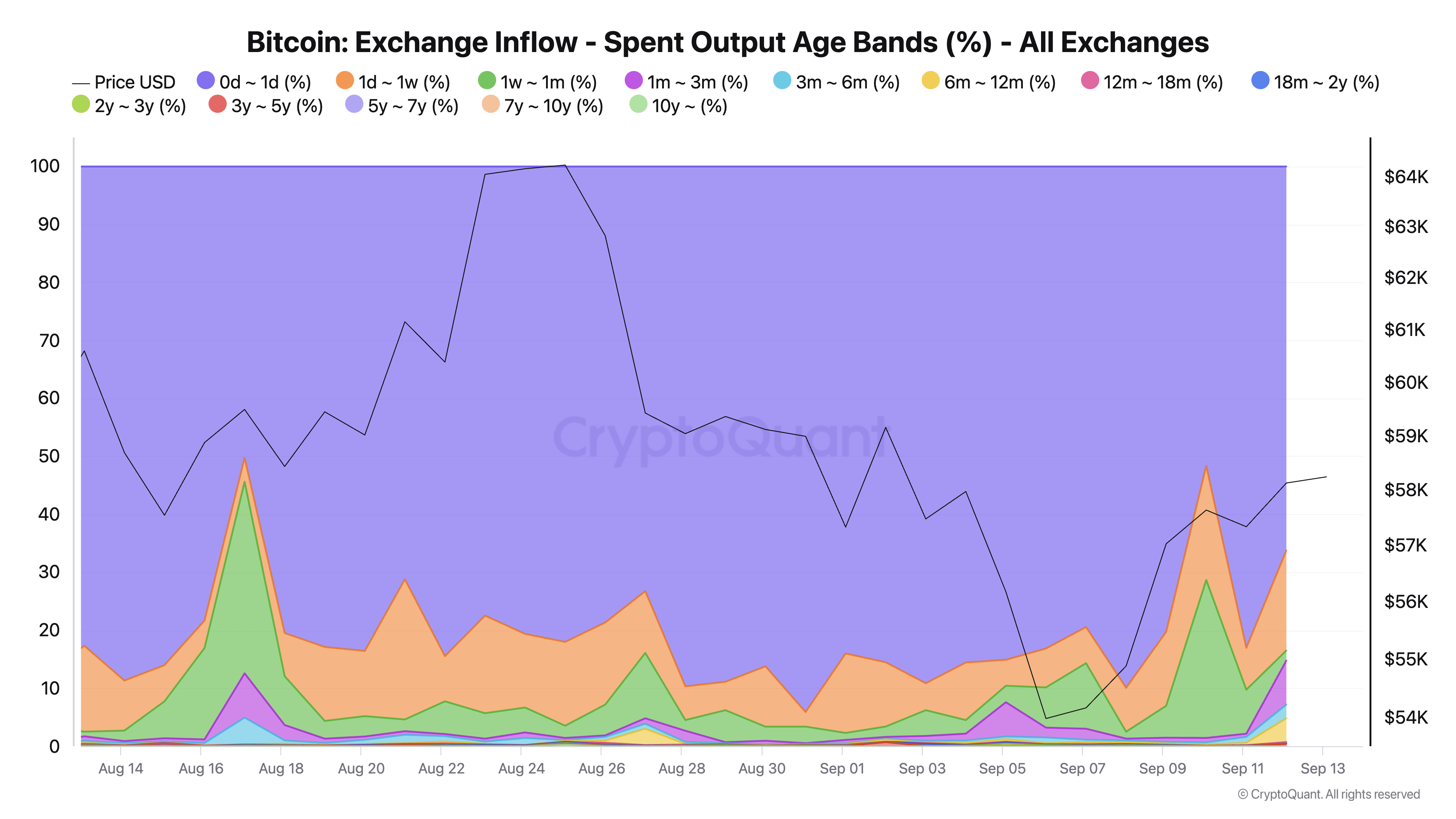

In the past month, the majority of Bitcoin exchange inflows have come from short-term holders, based on CryptoQuant data.

According to the data, addresses that held BTC for less than three months made up over 92% of the total exchange inflows on Sep. 12. Over 83% of exchange inflows came from coins held for less than a week.

This distribution of inflow age bands shows the dominance of speculative traders looking to capitalize on short-term price movements. This behavior is typical in a volatile market. When Bitcoin experiences rallies, these short-term holders are the first to sell, contributing to significant price fluctuations.

However, there has also been a notable increase in exchange inflows from long-term holders — those who have held their coins for over three months. The increase in inflows from coins held for over three months — up from 0.55% on Sep. 11 to 7.59% on Sep. 12 — suggests that some long-term holders are also beginning to take profits. While short-term traders dominate inflows, the slight uptick in long-term selling reflects growing caution among investors who may see current price levels as an opportunity to exit.

Despite this uptick in long-term inflows, the overall volume from long-term holders remains relatively low. It indicates that most long-term investors continue to hold, reflecting underlying confidence in Bitcoin’s long-term potential. Their reluctance to sell in large volumes suggests they see current price levels as a healthy part of Bitcoin’s broader market cycle.

The trend is clear: short-term traders are driving the majority of the inflows and subsequent volatility, while long-term holders are making calculated decisions to sell selectively.