$100 Million Bitcoin Mystery Stuns Top Exchange in 24 Hours

09/15/2024 23:39

Mysterious $100 million Bitcoin withdrawal exposes anonymous large buyer

Although Saturday and Sunday are traditionally days off for the traditional financial markets, the crypto world never sleeps, especially on the weekends. Thus, the last 24 hours were once again accompanied by a series of events on the market and behind the scenes — in the on-chain realm.

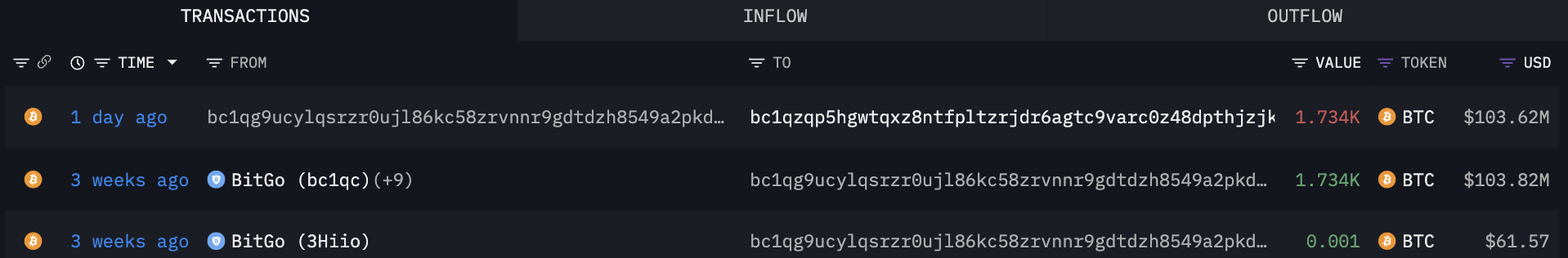

One of these events was a sudden withdrawal of over 1,734 BTC, equivalent to about $103.62 million, from the top exchange BitGo to the unknown wallet "bc1qzqp5." The latter is a completely new entity and had no transaction history before, according to Arkham Intelligence data.

Now, this unknown anonymous whale owns a seven-figure stash of Bitcoin. Interestingly, before the cryptocurrency hit this wallet, this amount of BTC was stored in another wallet — "bc1qg9ucy" — which received it from BitGo three weeks ago. We cannot rule out that both addresses belong to the exchange itself.

However, there is no information about this and it doesn't mean much. What really matters is the perception of market participants about this development.

Withdrawals from exchanges are seen as bullish events according to common sense. What is more interesting is that this move came in anticipation of the Fed's interest rate decision next Wednesday.

This decision is especially important as it could bring the first rate cut in years after years of tightening monetary policy. Right now, market participants are guessing whether the cut will be an immediate 50 basis points or only 25 basis points.

All of these factors and speculations are causing volatility in the crypto market. If this whale is indeed a buyer, then its bias is probably toward the bullish consequences of the Fed's rate decision.